What Are Greeks in Finance and How Are They Used

Contents

What Are Greeks in Finance and How Are They Used?

What Are the Greeks?

"The Greeks" refers to the variables used in the options market to assess risk. Each Greek symbol represents a specific risk associated with an option.

Traders utilize different Greek values, including delta, theta, and others, to manage options risk and portfolios.

Key Takeaways

- The Greeks are symbols assigned to risk characteristics of an options position.

- Commonly used Greeks include delta, gamma, theta, and vega.

- Traders use Greeks to understand how options investments behave and hedge their positions accordingly.

Understanding the Greeks

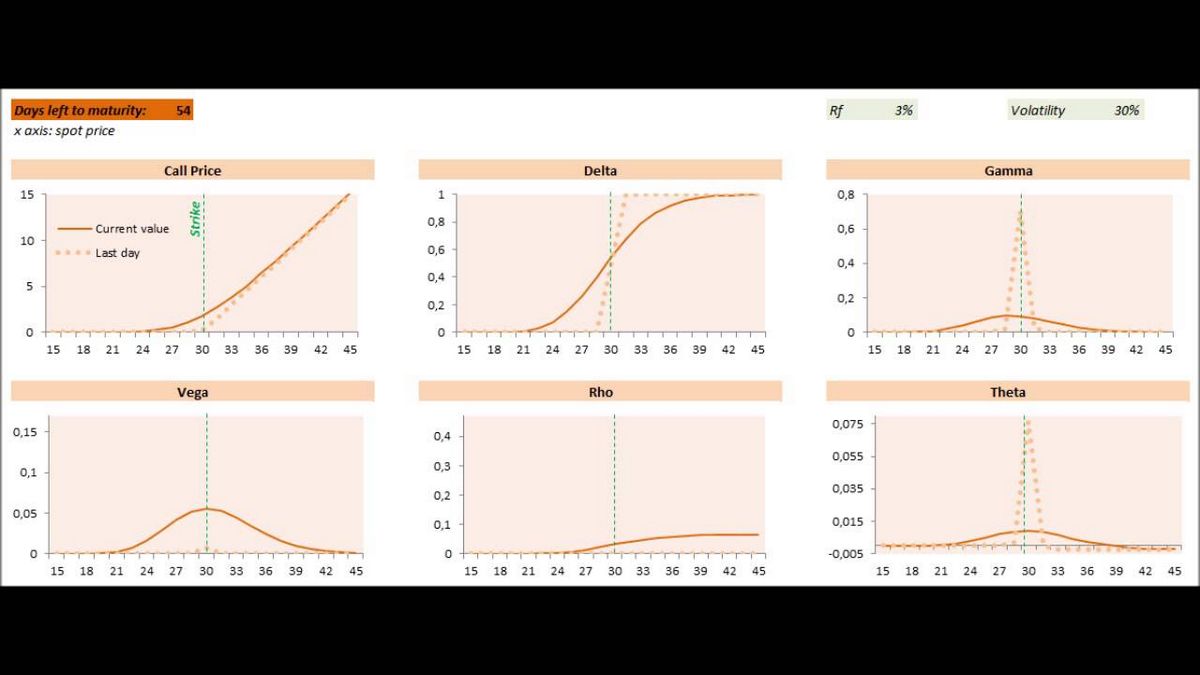

The Greeks encompass variables like delta, theta, gamma, vega, and rho. Each Greek represents a specific relationship between the option and an underlying variable.

These Greeks are calculated as first partial derivatives of the options pricing model.

Delta

Delta (Δ) represents the rate of change between the option’s price and the underlying asset’s price. It shows the option’s sensitivity to the underlying asset’s movements.

For options traders, delta also represents the hedge ratio for creating a delta-neutral position.

Theta

Theta (Θ) measures the rate of change between the option price and time. It indicates an option’s time decay.

Gamma

Gamma (Γ) represents the rate of change between an option’s delta and the underlying asset’s price. It measures second-order price sensitivity.

Vega

Vega (ν) measures the rate of change between an option’s value and the underlying asset’s implied volatility.

Rho

Rho (ρ) measures the rate of change between an option’s value and a 1% change in the interest rate.

Minor Greeks

In addition to the main Greeks, there are minor Greeks like lambda, epsilon, vomma, vera, zomma, and ultima. These Greeks affect more complex risk factors in options trading strategies.

Implied Volatility

Implied volatility is related to the Greeks and reflects expected volatility in the future. It helps traders assess option pricing.

Conclusion

The Greeks are essential tools for options traders to assess risk and manage option portfolios. They provide valuable insights into option behavior and help traders make informed investment decisions.