Weighted Average Loan Age WALA Meaning How it Works

Contents

Weighted Average Loan Age (WALA): Meaning, How it Works

Cierra Murry is a banking consultant with over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

What Is Weighted Average Loan Age (WALA)?

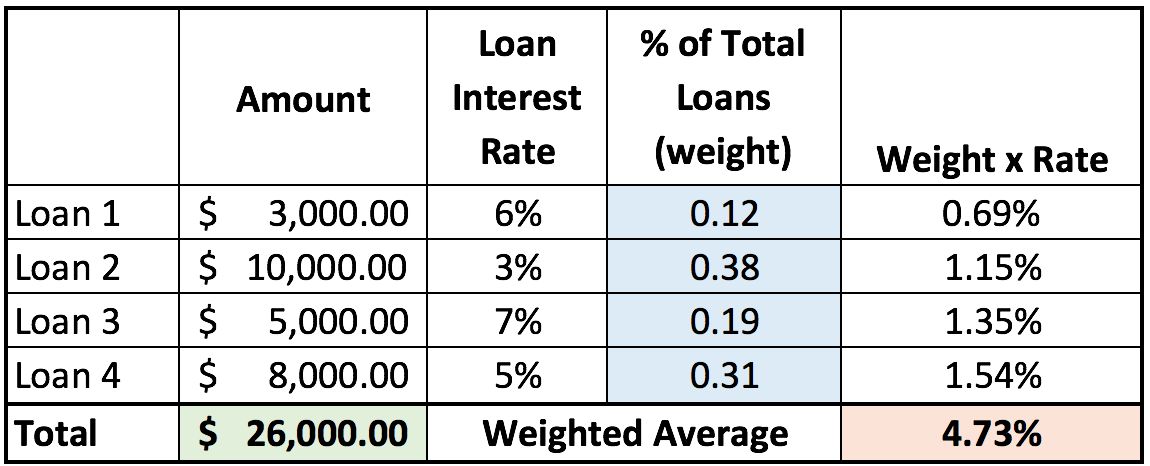

Weighted Average Loan Age (WALA) measures the average age of loans in a pool of mortgage-backed securities (MBS). The weights are based on the dollar amount of each loan at each maturity, proportionate to the total aggregate of the pool. The weights can be based on the remaining principal balance or the nominal value of the loan.

Key Takeaways

- WALA is a measure of the maturity of mortgages in an MBS.

- It is dollar-weighted based on mortgage size and time left until maturity (usually in months).

- WALA is computed as the inverse of weighted average maturity (WAM), which is a more common estimation of MBS profitability.

How Weighted Average Loan Age Works

Investors of mortgage-backed securities use WALA to estimate the repayment timeline for a pool of mortgages. As some mortgages get paid off faster than others, WALA varies over time.

A mortgage-backed security transforms banks into intermediaries between homebuyers and the investment industry. Banks grant mortgages and sell them at a discount to include in an MBS, recording the sale as a plus on their balance sheet. If homebuyers default, the bank loses nothing.

Investors buying MBS essentially lend money to homebuyers. MBSs can be bought and sold through brokers, with the minimum investment varying between issuers.

WALA is determined by multiplying the initial nominal value of each mortgage in the MBS pool by the number of months since the loan originated. It helps estimate profit potential and prepayment risk. Prepayment risk refers to the premature return of principal on a fixed-income security, such as when a mortgage is refinanced or a house is sold and the mortgage paid off. Early principal returns result in future interest payment loss for investors.

Weighted Average Loan Age vs. Weighted Average Maturity

While both WALA and weighted average maturity (WAM) estimate the profitability of investing in MBSs, WAM is more commonly used to measure the maturity of mortgage-backed security pools. It calculates the average time it takes for securities in a debt portfolio to mature, weighted in proportion to the dollar amount invested. Portfolios with higher weighted average maturities are more sensitive to interest rate changes.

WALA is actually calculated as the inverse of WAM: WAM measures the percentage value of each mortgage or debt instrument in the portfolio. The number of months or years until the bond’s maturity is multiplied by each percentage, and the sum of the subtotals equals the weighted average maturity of the bonds in the portfolio.