Market-on-Open Order MOO Definitiion When to Use It

Contents

Market-on-Open Order (MOO): Definition and Usage

What Is a Market-On-Open Order (MOO)?

A Market-On-Open (MOO) order is executed at the day’s opening price. MOO orders can only be executed when the market opens or shortly after and must provide the first printed price of the day. They are different from market-on-close (MOC) orders.

Key Takeaways

- MOO orders are non-limit market orders executed at the very opening print of the trading day.

- Traders place MOO orders in anticipation of price changes throughout the day.

- These orders influence where the market may open and can create buy or sell imbalances before the trading day is in full swing.

How a Market-On-Open Order Works

MOO orders on the Nasdaq can be entered, canceled, or amended from 7 a.m. to 9:28 a.m. Eastern Time, Monday to Friday. On the NYSE, MOO orders can be taken any time up until 9:28 a.m. Eastern Time. Execution of MOO orders is guaranteed if there is sufficient liquidity, but the exact price is not guaranteed.

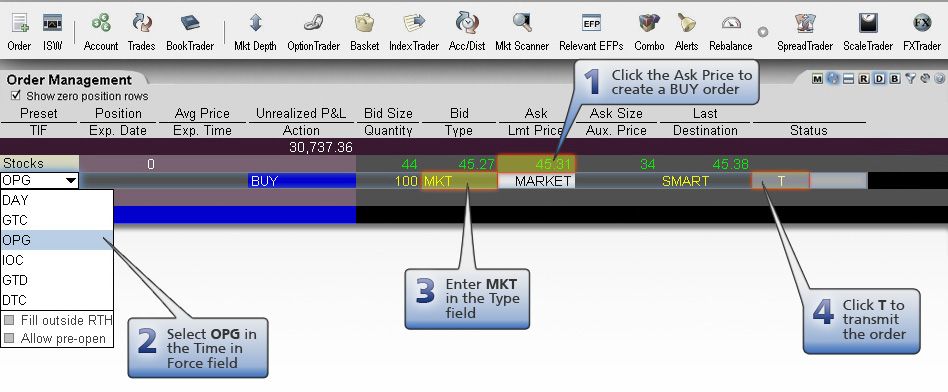

To execute a market-on-open order, a trader enters a buy order while the market is closed, at least two minutes before the market opens. During this time, market-making sellers assess how many orders are waiting for execution at the open, and the nature of those orders (large or small, buy or sell, Limit, Stop, or Market). Based on this information, they adjust their bids and offers, and the first trade of the session establishes the opening price.

The opening price incorporates all MOO orders. For example, if there were many MOO orders, the opening asking price will be significantly higher than the previous day’s closing price.

When to Use MOO Orders

Traders and investors use MOO orders when market conditions warrant buying or selling shares at the open. For instance, during earnings season, most companies report results after markets close. Price movement typically follows on the next trading day. Unlike a Limit-on-Open (LOO) order, MOO orders do not specify a limit price.

Brokers may use MOO orders to close error positions, which are often not discovered until trades are booked at the end of the trading day. To minimize risk, these orders ensure that errors are closed out as early as possible on the following day.

Example of a Market-on-Open Order

Assume an investor holds 1,000 shares in Intel, which has just reported that its sales and earnings for the next quarter will be below analysts’ estimates. The stock trades lower in the after-hours market, and the investor believes it will continue to decline sharply throughout the next day. They would enter a MOO order, expecting the stock to open at a lower price and close even lower.

The risk is that the investor receives Intel’s opening price, regardless of whether it’s down 5%, 10%, or 20%. Conversely, if the investor thinks that Intel may recover somewhat throughout the next trading day and prefers to hold their position instead of taking the opening market price, they could enter an LOO order. An LOO order specifies the price at which they are willing to sell their Intel shares, guaranteeing that the stock is not sold below their limit price. For instance, if the investor places an LOO order with a limit of $50, the shares would be sold on the open at the market price, as long as it is $50 or above.