What Is a Capital Asset How It Works With Example

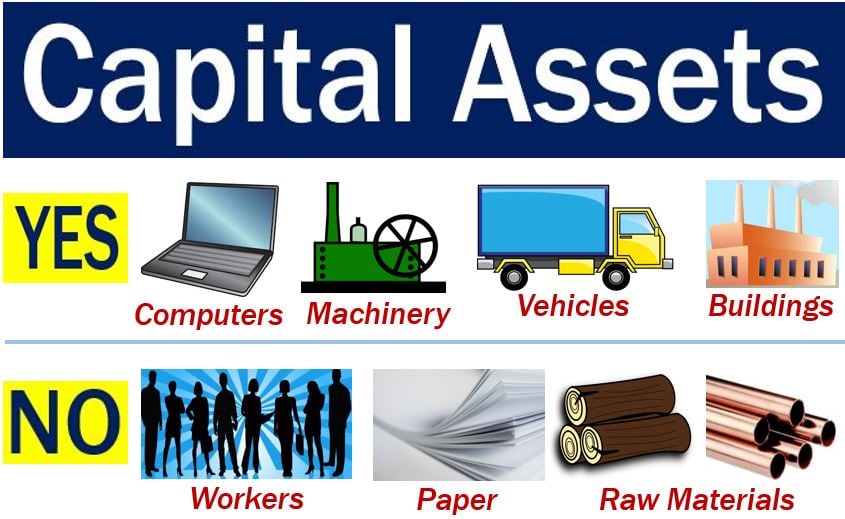

Capital assets, like homes, cars, investment properties, stocks, bonds, collectibles, and art, are important pieces of property. For businesses, a capital asset is a non-saleable asset with a useful life longer than one year. It is also a type of production cost. For example, if one company buys a computer for its office, the computer is a capital asset. However, if another company buys the same computer to sell, it is considered inventory.

Key Takeaways:

– Capital assets are assets used in a company’s business operations to generate revenue for more than one year.

– They are recorded as assets on the balance sheet and expensed through depreciation.

– Expensing the asset over its useful life matches the cost with the revenue.

– Capital assets can be tangible or intangible, but most are related to buildings, land, or FFE.

– Capital assets differ from ordinary assets, which are more useful in day-to-day operations.

Types of Capital Assets in Business:

Tangible Assets:

– Capital assets contribute to a business’s ability to generate profit for more than one year.

– They include land, buildings, and machinery.

– Capital assets may be liquidated in worst-case scenarios or upgraded as the business grows.

Intangible Assets:

– Capital assets can be non-physical goods like stocks, bonds, trademarks, or patents.

– Intangible assets have different limitations when expensing or depreciating their value.

– They require periodic evaluation to ensure they retain their value.

Selling or Maintaining Capital Assets:

– Capital assets can be disposed of by selling, trading, abandoning, or losing them.

– If owned for over a year, a capital gain or loss may incur on the sale.

– Impaired assets lead to adjustments on the balance sheet and recognized losses.

Individuals and Capital Assets:

– Significant assets owned by individuals are capital assets.

– Selling a capital asset results in a capital gain subject to tax.

– Primary homes are considered capital assets with certain exemptions.

Capital Assets Recording and Taxation:

– Costs for capital assets include transportation, installation, and insurance.

– Capital expenses are deducted over multiple years instead of the year of purchase.

Depreciation of Capital Assets:

– Depreciation aligns asset cost with revenue generated over its useful life.

– Depreciating assets reflect their decreasing value over time.

Capital Assets vs. Ordinary Assets:

– Ordinary assets, like cash or inventory, have short-term economic value.

– Capital assets, like buildings or machinery, have long-term economic value.

Capital Asset vs. Fixed Asset:

– A fixed asset is a tangible capital asset intended for long-term use.

– Capital assets encompass both fixed and non-fixed assets.

What Defines a Capital Asset?

– Capital assets have long-lasting value and are not part of regular business operations.

– They are unique and generally have higher dollar value.

Is Gold a Capital Asset?

– Gold can be a capital asset if held as an investment but is ordinary if used as inventory.

Are Capital Assets Better Than Ordinary Assets?

– Capital assets and ordinary assets serve different purposes.

– Capital assets offer long-term value while ordinary assets are necessary for day-to-day operations.

How Can a Company Acquire More Capital Assets?

– Companies acquire capital assets through initial investments or self-funded operations.

The Bottom Line:

– Capital assets are tangible, illiquid, and long-term assets that carry higher value compared to ordinary assets.

– They provide long-term benefits and are integral to business operations.