What Is a Call Option and How to Use It With Example

Call options are contracts that allow the buyer to purchase an asset at a specified price within a specific period. The buyer profits when the asset’s price increases. A call option can be contrasted with a put option, which gives the holder the right to sell the asset.

Here are the key takeaways:

– A call is an option contract that gives the owner the right, but not the obligation, to buy an underlying security at a specific price within a specified time.

– The specified price is called the strike price, and the specified time is the expiration or time to maturity.

– The buyer pays a fee called the premium to purchase a call option.

– Call options can be purchased for speculation, income purposes, or tax management.

– Call options can also be combined for use in spread or combination strategies.

Understanding the terms and basics of call options is crucial. Options allow investors to bet on the price movement of an asset. The contract gives the buyer the right to buy the asset at a specific price by a certain date. The buyer pays a fee called the premium. If the asset’s price is below the strike price at expiration, the option expires worthless.

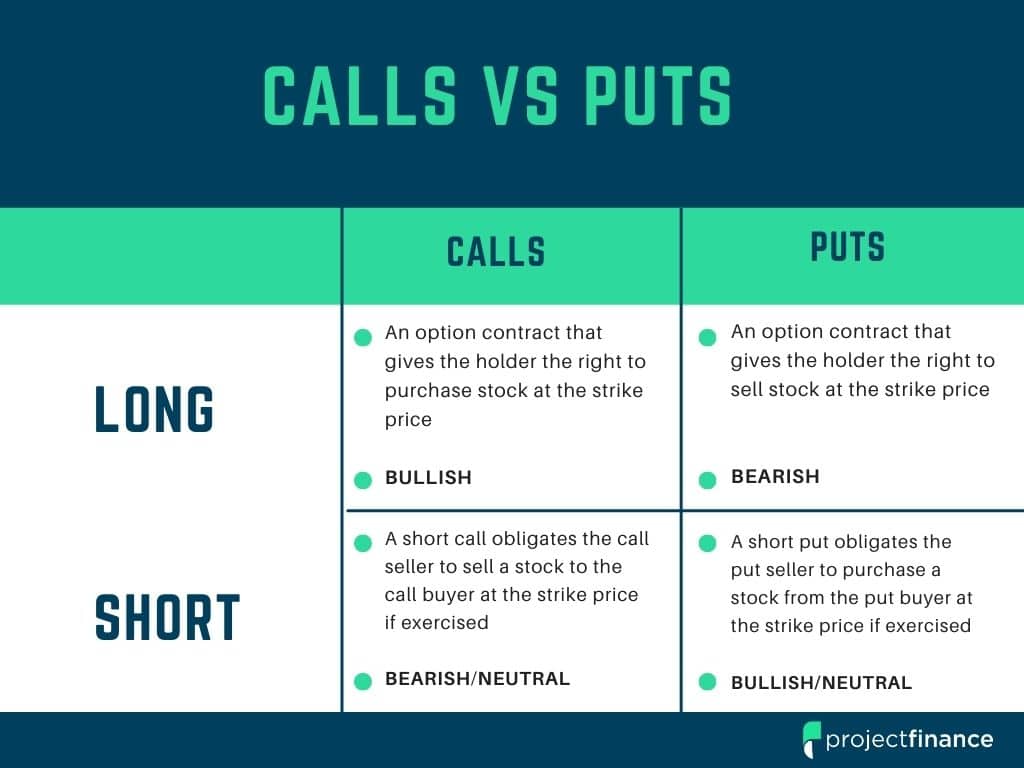

There are two types of call options: long call options and short call options.

– A long call option allows the buyer to purchase a stock at a predetermined strike price in the future. The buyer can plan ahead and buy the stock at a cheaper price.

– A short call option is the opposite. The seller promises to sell their shares at a fixed strike price in the future.

When it comes to calculating call option payoffs, there are three important variables: strike price, expiration date, and premium. There are two cases to consider:

– For call option buyers, if the stock price exceeds the strike price, the buyer makes a profit. If the stock price falls below the strike price, the buyer’s losses are limited to the premium paid.

– For call option sellers, if the stock price declines, the seller profits. The seller’s losses depend on whether the call is covered or not.

Call options can be used in different ways. Investors often use them to generate income, speculate on price movements, or manage their taxes. Covered calls involve owning the underlying stock while writing a call option to generate additional income.

In conclusion, call options are a type of financial contract that gives the buyer the right to purchase an asset at a specific price within a specific time. Buyers profit when the asset’s price increases, while sellers profit from collecting premiums. Understanding call options and their various uses is essential for investors.