What Is a Captive Insurance Company

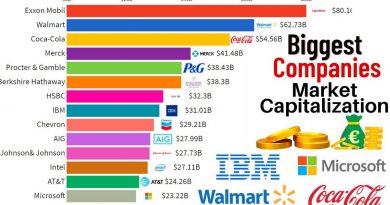

A captive insurance company is a subsidiary insurer formed to provide risk mitigation services for its parent company or related entities. Companies form "captives" for reasons such as:

– Inability to find suitable outside firm to insure against specific business risks

– Tax savings from premiums paid to the captive insurer

– More affordable coverage for specific risks

– Better coverage than what is available from other insurers

It’s important to note that a captive insurance company is different from a captive insurance agent, who exclusively works for one insurance company and cannot sell competitors’ products.

Key Takeaways:

– A captive insurance company is a wholly owned subsidiary insurer that provides risk mitigation services for its parent company or related entities.

– Benefits of having a captive insurance company include lower insurance costs, tax advantages, underwriting profits, and greater control over coverage.

– Captive insurance companies can help when the commercial insurance market cannot provide coverage for certain risks.

– Drawbacks include overhead expenses, compliance issues, and the potential to be underinsured.

– Most Fortune 500 companies today have captive insurance companies.

Understanding a Captive Insurance Company:

A captive insurance company is a form of corporate self-insurance. While there are financial benefits to creating a separate entity for insurance services, parent companies must consider associated administrative and overhead costs. They may also rely on traditional insurers to insure against some risks.

Captive insurance companies often supplement commercial insurance, allowing the parent company to save money on additional premiums.

Tax Issues of Captive Insurance Companies:

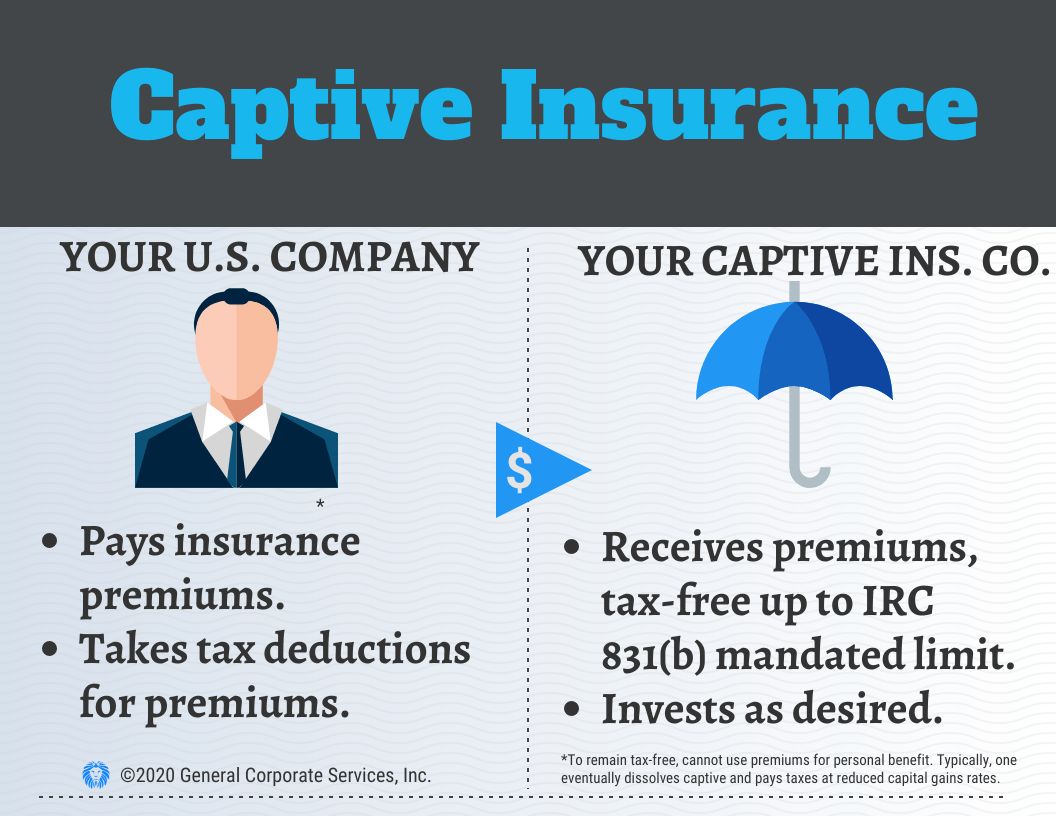

The tax concept of a captive insurance company is simple. The parent company pays insurance premiums to its captive insurer and seeks to deduct these premiums in a high-tax jurisdiction. Several U.S. states allow the formation of captive companies, which offer protection from tax assessment.

Whether a parent company gets a tax break from a captive insurance company depends on the insurance classification of the company’s transactions. The IRS requires risk distribution and risk shifting for a transaction to be considered insurance. The IRS has stated that it will take action against captive insurance companies suspected of abusive tax evasion.

Some risks could cause substantial expenses for a captive insurance company and potentially lead to bankruptcy. Large private insurers are less likely to go bankrupt due to the diversified pool of risk.

Pros and Cons of Captive Insurance:

While captives can be attractive for managing and distributing risk, there are advantages and disadvantages:

Pros:

– Potential cost savings

– Tax advantages

– Greater control over coverage and claims

– Underwriting profits

Cons:

– Company’s capital is at risk

– Potential to be underinsured

– Overhead expenses

– Compliance issues

Examples of Captive Insurance Companies:

British Petroleum (BP) is a well-known company that had a captive insurance company called Jupiter Insurance during the 2010 oil spill in the Gulf of Mexico. BP could receive up to $700 million in coverage from losses. Most Fortune 500 companies today have captive insurance subsidiaries.

The state of Tennessee launched its own captive insurance company in 2022 to cover state-owned buildings and contents, including public college campuses and general liability. The captive insures property valued at $31.4 billion as of July 2022. It will help the state better evaluate and control the risks of Tennessee state government.

Who Owns a Captive Insurance Company?

A captive insurance company is formed, owned, and controlled by the parent company it insures. About 90% of Fortune 500 companies today have captive subsidiaries, according to the National Association of Insurance Commissioners (NAIC).

Is Captive Insurance a Good Idea?

Captive insurance allows companies to meet their unique risk management needs. It can offer lower costs, significant tax advantages, underwriting profits, and greater control over coverage and claims decisions. Captives are also helpful when the commercial insurance market cannot provide coverage for certain risks. However, there are disadvantages to consider, such as the potential for underinsurance or a poorly drafted policy.

Which Types of Coverage Do Captives Provide?

Captives are not intended to protect against all risks. Companies usually rely on conventional commercial insurers for certain risks. Captives are often used for standard casualty lines like general liability, product liability, professional liability, and workers’ compensation.

The Bottom Line:

Insurance is a significant expense for large companies. Captive insurance companies allow companies to control costs, enjoy tax benefits, and cover risks that commercial insurers may not cover. Setting up a captive can be challenging, but third-party captive professionals can help companies navigate the process and avoid costly mistakes.