Unquoted Public Company What it is How it Works Example

Contents

Unquoted Public Company: What it is, How it Works, Example

What Is an Unquoted Public Company?

An unquoted public company is a firm that has issued equity shares that are no longer traded on a stock exchange.

Key Takeaways

- An unquoted public company is a firm that has issued equity shares that are no longer traded on a stock exchange.

- Companies might be unquoted because they are too small, have too few shareholders, or have been delisted.

- Shares in unquoted public companies are bought and sold in over-the-counter markets.

OTC markets that trade unquoted public companies typically have less transparency than public exchanges.

Understanding Unquoted Public Companies

A public company has issued stock shares through an initial public offering (IPO) and trades on a stock exchange or an over-the-counter market. Publicly-quoted stocks might trade on exchanges like the New York Stock Exchange, while unquoted public companies trade over-the-counter.

Reasons for an Unquoted Public Company

Companies might be unquoted because they are too small to qualify for a stock market listing. Major exchanges have listing requirements for stocks that include earnings thresholds, outstanding shares, and listing fees.

An unquoted company might have too few shareholders for a listing, or the company’s management might want to avoid ownership disclosure requirements under certain listing exchanges. Another reason for remaining unquoted is cost savings. A struggling company may not want to incur the expenses of listing.

Companies that have been delisted might result in their stock becoming an unquoted public company. Delisting can be voluntary or due to a failure to meet listing requirements.

By remaining unquoted, the firm’s owners can operate the business more like a private company and avoid some exchange regulations. However, unquoted public companies are less heavily regulated than listed companies but still have to comply with financial reporting requirements and may be subject to the same takeover codes. Unquoted public companies may also be banned from marketing themselves to investors.

Trading and Valuation

As unlisted securities, shares in unquoted public companies are bought and sold in over-the-counter markets (OTC). In an OTC market, broker-dealers quote stock prices at which they will buy and sell a stock. However, two investors can execute a trade on an OTC market without other investors being aware of the price. OTC markets that trade unquoted public companies typically have less transparency than public exchanges.

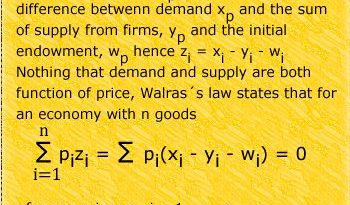

Stocks of unquoted public companies are rarely traded or are illiquid, leading to difficulty in pricing the stock. Unquoted public companies are valued using various financial models, including the comparables approach. The comparables approach analyzes similar companies or divisions. Comparing market transactions such as investments or buyouts in similar companies helps estimate the equity share value of the unquoted company.

Example of an Unquoted Public Company

Let’s say executives at Google have decided to remove the company’s stock from listed exchanges and become an unquoted public company. The company would be primarily owned by the founders and a few private investors.

The unquoted Google stock would not be readily available to trade, and any transactions would need to be processed through the OTC market. Valuing the company’s stock price would be a challenge since the financial information might not be available. Any valuation would be done by analyzing proxy companies in the social media sector. However, Google would have fewer regulatory requirements freeing up resources that were used to meet those requirements.