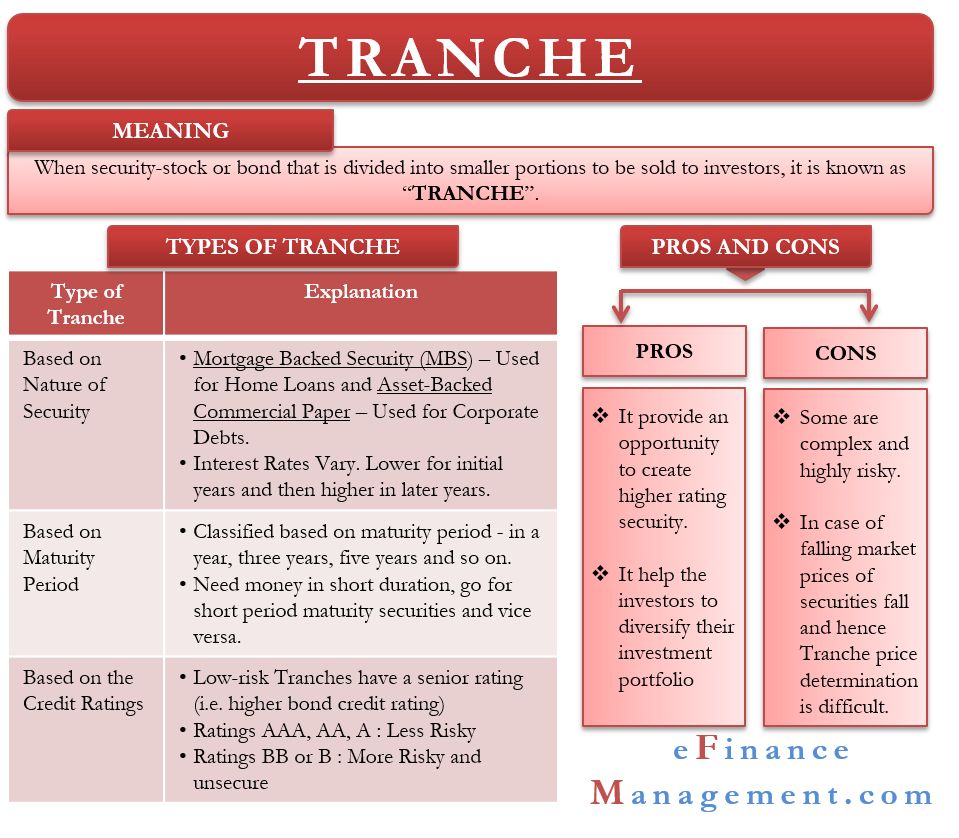

What Are Tranches Definition Meaning and Examples

Tranches are segments created from a pool of securities—usually debt instruments like bonds or mortgages—that are divided by risk, time to maturity, or other characteristics to be marketable to different investors. Each portion or tranche of a securitized or structured product is one of several related securities offered at the same time, but with varying risks, rewards, and maturities to appeal to a diverse range of investors.

Tranche is a French word meaning slice or portion. They are commonly found in mortgage-backed securities (MBS) or asset-backed securities (ABS).

Key Takeaways:

– Tranches are pieces of a pooled collection of securities, usually debt instruments, that are split up by risk or other characteristics to be marketable to different investors.

– Tranches carry different maturities, yields, and degrees of risk—and privileges in repayment in case of default.

– Tranches are common in securitized products like CDOs and CMOs.

Understanding Tranches:

Tranches in structured finance are a recent development, spurred by the increased use of securitization to divide up sometimes-risky financial products with steady cash flows and sell these divisions to other investors. The discrete tranches of a larger asset pool are usually defined in transaction documentation and assigned different classes of notes with different bond credit ratings.

Senior tranches usually contain assets with higher credit ratings than junior tranches. The senior tranches have first lien on the assets—they’re in line to be repaid first, in case of default. Junior tranches have a second lien or no lien at all.

Examples of financial products that can be divided into tranches include bonds, loans, insurance policies, mortgages, and other debts.

Tranches in Mortgage-Backed Securities:

A tranche is a common financial structure for securitized debt products, such as a collateralized debt obligation (CDO) or a mortgage-backed security. An MBS is made up of multiple mortgage pools with various loans, from safe loans with lower interest rates to risky loans with higher rates. Each specific mortgage pool has its own time to maturity, which factors into the risk and reward benefits. Tranches divide the different mortgage profiles into slices with suitable financial terms for specific investors.

For example, a collateralized mortgage obligation (CMO) offering a partitioned mortgage-backed securities portfolio might have mortgage tranches with one-year, two-year, five-year, and 20-year maturities, all with varying yields. Investors can choose the tranche type most applicable to their appetite for return and aversion to risk.

A Z tranche is the lowest-ranked tranche of a CMO in terms of seniority. Its owners are not entitled to any coupon payments until the more senior tranches are retired or paid off.

Investors receive monthly cash flow based on the MBS tranche in which they invested. They can sell it for quick profit or hold onto it for small but long-term gains in the form of interest payments. These monthly payments are bits and pieces of all the interest payments made by homeowners whose mortgage is included in a specific MBS.

Investment Strategy in Choosing Tranches:

Investors seeking long-term steady cash flow will invest in tranches with longer maturity timelines, while those looking for immediate income will invest in tranches with shorter maturities. All tranches, regardless of interest and maturity, allow investors to customize investment strategies to their specific needs and help attract investors across various profiles.

Tranches add complexity to debt investing and sometimes pose a problem to uninformed investors, who may choose unsuitable tranches for their investment goals. Tranches can also be miscategorized by credit rating agencies, exposing investors to riskier assets than intended. This mislabeling played a part in the mortgage meltdown of 2007 and the subsequent financial crisis.

Tranche Lawsuits in the 2007-2009 Financial Crisis:

After the financial crisis of 2007-09, lawsuits against issuers of CMOs, CDOs, and other debt securities became widespread, leading to what was dubbed "tranche warfare" in the press. Investors in the senior tranches of failed CDOs took advantage of their priority status to seize control of assets and cut off payments to other debt holders. CDO trustees filed suits to ensure all tranche investors continued to receive funds. Hedge fund Carrington Investment Partners also filed a lawsuit against mortgage-servicing company American Home Mortgage Servicing, claiming their junior tranches were being impacted by low-priced foreclosed property sales.

What Are the Three Types of Tranches?

Pooled financial securities are generally broken into three tranches: senior, mezzanine, and junior. Each tranche has a different level of risk and, therefore, a different level of return. Senior tranches have the least risk and lowest returns, while junior tranches have the highest risk and highest returns. Mezzanine tranches sit between the two.

What Is an Example of a Tranche?

An example of a tranche is as follows: Hundreds of mortgages are pooled into a security, such as a mortgage-backed security (MBS). The mortgages in this security have different credit profiles based on the holder. Some have excellent credit profiles and low interest rates, while others have bad credit profiles and high interest rates. These mortgages are broken into tranches, with each tranche representing a different credit profile. The low-risk mortgages go into the senior tranche, while the high-risk mortgages go into the junior tranche. Investors can choose their tranche based on their risk profile.

Is a CMO a CDO?

A collateralized mortgage obligation (CMO) is a collateralized debt obligation (CDO) constructed of underlying mortgages. CDOs are pooled investment securities made up of fixed-income assets, often loans. A CMO is a CDO specifically composed of mortgages.

What Is a AAA Tranche?

Most pooled fixed-income investments consist of tranches, each assigned with a credit rating. Tranches assigned a AAA rating are of the best quality, meaning they have the least risk but also the lowest return. Sometimes large corporations, projects, or sovereign governments require large amounts of funds, and banks may work together to offer funds and create pro-rata tranches. Pro-rata tranches also have an assigned credit rating.

The Bottom Line:

Tranches allow investors to choose the level of risk and return when investing in pooled securities. Those seeking higher returns will opt for higher-risk tranches containing below-investment-grade securities, while those seeking safer returns will opt for investment-grade tranches.