What Is a Balanced Scorecard BSC How Is It Used in Business

Contents

- 1 What Is a Balanced Scorecard (BSC), How Is It Used in Business?

- 1.1 What Is a Balanced Scorecard (BSC)?

- 1.2 Understanding Balanced Scorecards (BSCs)

- 1.3 Characteristics of the Balanced Scorecard Model (BSC)

- 1.4 Benefits of a Balanced Scorecard (BSC)

- 1.5 Examples of a Balanced Scorecard (BSC)

- 1.6 Balanced Scorecard (BSC) FAQs

- 1.7 What Is a Balanced Scorecard and How Does It Work?

- 1.8 What Are the Four Perspectives of the Balanced Scorecard?

- 1.9 How Do You Use a Balanced Scorecard?

- 1.10 What Are the Benefits of a Balanced Scorecard?

- 1.11 What Is an Example of a Balanced Scorecard?

- 1.12 The Bottom Line

What Is a Balanced Scorecard (BSC), How Is It Used in Business?

Evan Tarver has 6+ years of experience in financial analysis and 5+ years as an author, editor, and copywriter.

What Is a Balanced Scorecard (BSC)?

The term balanced scorecard (BSC) refers to a strategic management performance metric used to identify and improve internal business functions and their resulting external outcomes. Used to measure and provide feedback to organizations, balanced scorecards are common among companies in the United States, the United Kingdom, Japan, and Europe. Data collection is crucial to providing quantitative results as managers and executives interpret the information. Company personnel can use this information to make better decisions for the future.

Key Takeaways

Understanding Balanced Scorecards (BSCs)

Companies easily identify factors hindering business performance and outline strategic changes tracked by future scorecards.

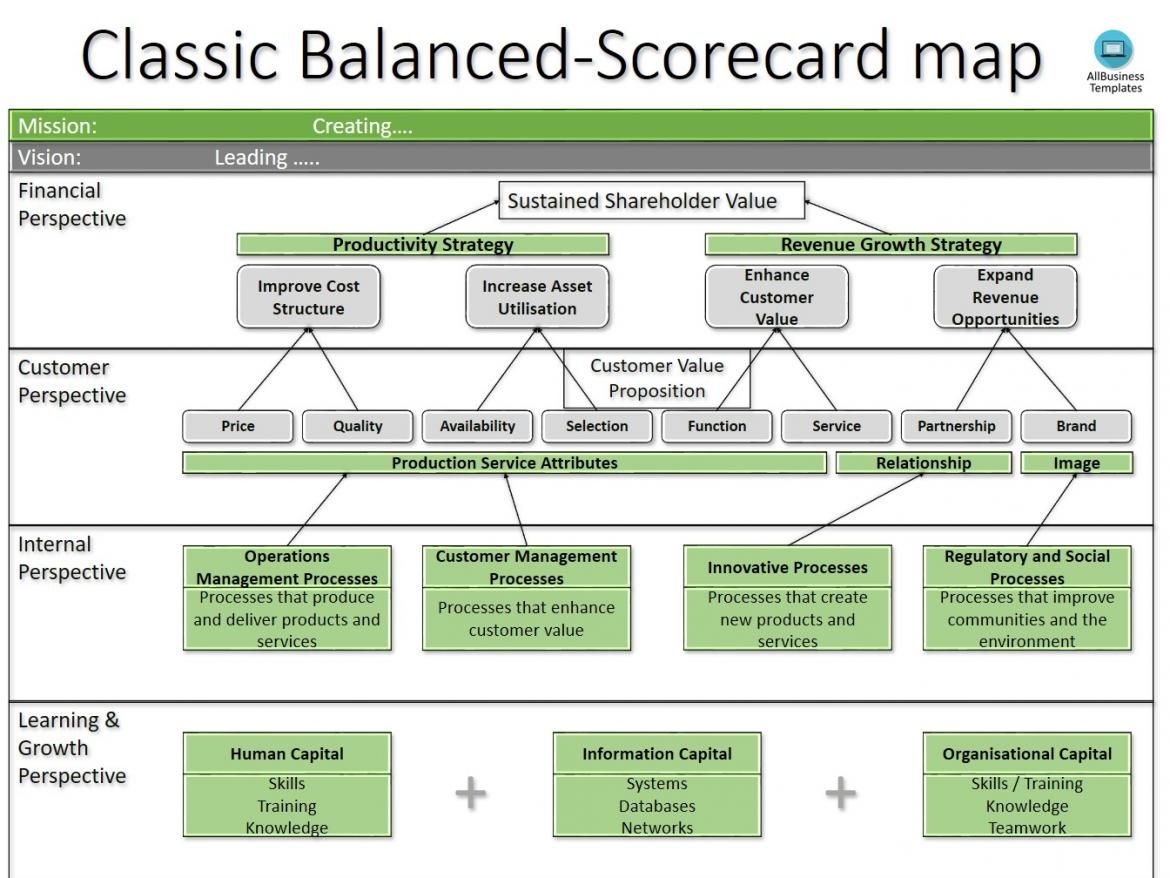

BSCs were originally meant for for-profit companies but later adapted for nonprofit organizations and government agencies. It measures the intellectual capital of a company, such as training, skills, knowledge, and proprietary information that gives it a competitive advantage in the market. The balanced scorecard model reinforces good behavior in an organization by isolating four separate areas that need to be analyzed. These four areas, also called legs, are:

- Learning and growth

- Business processes

- Customers

- Finance

The BSC is used to gather important information, objectives, measurements, initiatives, and goals resulting from these four primary functions of a business. Companies easily identify factors hindering business performance and outline strategic changes tracked by future scorecards.

The scorecard can provide information about the firm as a whole when viewing company objectives. An organization may use the balanced scorecard model to implement strategy mapping to see where value is added within an organization. A company may also use a BSC to develop strategic initiatives and objectives. This can be done by assigning tasks and projects to different areas of the company to boost financial and operational efficiencies, improving the company’s bottom line.

Characteristics of the Balanced Scorecard Model (BSC)

Information is collected and analyzed from four aspects of a business:

- Learning and growth: analyzed through investigation of training and knowledge resources. This first leg handles how well information is captured and how effectively employees use that information to convert it to a competitive advantage within the industry.

- Business processes: evaluated by investigating how well products are manufactured. Operational management is analyzed to track any gaps, delays, bottlenecks, shortages, or waste.

- Customer perspectives: collected to gauge customer satisfaction with the quality, price, and availability of products or services. Customers provide feedback about their satisfaction with current products.

- Financial data: such as sales, expenditures, and income used to understand financial performance. These financial metrics may include dollar amounts, financial ratios, budget variances, or income targets.

These four legs encompass the vision and strategy of an organization and require active management to analyze the data collected.

The balanced scorecard is often referred to as a management tool rather than a measurement tool because of its application by a company’s key personnel.

Benefits of a Balanced Scorecard (BSC)

There are many benefits to using a balanced scorecard. For instance, the BSC allows businesses to pool information and data into a single report rather than dealing with multiple tools. This allows management to save time, money, and resources when executing reviews to improve procedures and operations.

Scorecards provide management with valuable insight into their firm’s service and quality, in addition to its financial track record. By measuring all of these metrics, executives are able to train employees and stakeholders and provide them with guidance and support. This allows them to communicate goals and priorities to meet future goals.

Another key benefit of BSCs is how they help companies reduce their reliance on inefficiencies in their processes. This reduces suboptimization, resulting in increased productivity, revenue, and a stronger company brand and reputation.

Examples of a Balanced Scorecard (BSC)

Corporations can use their own internal versions of BSCs. For example, banks often contact customers and conduct surveys to gauge their customer service. These surveys include rating recent banking visits, with questions ranging from wait times, interactions with bank staff, and overall satisfaction. Banks may also ask customers for improvement suggestions. Bank managers can use this information to retrain staff or identify any issues customers have with products, procedures, and services.

In other cases, companies may hire external firms to develop reports for them. For instance, the J.D. Power survey is a common example of a balanced scorecard. This firm provides data, insights, and advisory services to help companies identify problems in their operations and make improvements for the future. J.D. Power does this through surveys in various industries, including financial services and automotive industries. Results are compiled and reported back to the hiring firm.

Balanced Scorecard (BSC) FAQs

What Is a Balanced Scorecard and How Does It Work?

A balanced scorecard is a strategic management performance metric that helps companies identify and improve their internal operations to help their external outcomes. It measures past performance data and provides organizations with feedback on how to make better decisions in the future.

What Are the Four Perspectives of the Balanced Scorecard?

The four perspectives of a balanced scorecard are learning and growth, business processes, customer perspectives, and financial data. These four areas, also called legs, make up a company’s vision and strategy. They require a firm’s key personnel, such as executives and management teams, to analyze the data collected in the scorecard.

How Do You Use a Balanced Scorecard?

Balanced scorecards allow companies to measure their intellectual capital along with their financial data to analyze successes and failures in their internal processes. By compiling data from past performance into a single report, management can identify inefficiencies, devise plans for improvement, and communicate goals and priorities to employees and stakeholders.

What Are the Benefits of a Balanced Scorecard?

There are many benefits to using a scorecard. The most important advantages include bringing information into a single report, which saves time, money, and resources. Scorecards also allow companies to track their service and quality performance, in addition to their financial data. They also enable companies to recognize and reduce inefficiencies.

What Is an Example of a Balanced Scorecard?

Corporations may use internal methods to develop scorecards. For instance, they may conduct customer service surveys to identify successes and failures in their products and services, or they may hire external firms to do the work for them. J.D. Power is an example of a firm hired by companies to conduct research on their behalf.

The Bottom Line

Companies have options to identify and resolve issues with their internal processes, improving their financial success. Balanced scorecards allow companies to collect and study data from four key areas: learning and growth, business processes, customers, and finance. By pooling information into a single report, companies can save time, money, and resources to better train staff, communicate with stakeholders, and improve their financial position in the market.

Companies have options to identify and resolve issues with their internal processes, improving their financial success. Balanced scorecards allow companies to collect and study data from four key areas: learning and growth, business processes, customers, and finance. By pooling information into a single report, companies can save time, money, and resources to better train staff, communicate with stakeholders, and improve their financial position in the market.