What Is a Call Provision How It Works in Real Esate and Example

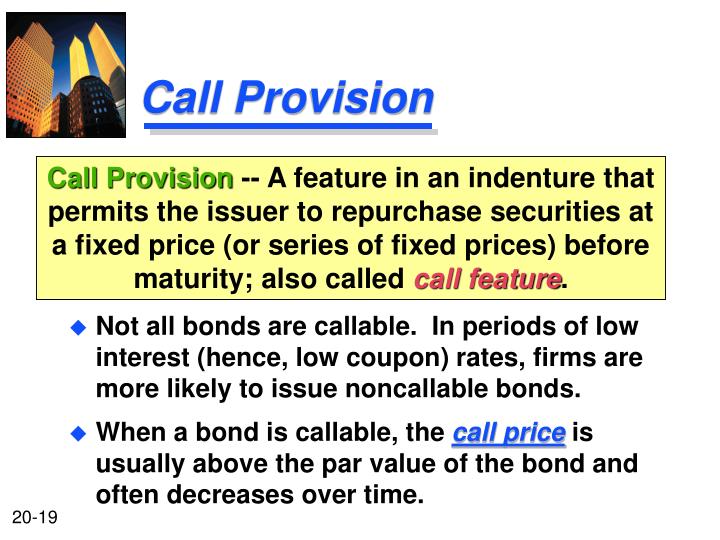

A call provision is a stipulation on a bond—or other fixed-income instruments—that allows the issuer to repurchase and retire the debt.

Call provision triggering events include the underlying asset reaching a preset price and a specified anniversary or other date being reached. The bond indenture will detail the events that can trigger the calling of the investment. An indenture is a legal contract.

If the bond is called, investors are paid any accrued interest up to the date of recall, and the return of their principal. Some debt securities have a freely-callable provision, allowing them to be called at any time.

Key Takeaways:

– A call provision allows the issuer to repurchase and retire bonds.

– The provision can be triggered by a preset price and a specified period.

– Callable bonds pay higher interest rates than noncallable bonds.

– Call provisions help companies refinance debt at lower interest rates.

Companies issue bonds to raise capital for their operations, such as purchasing equipment or launching a new product. Investors lend the company money.

An investor purchases a bond for its face value or a price lower or higher due to the secondary market. The company pays the bondholder an interest rate, known as the coupon rate, which can be paid annually, semiannually, quarterly, or monthly. At maturity, the company pays back the principal.

With a call provision, the corporation can pay off the debt early, avoiding additional interest payments. The provision is outlined in the bond indenture, which also details the bond’s features.

A callable bond is a bond with an embedded call option. The issuer can buy back the bond based on the terms defined in the indenture, which may allow redemption of a portion or all of the bonds through a random selection process.

A bond call benefits the issuer when market interest rates have fallen. The issuer can refinance its debt at a lower coupon payment rate. If rates have risen significantly, the issuer benefits from the lower interest rate associated with the bond.

Investors face the risk of losing long-term interest income if the bond is called. Reinvestment risk occurs when the investor must find another bond with a comparable rate. Callable bonds have higher coupon rates to compensate for the reinvestment risk.

Bonds with call provisions pay higher coupon rates than noncallable bonds. The provision allows companies to refinance debt when rates fall. However, investors face reinvestment risk when the bond is called.

Many municipal bonds have call features. Corporations can establish sinking funds to redeem bonds early.

In a real-world example, Exxon Mobil Corp. borrows $20 million by issuing callable bonds. Five years later, when market interest rates fall, Exxon exercises the call provision and refinances its debt at a lower rate. The original bondholders must find a comparable rate of return.