Mortgage Originator Definition What It Does Types

Contents

Mortgage Originator: Definition, Types

What Is a Mortgage Originator?

A mortgage originator works with a borrower to complete a home loan transaction. They can be a mortgage broker or a mortgage banker, and they are part of the primary mortgage market. They work with underwriters and loan processors to gather necessary documentation and guide the file through the approval process.

key takeaways

- A mortgage originator works with an underwriter to complete a home loan transaction.

- Mortgage originators include retail banks, mortgage bankers, and mortgage brokers.

- They often sell their loans quickly into the secondary mortgage market.

- Mortgage originators make money through fees and the difference between the interest rate given to a borrower and the premium paid by the secondary market.

Understanding a Mortgage Originator

A mortgage originator is the first company involved in creating a mortgage. They consist of retail banks, mortgage bankers, and mortgage brokers. Mortgage bankers typically use a warehouse line of credit to fund loans, while banks use traditional sources of funding. Most mortgage originators quickly sell newly originated mortgages into the secondary mortgage market.

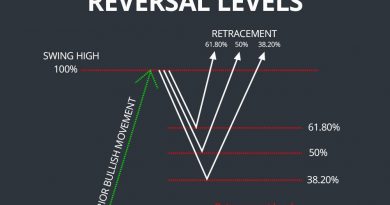

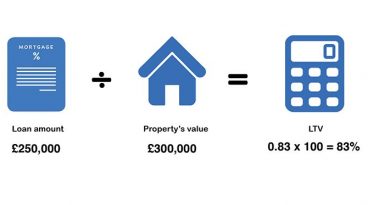

Depending on size and sophistication, a mortgage originator might aggregate mortgages before selling them or sell individual loans as they are originated. There is risk involved when an originator holds onto a mortgage after an interest rate has been quoted and locked in by a borrower. A mortgage calculator can show the impact of different rates on monthly payments.

Originators that aggregate mortgages often hedge their mortgage pipelines against interest rate shifts. Smaller originators tend to use best efforts trades, a special type of transaction designed for the sale of a single mortgage.

Mortgage originators make money through fees and the difference between the interest rate given to a borrower and the premium paid by the secondary market.

$453,000

Average loan size of a mortgage in 2022, according to the Mortgage Bankers Association.

Primary vs. Secondary Mortgage Market

The primary mortgage market is where the borrower and the mortgage originator conduct a mortgage transaction. The primary mortgage lender provides funds to the borrower at the closing table.

There are large firms and thousands of smaller firms and individuals involved in the primary mortgage market. Once originated, the servicing rights to mortgages often get sold to other institutions on the secondary mortgage market. Government-sponsored enterprises like Fannie Mae and Freddie Mac are some of the largest buyers on the secondary market. Secondary buyers often package pools of loans into mortgage-backed securities (MBS) and sell them to investment banks.

The percentage of originations belonging to each mortgage originator depends on how an origination is counted. It’s possible for an origination to be double-counted if a mortgage is immediately sold into the secondary market.

Different Types of Mortgage Originators

Mortgage bankers and mortgage brokers are the most common types of mortgage originators. A mortgage banker works for a lending institution and funds loans with its own money. Retail banks and credit unions often employ mortgage bankers.

A mortgage broker serves as a middleman between the borrower and various mortgage banking institutions. They check credit and income, handle underwriting and processing, and then send the loan to a lending institution for funding at closing.