What Is a Certificate of Insurance COI When You Need One

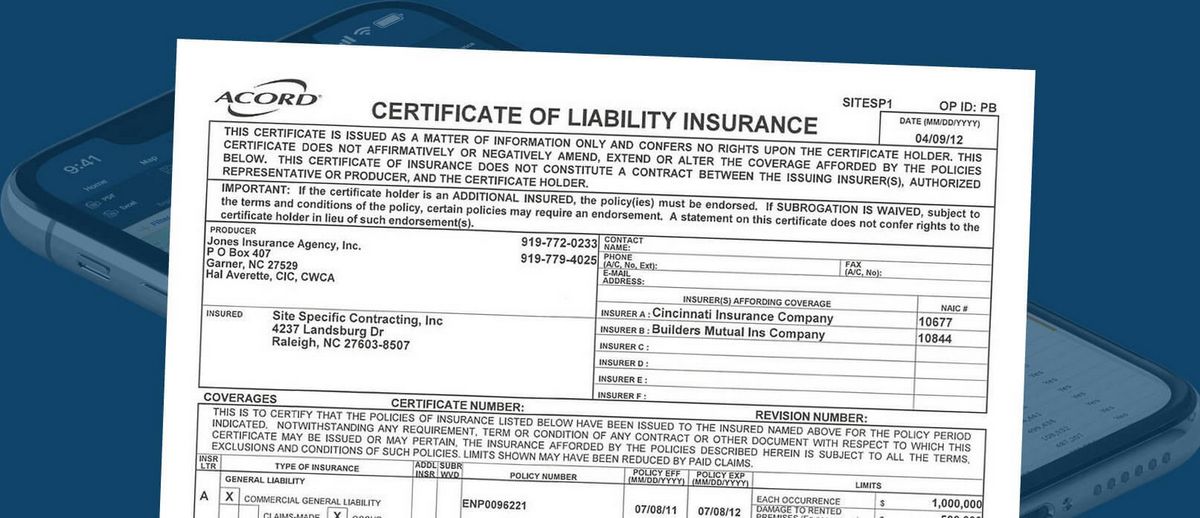

A Certificate of Insurance (COI) is issued by an insurance company or broker to verify the existence of an insurance policy. It summarizes the key aspects of the policy, including the policyholder’s name, effective date, coverage type, limits, and other important details.

Without a COI, companies or contractors may struggle to secure clients who are reluctant to assume the risk of any potential costs caused by the contractor or provider.

Key Takeaways:

– A COI is issued by an insurance company or broker to verify insurance coverage.

– Small business owners and contractors typically require a COI to protect against liability and conduct business.

– When you receive a COI, check the coverage dates and policy limits.

COIs are used in situations where liability and significant losses are concerns. It proves insurance coverage and is especially important for small business owners and contractors, who often have liability insurance to protect against workplace accidents or injuries. Purchasing liability insurance usually results in the insurance company providing an insurance certificate.

A COI is essential for businesses to win contracts. Clients want assurance that business owners or contractors have liability insurance, so they don’t bear any risk for damage, injury, or substandard work.

When hiring a contractor or service provider, it is crucial to obtain their COI and ensure it is up to date.

Validating a COI typically involves directly requesting it from the insurance company. The insured’s name on the certificate should match the business owner or contractor’s name. Additionally, check the coverage dates to ensure they are current and request a new certificate if the policy will expire before the work is complete.

Details of a COI include separate sections for different types of liability coverage, such as general, auto, umbrella, and workers’ compensation. The certificate includes the policyholder’s name, address, and a description of the insured’s operations. Contact information for the issuing insurance company and, if applicable, other involved insurance companies is listed.

When a client requests a COI, they become a certificate holder. The client’s name and contact information are included, along with statements regarding the insurer’s obligation to notify the client of policy cancellations. The certificate briefly describes the insured’s policies and their limits.

To obtain a COI from a contractor or business, either ask them to retrieve it from their insurance company or provide their insurance company’s contact information for direct verification. Be cautious of contractors submitting fraudulent COIs.

Anyone hiring an independent contractor or business for services should require a COI. Contractors and businesses should have a COI to demonstrate their insurance coverage to clients.

It is advisable to keep any received COIs indefinitely to address any issues that may arise regarding completed jobs or services provided.

Request a COI and have it in hand before allowing anyone to work on your property. Ensure that any written contract includes insurance requirements verified with a COI.

In summary, a COI may be necessary in various situations. Clients typically request it directly from your insurance company to confirm your coverage. If you are hiring a contractor, it’s wise to obtain a COI from their insurance company, even if you’ve worked with them before, as their coverage may have changed.