What Is a Buy Stop Order and When Would You Use One

Contents

What Is a Buy Stop Order and When Would You Use One?

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for leading finance publications, including The Motley Fool and Passport to Wall Street.

What is a Buy Stop Order

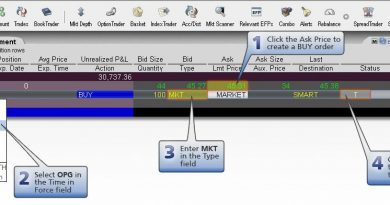

A buy stop order instructs a broker to purchase a security when it reaches a specified price. Once the price hits that level, the buy stop becomes either a limit or a market order, fillable at the next available price.

This type of stop order can apply to stocks, derivatives, forex, or other tradable instruments. The buy stop order can serve various purposes with the assumption that a share price that climbs will continue to rise.

Key Takeaways

- A buy stop order is an order to purchase a security only once the price reaches the specified stop price.

- The stop price is entered at a level, or strike, set above the current market price.

- It is a strategy to profit from an upward movement in a stock’s price by placing an order in advance.

- Buy stop orders can also protect against unlimited losses of an uncovered short position.

Basics of a Buy Stop Order

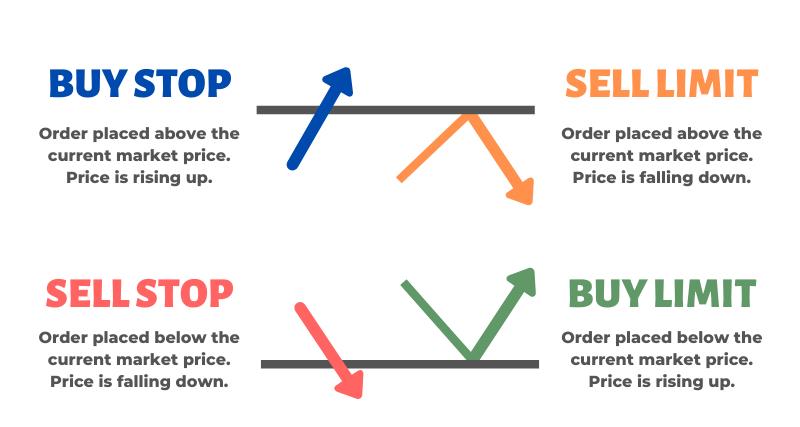

A buy stop order mainly protects against unlimited losses of an uncovered short position. An investor opens a short position to bet that a security’s price will decline. If the price decreases, the investor can buy cheaper shares and profit from the difference between the short sale and the purchase of a long position. To guard against a rise in share price, the investor can place a buy stop order to cover the short position at a price that limits losses. This is often referred to as a stop loss order.

The short seller can place their buy stop at a stop price either lower or higher than the point they opened their short position. If the price has declined significantly, and the investor wants to protect their profitable position against subsequent upward movement, they can place the buy stop below the original opening price. An investor looking to protect against catastrophic short position loss from significant upward movement will open a buy stop order above the original short sale price.

Buy Stop Orders for Bulls

The strategies described above use the buy stop to protect against bullish movement in a security. Another strategy uses the buy stop to profit from anticipated upward movement in share price. Technical analysts often refer to levels of resistance and support for a stock. The price may go up and down, but it is bracketed at the high end by resistance and at the low end by support. Some investors anticipate that a stock that climbs above the line of resistance, known as a breakout, will continue to climb. A buy stop order can be useful to profit from this phenomenon. The investor opens a buy stop order just above the line of resistance to capture the profits available once a breakout has occurred. A stop loss order can protect against subsequent decline in share price.

Example of a Buy Stop Order

Consider the price movement of a stock ABC that is poised to break out of its trading range of $9 to $10. Let’s say a trader bets on a price increase beyond that range for ABC and places a buy stop order at $10.20. Once the stock hits that price, the order becomes a market order, and the trading system purchases stock at the next available price.

The same type order can be used to cover short positions. Assume that the trader has a large short position on ABC, meaning she is betting on a future decline in its price. To hedge against the risk of the stock’s movement in the opposite direction, i.e., an increase in its price, the trader places a buy stop order that triggers a buy position if ABC’s price increases. Thus, even if the stock moves in the opposite direction, the trader stands to offset her losses.