What Is a Bridge Loan and How Does It Work With Example

Bridge Loan: A Short-Term Solution for Financing

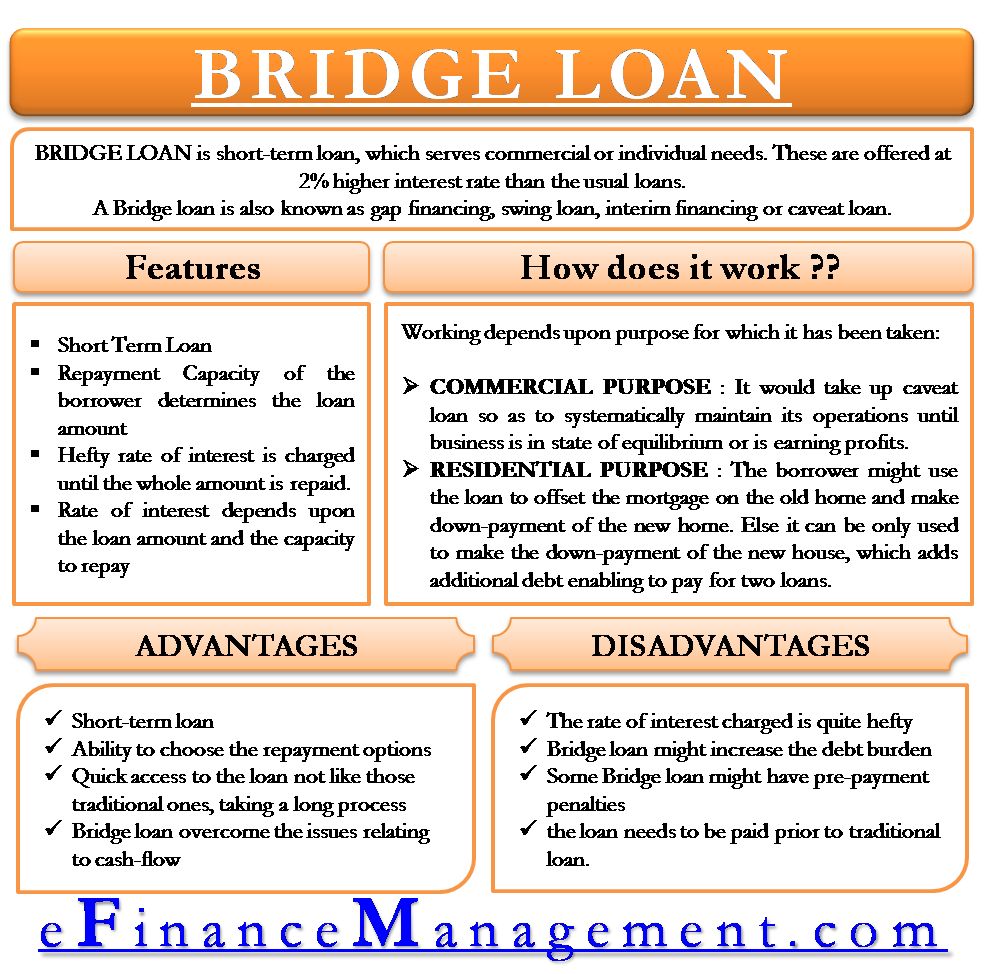

A bridge loan is a temporary loan used to secure permanent financing or fulfill existing obligations. It provides immediate cash flow, allowing borrowers to meet their current obligations. Typically, bridge loans have high interest rates and are backed by collateral, such as real estate or business inventory.

These loans, also known as bridge financing or bridging loans, are commonly used in real estate. However, various businesses also utilize them. For example, homeowners can use bridge loans to purchase a new home while waiting for their current home to sell.

Bridge loans, also referred to as interim financing, gap financing, or swing loans, serve as a solution when financing is needed but not yet available. They cater to both individuals and companies, with lenders customizing loans for different situations.

For homeowners, bridge loans offer the flexibility to use equity from their current home for the down payment on a new home. This gives them the time and peace of mind they need. However, it’s important to note that bridge loans often carry higher interest rates than other credit facilities like home equity lines of credit (HELOC).

When it comes to real estate bridge loans, lenders typically require applicants to have excellent credit and low debt-to-income (DTI) ratios. These loans allow the consolidation of mortgages from two properties, enabling buyers to wait for their former house to sell. However, lenders usually offer bridge loans worth only 80% of the combined property value, necessitating significant home equity or cash savings.

Businesses turn to bridge loans when awaiting long-term financing. These loans cover expenses like payroll, rent, utilities, and inventory costs during the interim period. For instance, a company engaged in equity financing expected to conclude in six months might choose a bridge loan to ensure working capital until the funding round finalizes.

In the case of real estate bridge loans, homeowners with outstanding mortgages must make two payments: one for the bridge loan and another for the mortgage until the old home sells.

An example of a bridge loan is Olayan America Corp.’s use of a loan from ING Capital to purchase the Sony Building in New York City, expediently covering part of the acquisition cost until Olayan secured long-term funding.

Compared to traditional loans, bridge loans offer quicker application, approval, and funding processes. Yet, in exchange for convenience, these loans typically have shorter terms, higher interest rates, and substantial origination fees.

Borrowers accept these terms due to the need for fast, convenient access to funds. They are willing to pay high interest rates because they intend to quickly repay the loan with low-interest, long-term financing. Moreover, most bridge loans do not have repayment penalties.

Bridge loans provide short-term cash flow, allowing homeowners to purchase a new home before selling their existing one. However, they come with higher interest rates compared to traditional loans. Additionally, if a homeowner still has a mortgage while waiting to sell their home, they must make payments on both loans.

To qualify for a real estate bridge loan, an excellent credit score and low debt-to-income ratio are essential.

In summary, bridge loans are temporary financing solutions used until permanent financing is secured or existing obligations are settled. While commonly used in residential real estate, they are also utilized by various businesses. Homeowners benefit from the ability to purchase a new home while their current one is being sold. Meanwhile, businesses rely on bridge loans for interim financing. It’s crucial to be aware that these loans typically carry higher interest rates compared to other available credit facilities.