Watchlist Definition Purpose and How To Create One

Watchlist: Definition, Purpose, and How To Create One

What Is a Watchlist?

A watchlist is a set of securities that an investor monitors for potential trading or investing opportunities.

Many brokerage and financial platforms allow for easy construction and viewing of watchlists. A well-organized watchlist can help identify trading opportunities, track portfolio performance, or monitor hot or popular stocks.

Key Takeaways

– A watchlist is an inventory of ticker symbols that are monitored for potential opportunities or to track their performance.

– Most online brokerages and financial portals allow for easy watchlist construction.

– Some trading platforms may offer curated watchlists, according to criteria that experts believe may be important to the platform’s users.

– Using a stock screener, it is possible to create an automated watchlist focused on a specific metric, such as earnings or long-term performance.

– Watchlists can be proactively managed and monitored, or passively viewed over time.

Understanding Watchlists

A watchlist is basically a list of stocks that an investor watches to take advantage of undervalued situations. These are names that an investor would buy and own at the right price or with the right catalyst.

An investor or trader may create a watchlist of trading instruments to make more informed investment decisions. A watchlist can help an investor track companies and stay abreast of news that could impact these instruments.

Typically, the investor monitors the list, waiting for certain criteria to be met, such as trading volume, breaking out of a range, or moving above its moving average, before placing trade orders.

Types of Watchlists

Most trading platforms allow users to create their own watchlists for the securities they are interested in.

Fidelity, for example, allows users to create up to fifteen different watchlists, with 50 symbols each. Users can also configure their lists to alert them of any new trading signals, such as sudden price changes. An investor could use this functionality to create separate watchlists for stocks, bonds, mutual funds, or other assets.

Watchlists are also used in cryptocurrency trading, where price swings can offer opportunities for high profits. In addition to trading metrics, a watchlist for cryptocurrencies might track tokens with an upcoming fork or mainnet launch.

When to Use a Watchlist

If an investor is interested in purchasing stocks in a particular sector, they could create a list of stocks in that sector and track various valuation measures. When a company on the list meets a specified valuation criterion, it would be a possible candidate for investment.

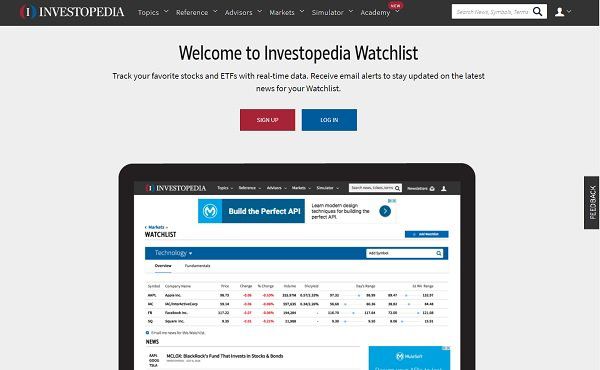

Many investment-oriented websites and brokerage platforms allow visitors or customers to create watchlists online, often for free.

If you’re interested in keeping track of securities, you can build your own watchlist on most brokerage platforms.

Many novice investors are tempted to track as many stocks as possible, but a watchlist with hundreds of entries is too broad for any one investor. Don’t try to track everything at once.

Special Considerations

The watchlists provided by brokerage platforms can accommodate around 25 to 75 names depending on space taken up by charts, scanners, news tickers, and market depth windows. A longer watchlist of 200 stocks is likely to be too broad for almost any investor to monitor or maintain. Investors should refresh this list at least a couple of times per month. After all, this is generally supposed to be a list of names that an investor is simply waiting to get cheap enough to buy.

It’s a good idea to devote at least one screen entirely to watchlist tickers, with each entry displaying just two or three fields, including last price, net change, and percentage change. Some traders add a single chart to this linking the tickers to allow a quick review of price patterns during the trading day.

Example of a Watchlist

For examples of stock watchlists, Yahoo! Finance offers several curated watchlists with preset criteria like "Most Active Penny Stocks" and "Most Shorted Stocks." These lists have the added advantage of automatic updates so that users do not need to manually add or remove stocks that no longer fit the list criteria.

The Bottom Line

Watchlists are an easy way for investors to track the market for trading signals and opportunities. There are now many tools for investors to create their own watchlists or follow curated watchlists by other parties. By narrowing the market down to a list of key securities, traders can focus their attention on closely watching the securities they are interested in.

How Do You Create a Stock Watchlist?

Most online trading platforms offer functionality for users to create their own watchlists, allowing them to easily track any security that catches their interest. To create a watchlist, you should first identify your key investment criteria and decide what kinds of investments you are looking for. Then, using a stock screener or similar tool, search for stocks that fit those criteria and add them to your watchlist.

What Is a Good Stock Watchlist Tool?

In terms of functionality, the most versatile watchlist tools come as part of a paid investment product. Worden’s TC2000, Wealth Lab, and Trade Ideas each offer large databases for paying customers. Free trading platforms, such as Fidelity or Robinhood, also come with the ability to create watchlists and follow stocks, although they may track fewer metrics than paid versions. Many online finance sites, such as Marketwatch and TradingView, also offer free watchlists and stock screeners.

What Is a Curated Stock Watchlist?

A curated stock watchlist is a watchlist that has been created by a broker or trading platform for the benefit of its clients. These watchlists have the added convenience of automatic maintenance, so the end-user does not need to add or remove stocks that no longer fit the list criteria.

Note