Weighted Average Cost Of Equity Wace Meaning Calculation

Weighted Average Cost Of Equity (WACE): Meaning, Calculation

What is the Weighted Average Cost of Equity (WACE)?

The weighted average cost of equity (WACE) is a way to determine the cost of a company’s equity by assigning different weights to different types of equities based on their proportion in the corporate structure. Instead of combining retained earnings, common stock, and preferred stock, WACE provides a more accurate assessment of the company’s total cost of equity.

Determining the accurate cost of equity is crucial for calculating a firm’s cost of capital. This measure is essential when evaluating the profitability of future projects.

How the Weighted Average Cost of Equity (WACE) Works

The weighted average cost of equity (WACE) is similar to the cost of equity used in the Capital Asset Pricing Model (CAPM). Rather than simply averaging the cost of equity, WACE applies a weight that reflects the equity type’s mix in the company at that time. Weighting prevents an overstatement or understatement of the cost that could be caused by outliers in the cost of equity.

Key Takeaways

– WACE measures the cost of equity proportionally for a company rather than simply averaging overall figures.

– With WACE, the cost of a specific equity type is multiplied by the percentage of the capital structure it represents.

– The cost of equity used in most formulas is usually a weighted average cost of equity.

Calculating the Weighted Average Cost of Equity (WACE)

Calculating the weighted average cost of equity is not as straightforward as determining the cost of debt. First, you calculate the cost of new common stock, preferred stock, and retained earnings separately, using the CAPM formula:

Cost of equity = Risk-free rate of return + [beta x (market rate of return – risk-free rate of return)]

The cost of equity for common stock, preferred stock, and retained earnings usually falls within a narrow range. For this example, assume the costs are 14% for common stock, 12% for preferred stock, and 11% for retained earnings.

Next, calculate the portion of total equity represented by each equity type. Assume this is 50% for common stock, 25% for preferred stock, and 25% for retained earnings.

Finally, multiply the cost of each equity type by its respective portion of total equity and sum the values to obtain the WACE. In this example, the WACE is 19.5%.

WACE = (.14 x .50) + (.12 x .25) + (.11 x .25) = 0.1275 or 12.8%

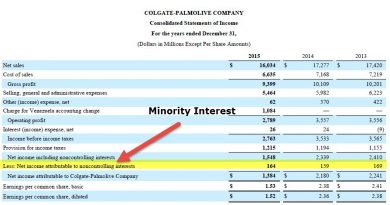

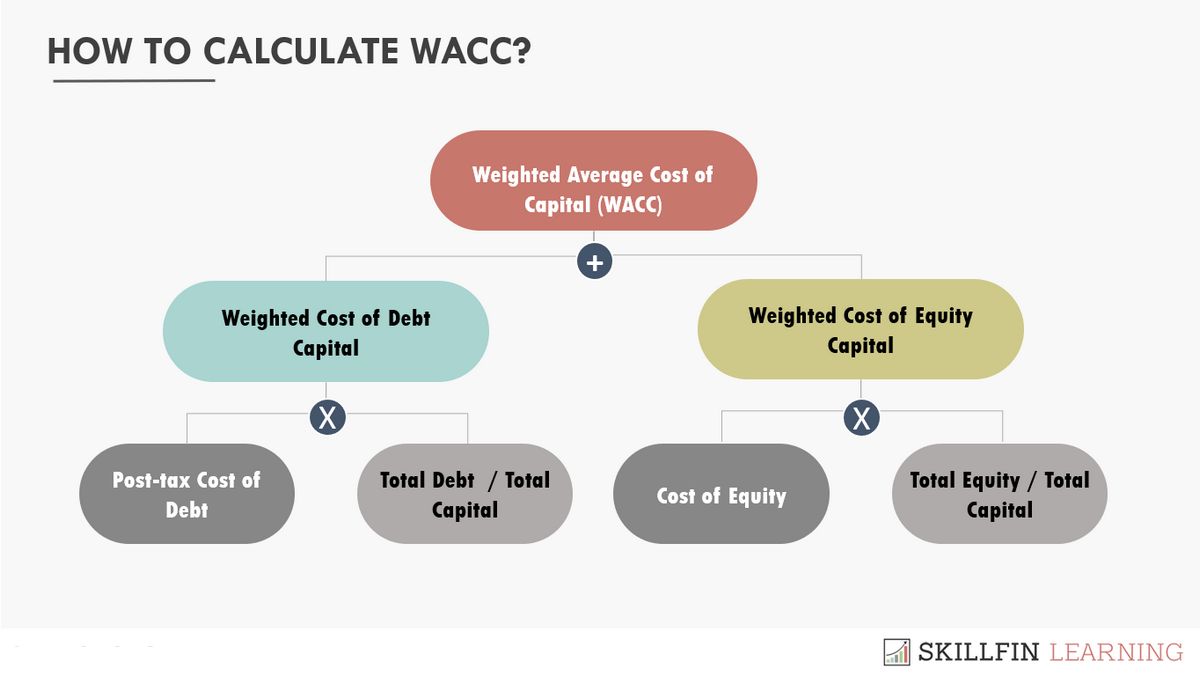

Simply averaging the cost of equity across categories in the example above would yield a cost of equity of 12.3%. However, the weighted average cost of equity is usually used as part of the larger calculation of a company’s weighted average cost of capital (WACC), rather than simply averaging.

Why the Weighted Average Cost of Equity (WACE) Matters

Potential buyers assessing the acquisition of a company may use the weighted average cost of equity to determine the value of the target company’s future cash flows. This formula can be combined with other indicators, such as the after-tax cost of debt, for a more comprehensive assessment. The weighted average cost of equity is commonly used with the weighted average cost of debt to calculate a firm’s weighted average cost of capital (WACC).

Within the company, the WACE is used as part of the WACC to evaluate how campaigns and capital-intensive projects contribute to the overall return on earnings for shareholders. As a standalone metric, the weighted average cost of equity influences a company’s decision to issue new stock when raising capital. Most companies find it cheaper to raise capital through debt in the form of bonds, as the capital costs of debt are easier for investors to calculate during balance sheet analysis.