Wash-Out Round What It Means How It Works

Contents

Wash-Out Round: What It Means, How It Works

What Is a Wash-Out Round?

A wash-out round, also known as a "burn-out round" or a "cram-down deal," is a round of new financing that takes control away from previous equity holders. This financing significantly dilutes the ownership stake of previous investors and owners, allowing new investors to take control. Wash-out rounds are commonly associated with smaller companies or startups that lack financial stability or a strong management team.

Key Takeaways

- A wash-out round is a round of financing where new investors take control of the company from existing equity holders.

- Wash-outs are often emergency funding rounds for smaller or new ventures and act as a last resort to avoid bankruptcy or shutdown.

- Depending on the deal structure, existing management may be retained but are likely to be replaced.

Understanding Wash-Out Rounds

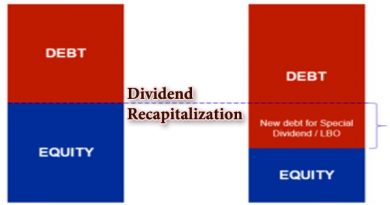

In many cases, a wash-out round is offered with the intent to seize control of a company and gain access to valuable assets. This round typically prices shares at a significantly reduced value and with a substantial interest, rendering the previous owners’ stake almost worthless. The financing is structured to force prior owners to submit to the decisions of the new investors.

For struggling ventures, the wash-out round often represents the final opportunity for financing before bankruptcy. These rounds commonly occur when companies fail to meet performance levels required for additional financing. Multiple wash-outs took place during the dotcom craze of the late 1990s when many overvalued companies faced financial challenges.

The Effect of a Wash-Out Round

While some previous management might remain, it is highly likely for leadership to be removed in a wash-out round. Given the circumstances that led to the need for a wash-out round, new owners typically seek to make significant changes. Although elements of prior management and operations might be retained for brand recognition, new owners often focus on selling assets such as intellectual property, product lines, or customer databases for the best return on investment.

Companies that experience a sudden or gradual decline in prospects due to regulatory rejection or failure to reach market penetration might seek wash-out round financing. These rounds can be a last-ditch effort to salvage the brand when companies have no substantial product alternatives or fail to achieve revenue growth goals.