What are Financial Securities Examples Types Regulation and Importance

Contents

- 1 Financial Securities: Examples, Types, Regulation, and Importance

- 1.1 What Is a Security?

- 1.2 Understanding Securities

- 1.3 Types of Securities

- 1.4 How Securities Trade

- 1.5 Investing in Securities

- 1.6 Regulation of Securities

- 1.7 Other Types of Securities

- 1.8 Issuing Securities: Examples

- 1.9 What Is the Difference Between Stocks and Securities?

- 1.10 What Are Marketable Securities?

- 1.11 What Are Treasury Securities?

- 1.12 The Bottom Line

Financial Securities: Examples, Types, Regulation, and Importance

What Is a Security?

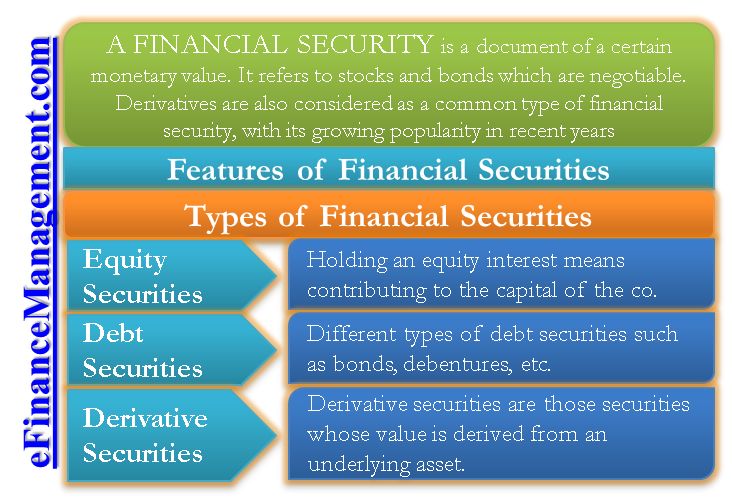

The term "security" refers to a financial instrument that holds monetary value. It can represent ownership in a corporation (stock), a creditor relationship (bonds), or rights to ownership (option).

Key Takeaways

- Securities are tradable instruments used to raise capital.

- Types of securities include equity, debt, and hybrids.

- Sales of securities are regulated by the SEC and other organizations.

Understanding Securities

The Securities Act of 1933 regulates the U.S. stock market. It requires companies to disclose information about investment contracts to protect investors. The Securities and Exchange Commission (SEC) enforces these regulations.

Courts have interpreted the definition of securities broadly. The Howey Test determines if something qualifies as a security based on four criteria.

Types of Securities

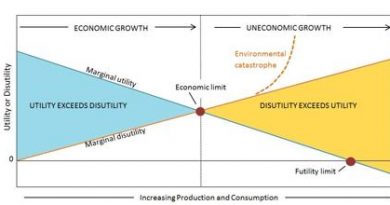

Securities can be categorized into equity, debt, and hybrid.

Equity Securities

Equity securities represent ownership in an entity. They provide control and the potential for capital gains.

Debt Securities

Debt securities represent borrowed money and include bonds and certificates of deposit. They provide regular interest payments and the return of principal.

Hybrid Securities

Hybrid securities combine elements of equity and debt, such as convertible bonds and preference shares.

Derivative Securities

Derivatives are financial contracts whose value depends on underlying assets, such as call and put options.

Asset-Backed Securities

Asset-backed securities represent income generated by a pool of similar assets, such as mortgages or loans.

How Securities Trade

Securities are traded on stock exchanges or through electronic systems. Publicly traded securities can be sold in initial public offerings (IPOs) or secondary markets. Private placements are offered to a specific group. Securities can also be traded directly between investors.

Investing in Securities

Securities allow companies and governments to raise capital. Investors can purchase securities for income or to seek capital appreciation. Buying on margin is a popular investment technique.

Regulation of Securities

The SEC regulates public offerings and trades of securities. Self-regulatory organizations also play a role in the regulation of derivative securities.

Other Types of Securities

Certificated and uncertificated securities can be held physically or in book-entry form. Bearer, registered, letter, and cabinet securities have different characteristics and market practices.

Issuing Securities: Examples

Companies can issue equity securities through IPOs or private placements. Governments issue debt securities to raise funds. Startups can offer convertible notes, which turn into equity securities.

What Is the Difference Between Stocks and Securities?

Stocks are one type of security. Securities encompass stocks, bonds, derivatives, and asset-backed securities.

What Are Marketable Securities?

Marketable securities are easily bought and sold on public exchanges. Non-marketable securities have limited trading opportunities.

What Are Treasury Securities?

Treasury securities are low-risk debt securities issued by the U.S. Treasury department.

The Bottom Line

Securities are common investment contracts that allow companies to raise capital and individuals to invest for retirement. Regulatory bodies ensure the integrity of these markets.