What Is a Co-Owner How It Works Advantages and Example

Contents

Co-Owner: Definition, Function, and Example

Definition of Co-Owner

A co-owner is an individual or group that shares ownership of an asset with another. Each co-owner owns a percentage of the asset, as defined in the ownership agreement. The rights of each owner are outlined in a contract, which includes revenue and tax obligations. The specifics of the agreement will vary based on the asset, jurisdiction, and relationship between co-owners.

Key Takeaways

- A co-owner can be an individual or a group that owns a percentage of an asset with another.

- Revenue, tax, legal, and financial obligations differ for each co-owner based on the ownership agreement and asset.

- Co-ownership allows for cost sharing and resource pooling.

- However, co-ownership carries risks, including shared responsibility for the actions of the other co-owner(s).

- Co-ownership is applicable to various assets, such as businesses, properties, vehicles, and accounts.

Understanding Co-Ownership

The relationship between co-owners can vary, and their obligations depend on their relationship and desired benefits. In real estate, co-ownership is governed by arrangements like joint tenancy or tenancy in common.

Similarly, co-owners of a brokerage or bank account follow strict procedures. For instance, co-owners or their representatives must be involved when closing an account.

Co-owners have obligations dependent on the ownership structure. In real estate, co-owners may be joint tenants or tenants in common. Business ownership involves different responsibilities.

Partners vs. Co-Owners

Partnership and co-ownership differ. For example, if two brothers purchase a property together, it is co-ownership. They must agree to sell the property and share the proceeds, but the purchase might not have been for profit.

If the property was bought to generate rental income, it becomes a partnership, involving joint ownership and a business motive.

In addition, partners can act in the interests of the business, while co-owners have no such agency relationship. Co-owners are each solely responsible for their actions and may face liability if the other co-owner’s actions do not align with their shared interest in the asset.

Advantages of Co-Ownership

Co-ownership benefits individuals when purchasing expensive assets, such as real estate, by sharing costs and making the asset more affordable. Co-owners can also share associated expenses like insurance, fees, or taxes. Co-ownership can also divide management responsibilities among multiple parties.

Problems with Co-Ownership

Co-ownership carries risks, such as disagreements on running the business. Buying out a co-owner can be challenging if they refuse to sell, straining the relationship.

Depending on the asset and co-ownership agreement, liability can be substantial. If a co-owner defaults on a mortgage payment, the other co-owner must cover the full amount, even if they only own a portion of the property.

Disagreements and disputes are common in co-ownership, and trust, communication, and shared vision are crucial before entering into such an agreement, given the significant personal and financial repercussions.

Real-World Example

Consider a co-owner of a bank account who irresponsibly gambles away a large sum of money. The creditor, such as a casino, may come after the account, causing the responsible party to incur significant losses. Proper titling of accounts is vital in estate planning to ensure desired distribution of assets after the owner’s passing.

Application to Real Estate

Co-ownership is common when two parties purchase real estate. Sharing the financial burden makes homeownership more manageable. There are various co-ownership agreements, such as tenancy in common and joint tenancy, with the latter including a right of survivorship.

Definition of Co-Ownership

Co-ownership involves sharing ownership of an asset, with each party owning a percentage of the asset.

Advantages of Co-Ownership

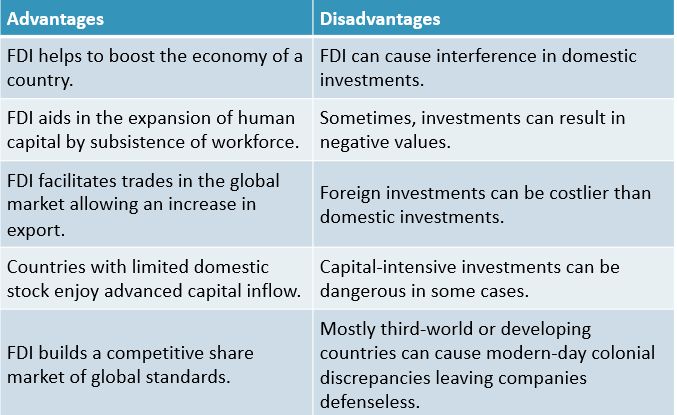

Co-ownership enables cost sharing, making expensive assets more attainable. It can also reduce associated costs and divide management responsibilities.

Disadvantages of Co-Ownership

Depending on the agreement and nature of the asset, co-owners may face liability for defaulting or backing out. Disagreements and disputes can also arise around managing or selling the asset.

The Bottom Line

Co-ownership applies to various assets, and its benefits and risks depend on revenue, tax, legal, and financial obligations associated with the situation.