What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income

Contents

- 1 What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

- 1.1 What Does It Mean to Be Tax-Exempt?

- 1.2 Common Tax-Exempt Earnings

- 1.3 Other Tax-Exempt Income

- 1.4 Capital Gains Tax-Exemption

- 1.5 Alternative Minimum Tax and Exemptions

- 1.6 Tax-Exempt Organizations

- 1.7 Becoming Tax-Exempt

- 1.8 Tax-Exempt Organization vs. Nonprofit Organization

- 1.9 Limitations of Tax-Exempt Status

- 1.10 Is a Tax-Exempt Organization the Same As a 501(c)(3) Organization?

- 1.11 What Is the Downside of Being Tax-Exempt?

- 1.12 Why Do Nonprofit Organizations Not Pay Taxes?

- 1.13 Can a Tax-Exempt Organization Make Money?

- 1.14 The Bottom Line

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Does It Mean to Be Tax-Exempt?

Tax-exempt refers to income or transactions that are free from tax at the federal, state, or local level. The reporting of tax-free items may be on a taxpayer’s individual or business tax return and shown for informational purposes only. The tax-exempt article is not part of any tax calculations.

Tax-exempt may also refer to the status of a business or organization which has limits on the amount of income or gifts which are taxable. These organizations include religious and charitable institutions.

Key Takeaways

- Tax-exempt status allows a taxpayer to file a return with the IRS that exempts them from paying taxes on any net income or profit.

- A taxpayer can offset capital gains and avoid taxes on disposed assets, though this often allows a taxpayer to be exempt up to their current or prior losses.

- Taxpayers who avoid taxes may still be required to pay alternative minimum taxes.

- Most commonly, organizations gain tax-exempt status by requesting the status from the IRS.

- To maintain the status, organizations must meet ongoing filing and reporting requirements.

Common Tax-Exempt Earnings

Not to be confused with a tax deduction, tax exemption frees the taxpayer of any tax obligation to submit taxes on the tax-free transaction or income. Whereas the use of a tax deduction is to reduce the tax obligation by lowering gross income.

One common type of tax-exempt income is interest earned on municipal bonds, which are bonds issued by states and cities to raise funds for general operations or a specific project. When a taxpayer makes interest income on municipal bonds issued in their state of residence, the profit is exempt from both federal and state taxes.

Taxpayers receive IRS Form 1099-INT for any investment interest they earn during the tax year. The reporting of tax-exempt interest is in box 8 of the 1099 form. This information is only data and is not included in the calculation of personal income taxes.

Other Tax-Exempt Income

There’s a range of types of income that may be tax-exempt based on your specific situation. In addition, tax rules may continually evolve and change. When crafting your personal tax strategy, consult with a tax prepared to best understand the latest news and widest scope on other tax-exempt income.

The list below contains other common tax-exempt income sources. The list is not meant to be exhaustive, and some of those additional items may include:

- Health Savings Account (HSA) Withdrawals: Withdrawals from HSAs used to pay for qualified medical expenses are tax-exempt. Contributions to HSAs may also be tax-deductible, and any earnings within the account grow tax-free.

- Qualified Roth IRA Distributions: Distributions from Roth IRAs are tax-exempt if certain conditions are met.

- Certain Social Security Benefits: A portion of Social Security benefits may be tax-exempt, depending on the recipient’s total income and filing status. Generally, if Social Security benefits are the only source of income, they are likely to be tax-exempt as the taxpayer may not meet a taxable threshold.

- Certain Veterans Benefits: Some benefits provided to veterans, their dependents, and survivors by the Department of Veterans Affairs are tax-exempt.

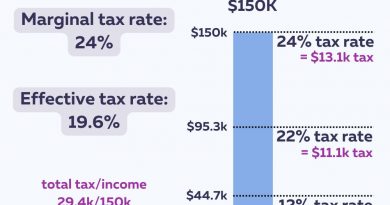

Capital Gains Tax-Exemption

A taxpayer may buy an asset and subsequently sell that asset for a profit. The profit is a capital gain, which creates a taxable event. However, several types of capital gains are exempt from taxation.

A taxpayer can offset capital gains with other capital losses for the tax year. For example, an investor with $5,000 in profits and $3,000 in losses pays taxes on only $2,000 in capital gains. The amount of capital losses a taxpayer may claim in a given year has a cap of $3,000. When capital losses exceed this cap, the excess may be carried forward to offset gains in future years.

The tax code also allows taxpayers to exclude from federal taxes a specific portion of capital gains from the sale of a home.

Alternative Minimum Tax and Exemptions

The alternative minimum tax (AMT) is an alternative method for determining tax liability. AMT adds back specific tax-exempt items into the personal tax calculation. Interest from private activity bonds exempt from regular tax, for example, is added to the AMT tax calculation. Individual taxpayers must include the AMT calculation with their original tax return and pay tax on the higher tax liability.

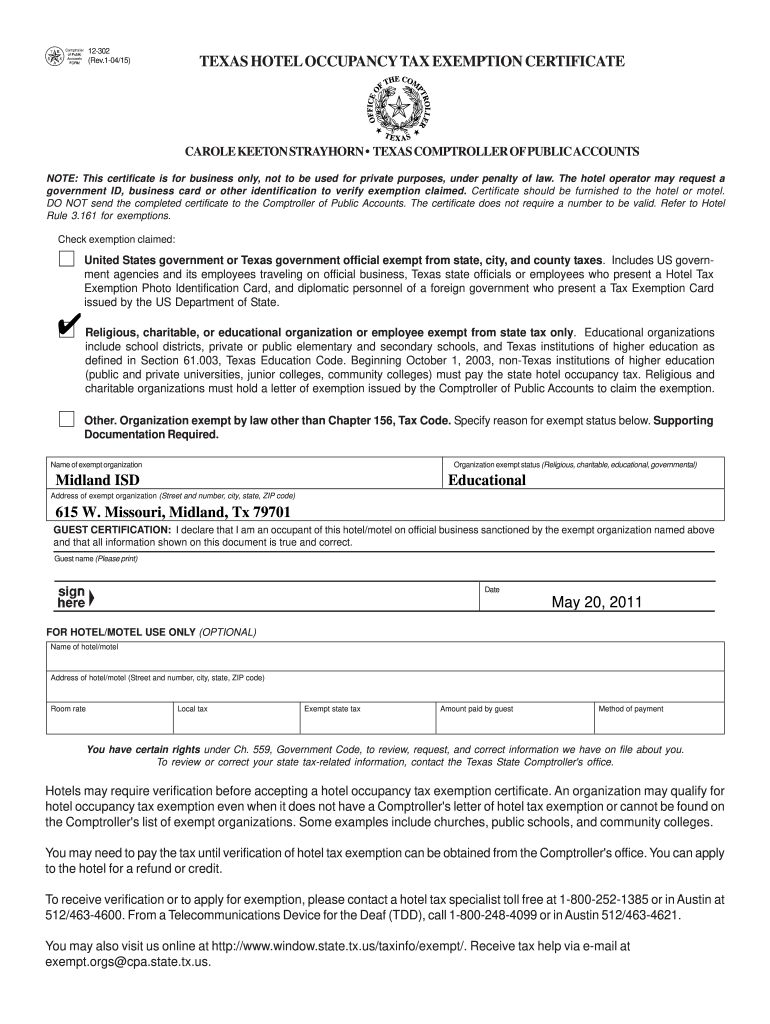

Tax-Exempt Organizations

An exempt organization that has $1,000 or more of gross income from an unrelated business must file Form 990-T. An organization must pay an estimated tax if it expects its tax for the year to be $500 or more.

A 501(c)(3) nonprofit corporation is a charitable organization that the IRS recognizes as tax-exempt. This type of organization does not pay income tax on its earnings or on the donations it receives. Also, any taxpayer donations may reduce a taxpayer’s taxable income by the donation amount. This incentive encourages private charity and makes it easier for nonprofits to raise money.

A 501(c)(3) is a charitable organization involved in religious, charitable, educational, literary, preventing cruelty to animals and children, fostering amateur local and international sports competitions, testing for public safety, and scientific activities or operations.

To gain the exemption, an organization must demonstrate how the exemption will serve the public and provide a benefit to a community.

Becoming Tax-Exempt

An entity can become tax-exempt by meeting the requirements set forth by the IRS. There are several categories of tax-exempt status for charitable, religious, educational, and scientific organizations. The type of tax-exempt status needed will depend on the nature of the organization’s activities.

The organization must be formed as a legal entity, and the organization must obtain an EIN from the IRS. With this EIN, the organization is able to file an application with the IRS to obtain tax-exempt status. The most common form is Form 1023 for 501(c)(3) organizations. The application must provide detailed information about the organization’s activities, governance, finances, and other relevant information.

The IRS will review the application and make a determination about the organization’s tax-exempt status. The process can take several months, and the IRS may request additional information or clarification during the review process.

Once tax-exempt status is granted, the organization must maintain compliance with IRS rules and regulations via filing annual tax returns and other forms, meeting governance and operational requirements, and avoiding prohibited activities that could jeopardize tax-exempt status.

Tax-Exempt Organization vs. Nonprofit Organization

Though often interchanged to describe the same entity, there are worthwhile differences to mention between a tax-exempt organization and a nonprofit organization.

A nonprofit organization is a type of entity that is organized for a specific purpose. Nonprofits can be structured in a variety of ways such as a corporation, trust, or unincorporated association. They are not required to pay federal income taxes on their earnings.

A tax-exempt entity, on the other hand, is an organization that has been granted exemption from federal income tax by the IRS. Though this includes most nonprofit organizations, not all nonprofits are automatically tax-exempt. In addition, a nonprofit must apply to become tax-exempt; without the review and approval by the IRS, the nonprofit will technically not be tax-exempt.

Limitations of Tax-Exempt Status

Keep in mind there are some downsides to obtaining a tax-exempt status. Tax-exempt organizations, particularly those classified as 501(c)(3) organizations, are subject to strict limitations and reporting requirements when engaging in political activities. This includes endorsing or opposing political candidates, contributing funds to political campaigns, and engaging in partisan activities.

Tax-exempt entities must adhere to regulations regarding transactions with insiders such as board members, officers, and key employees. These regulations are designed to prevent conflicts of interest, self-dealing, and private inurement, where individuals in positions of authority benefit personally from the organization’s resources. Engaging in prohibited transactions can result in penalties, fines, or loss of tax-exempt status.

Last, tax-exempt entities are generally prohibited from distributing profits or assets to individuals or shareholders. Any excess, ungranted funds are to be kept internally with potentially minimal flexibility. Though this restriction ensures that the organization’s resources are dedicated to its tax-exempt purpose, it puts an onus on the entity to disburse funds for a specific purpose. The tax-exempt entity risks jeopardizing future funding from donors or grantors if disbursement is slow.

Is a Tax-Exempt Organization the Same As a 501(c)(3) Organization?

A 501(c)(3) is a tax-exempt organization recognized by the IRS. However, there are other forms of organization an entity can file for and be awarded that are also tax-exempt. Therefore, while a 501(c) is tax-exempt, not all tax-exempt organizations are 501(c)(3) organizations.

What Is the Downside of Being Tax-Exempt?

Administratively, there may be additional requirements a company must meet such as annual reporting and meeting stipulated criteria. To become and maintain its status as tax-exempt, there is an additional burden to an organization from a time and labor standpoint. Outside of this reporting and filing requirement, there are often little to no downsides to becoming tax-exempt.

Why Do Nonprofit Organizations Not Pay Taxes?

Nonprofit organizations do not pay taxes because they are engaged in public or private interests. The purpose of a nonprofit is to further extend the benefit to a community; for this reason, the IRS recognizes and awards these entities tax-exempt as any collected taxes would be used for a similar purpose (i.e. would be redistributed to benefit the community).

Can a Tax-Exempt Organization Make Money?

Yes, tax-exempt organizations such as nonprofits are often encouraged and expected to make money or earn more money than what they spend. For the financial health and longevity of the organization, these entities must build reserves and have excess cash reside in bank accounts. The purpose of being tax-exempt is to have this net profit not be taxed by the IRS.

The Bottom Line

A tax-exempt organization is a type of entity that is recognized by the IRS as being exempt from paying federal income taxes on its earnings. To be considered tax-exempt, an organization must meet certain requirements set forth by the IRS and must apply for tax-exempt status. Taxpayers can be exempt from paying certain amounts of ordinary income or capital gains.