What Are Accounts Uncollectible Example

Amy is an ACA, CEO, and founder of OnPoint Learning, a financial training company for professionals and individuals. She has nearly two decades of experience in the financial industry and as a financial instructor.

Accounts uncollectible are receivables, loans, or debts that have no chance of being paid. Possible reasons for accounts uncollectible include debtor’s bankruptcy, inability to find the debtor, debtor fraud, or lack of proper documentation to prove the debt.

Key takeaways:

– Accounts uncollectible are receivables or debts that won’t be paid by a debtor.

– Reasons for accounts uncollectible relate to bankruptcy or refusal to pay.

– Goods sold on credit usually have a 30 to 90 day repayment period.

– Unpaid receivables or debts are written off, with amounts credited to accounts receivable and debited to the allowance for doubtful accounts.

When a customer purchases goods on credit, the vendor books the amount as accounts receivable. The payment terms typically range from 30 to 90 days.

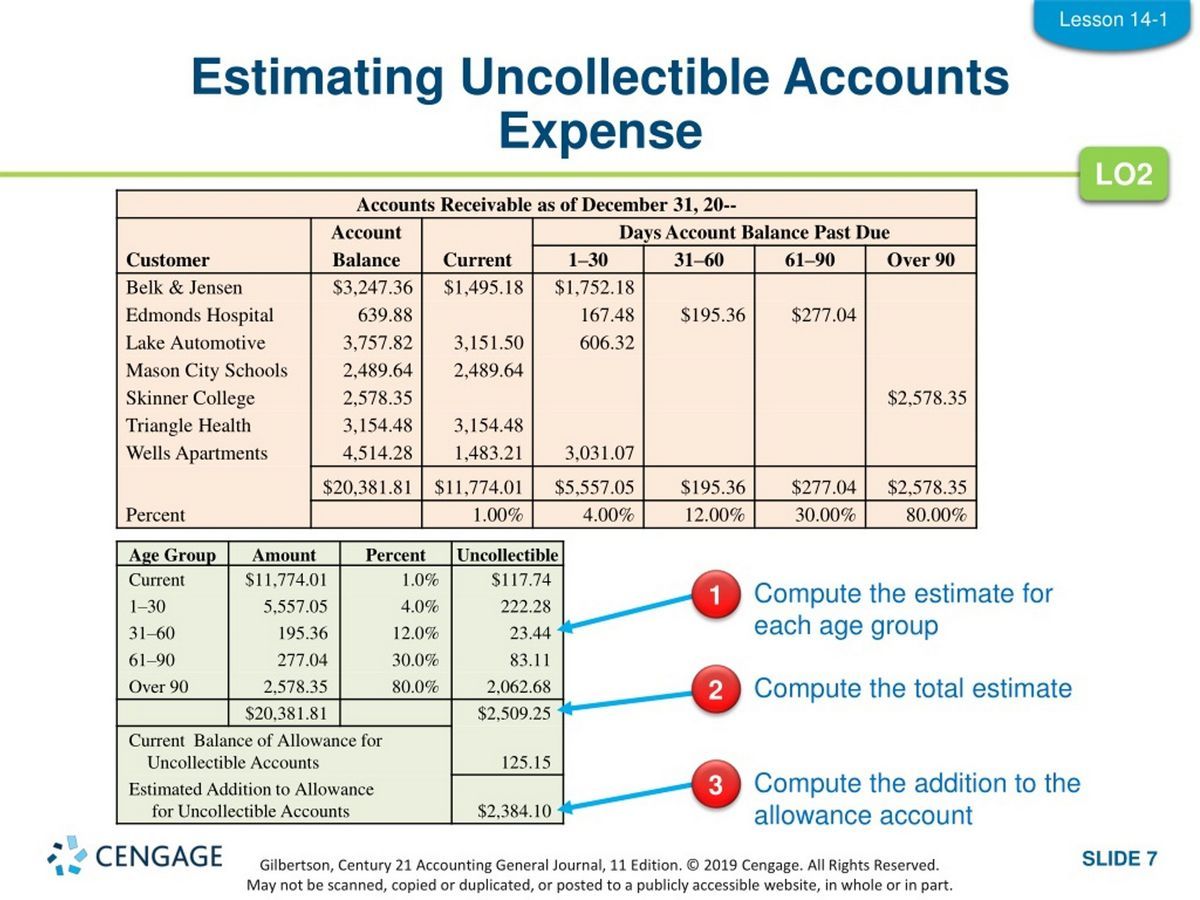

If a customer has not paid after three months, the amount may be classified as "aged" receivables, and later as a "doubtful" account. At this point, the company believes receiving the outstanding amount is doubtful and will debit the bad debt and credit the allowance for doubtful accounts.

For bookkeeping, the amount is written off with journal entries as a debit to allowance for doubtful accounts and a credit to accounts receivable. When it is confirmed that the company will not receive payment, this is reflected in the income statement as bad debt expense, which reduces profits.

Accounts uncollectible provide insight into a company’s lending practices and customers. If accounts uncollectible remain steady or increase, it indicates that the company is extending credit to risky customers and should improve its vetting measures.

Example: Barry and Sons Boot Makers sold $5 million worth of boots on credit. Of that amount, $1 million was from Fancy Foot Store. However, Fancy Foot Store declares bankruptcy, and Barry and Sons Boot Makers will not receive the $1 million. The entire amount is written off as bad debt expense on the income statement, and the allowance for doubtful accounts is reduced by $1 million.