What Are Transaction Costs Definition How They Work and Example

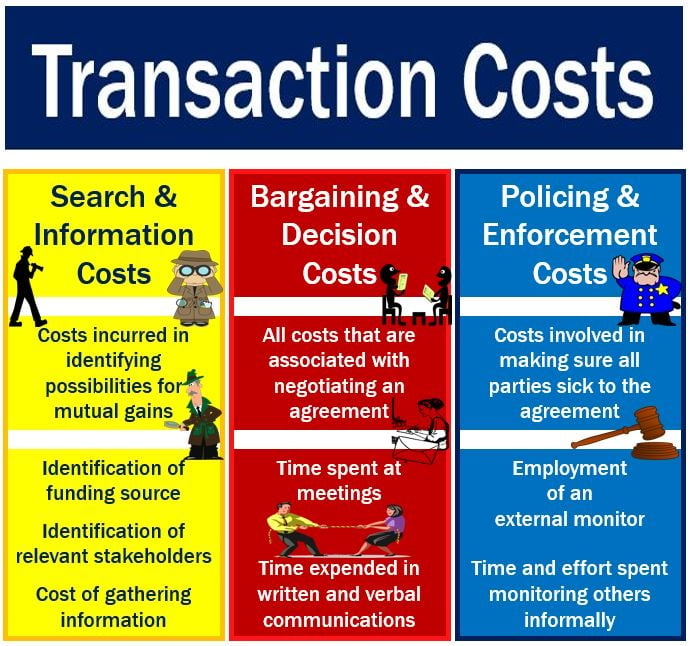

Transaction costs are expenses incurred when buying or selling a good or service. They represent the labor required to bring a good or service to market, giving rise to industries dedicated to facilitating exchanges. In a financial sense, transaction costs include brokers’ commissions and spreads.

– Transaction costs are payments that banks and brokers receive for their roles in buying and selling. They are one of the key determinants of net returns.

– Different asset classes have different ranges of transaction costs; investors should select assets with costs at the low end of the range.

– Ongoing fees are charges related to the passage of time, while transaction costs are incurred with each purchase or sale.

– Traders can minimize transaction fees through aggregated trades or a more passive investment strategy.

Transaction costs also exist in buying and selling real estate, including agent commissions and closing costs. There are also costs associated with transporting goods across long distances.

Fees, such as mutual fund expense ratios, have a similar effect. Investors should choose assets with low costs.

Ongoing fees and transaction costs are technically different. Ongoing fees are charged periodically, while transaction costs occur with each transaction.

It may be impossible to avoid transaction costs entirely, as they are inherent in certain markets and activities.

When transaction costs decrease, an economy becomes more efficient, and more capital and labor are freed. However, labor markets must adjust to this new environment.

Barriers to communication can be a type of transaction cost. The internet and telecommunications have reduced these barriers, threatening traditional jobs like insurance agents and real estate agents.

The prices of goods and services have lowered due to reduced barriers to communication. E-commerce transactions have become more efficient, although they have shifted the type of transaction cost involved.

Transaction costs can be avoided to some extent by minimizing the number of transactions and seeking brokers that offer free trades.

High transaction costs can have significant implications over time, reducing the overall portfolio value.

Transaction costs are necessary to reward intermediaries who facilitate exchanges. Investors should be mindful of the fees charged by their brokers and consider strategies to minimize them.