Money Market Account How It Works and How It Differs From Other Bank Accounts

Contents

- 1 Money Market Account: How It Works and How It Differs From Other Bank Accounts

- 1.1 What Is a Money Market Account (MMA)?

- 1.2 How Money Market Accounts (MMAs) Work

- 1.3 History of Money Market Accounts (MMAs)

- 1.4 Advantages and Disadvantages of Money Market Accounts (MMAs)

- 1.5 Money Market Accounts (MMAs) vs. Savings Accounts

- 1.6 Money Market Accounts (MMAs) vs. Checking Accounts

- 1.7 Money Market Accounts (MMAs) vs. Mutual Funds

- 1.8 Alternatives to Money Market Accounts (MMAs)

- 1.9 Frequently Asked Questions (FAQs)

- 1.10 Are Money Market Accounts Safe?

- 1.11 What Are the Benefits of Money Market Accounts?

- 1.12 What Are the Disadvantages of MMAs?

Money Market Account: How It Works and How It Differs From Other Bank Accounts

Jim Probasco has 30+ years of experience writing for online, print, radio, and television media, including PBS. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership, and loans. He has a bachelor’s from Ohio University and Master’s from Wright State University in music education.

What Is a Money Market Account (MMA)?

The term money market account (MMA) refers to an interest-bearing account at a bank or credit union. Sometimes referred to as money market deposit accounts (MMDA), money market accounts have features not found in other accounts. Most money market accounts pay higher interest rates than regular savings accounts and often include check-writing and debit card privileges. They may also have restrictions that make them less flexible than a regular checking account. They are important for calculating tangible net worth.

Key Takeaways

- Money market accounts are offered by banks and credit unions and provide the benefits and features of savings and checking accounts.

- They generally pay higher interest rates than regular savings accounts and may come with debit cards and limited check-writing privileges.

- MMAs are suited for short-term goals rather than long-term financial planning.

- Many banks also offer high-yield or high-interest checking accounts, which may pay better rates than money market accounts but impose more restrictions.

- Alternatives to MMAs include high-yield savings accounts and certificates of deposit.

How Money Market Accounts (MMAs) Work

Money market accounts are financial products offered by traditional and online banks and credit unions. They give account holders benefits of a savings account while providing features of a checking account, including:

- Interest: Like savings accounts, MMAs allow account owners to earn interest on their balances. The interest rate offered is normally higher than a traditional savings account. The interest rate fluctuates based on market conditions.

- Debit Cards: Some banks include a debit card with the account, allowing owners to use ATMs for deposits, withdrawals, and transfers.

- Check-Writing: Clients may be able to write checks against their account balances.

Banks often require a minimum initial deposit to open an MMA, and balances must be maintained above a certain threshold while active. Banks may impose a service charge if the balance falls below the minimum amount.

Money market accounts are suited for individuals who want to earn more interest than with a savings account for short-term goals. An MMA may be a good idea if saving up for a specific purchase, such as a vacation, car down payment, or emergency fund. They are not intended for long-term purposes like retirement.

History of Money Market Accounts (MMAs)

Until the early 1980s, the federal government placed a cap on the interest banks and credit unions could offer on savings accounts.

Institutions offered small appliances and incentives to attract deposits because they couldn’t compete with money market mutual funds’ interest rates.

The Garn-St. Germain Depository Institutions Act in 1982 allowed banks and credit unions to offer money market accounts with higher rates.

Advantages and Disadvantages of Money Market Accounts (MMAs)

MMAs have advantages and disadvantages compared to other types of accounts.

Advantages include higher interest rates, check-writing, and debit card privileges. Banks and credit unions require a minimum deposit and balance to open and maintain an account. Monthly fees may apply if the balance falls below the minimum.

MMAs provide federal insurance protection. Accounts held at banks are insured by the FDIC, while those held at credit unions are insured by the NCUA. FDIC and NCUA cover certain types of accounts, including MMAs, up to $250,000 per depositor per bank.

Disadvantages include limited transactions, fees, and minimum balance requirements.

- Higher interest rates

- Check-writing privileges

- Debit cards

- Insurance protection

- Limited transactions

- Fees

- Minimum balance requirement

To insure more than $250,000, depositors can open accounts at multiple banks or credit unions.

Money Market Accounts (MMAs) vs. Savings Accounts

Money market accounts offer higher interest rates than savings accounts. For example, the average MMA rate in May 2022 was 0.08%, while the average savings account rate was about 0.07%.

Money market accounts can offer higher rates by investing in CDs, government securities, and commercial paper, which savings accounts cannot do.

The interest rates on money market accounts fluctuate with market conditions. Compounding frequency can affect returns, especially with high balances.

MMAs often include check-writing privileges and a debit card, like a regular checking account.

High-yield savings accounts are increasingly similar to money market accounts. Compare rates to choose the best product.

Money Market Accounts (MMAs) vs. Checking Accounts

Money market and checking accounts offer similar features, including unlimited deposits and some offer debit cards and check-writing capabilities.

The Federal Reserve lifted restrictions on MMAs in 2020, but some banks may still have limitations. Check with your financial institution for rules.

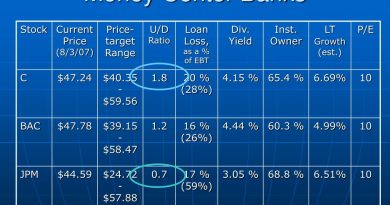

Money Market Accounts (MMAs) vs. Mutual Funds

Money market mutual funds, unlike bank accounts, are not FDIC- or NCUA-insured but are considered low risk.

Both MMAs and money market mutual funds provide quick access to cash, but companies can limit withdrawals and check amounts. Money market mutual funds have higher returns than money market accounts.

Compare rates and features when choosing between MMAs and other accounts.

Alternatives to Money Market Accounts (MMAs)

Banks and credit unions offer various accounts that can be competitive with or superior to money market accounts.

Passbook Savings Accounts

Regular savings accounts have no initial deposit or minimum balance requirements. They offer interest, although generally less than MMAs. Passbook savings accounts are FDIC- or NCUA-insured. Check for withdrawal restrictions.

High-Yield Savings Accounts

High-yield savings accounts may have better interest rates than MMAs. Rates vary by institution, and they may have additional requirements like direct deposits.

Regular Checking Accounts

Checking accounts offer unlimited transactions but usually have low or no interest rates. They are FDIC- or NCUA-insured.

High-Yield/High-Interest Checking Accounts

High-yield checking accounts have rates similar to MMAs. They may have more requirements, like a minimum number of debit transactions. They also impose a cap above which the high-interest rate does not apply.

Rewards Checking Account

This account offers various rewards, such as high yields or cashback. Fees apply unless all rules are met.

Certificates of Deposit (CDs)

CDs have fixed durations and higher interest rates than regular savings accounts. Early withdrawals result in penalties. Some CDs offer liquidity but lower interest rates.

Frequently Asked Questions (FAQs)

Are Money Market Accounts Safe?

Money market accounts at banks are insured by the FDIC. Accounts up to $250,000 per depositor per bank are covered. Multiple insurable accounts at the same bank count toward the limit. Joint accounts are insured for $500,000. Depositors can open accounts at multiple banks or credit unions for additional coverage.

What Are the Benefits of Money Market Accounts?

MMAs offer benefits such as higher interest rates, insurance protection, check-writing, and debit card privileges. They provide access to funds and flexibility to transfer between accounts. Many MMAs include check-writing privileges and debit cards.

What Are the Disadvantages of MMAs?

Potential disadvantages include limited transactions, fees, withdrawal restrictions, and minimum balance requirements. Monthly fees may apply if the balance falls below the minimum. MMAs generally can’t compete with other higher-yielding alternatives. Banks and credit unions offer a variety of accounts with competitive features.