Walras s Law Definition History and View on Supply and Demand

Contents

Walras’s Law: Definition, History, and View on Supply and Demand

What Is Walras’s Law?

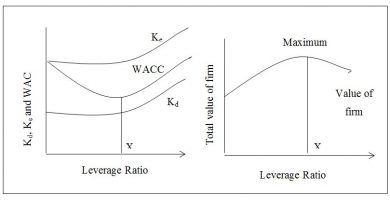

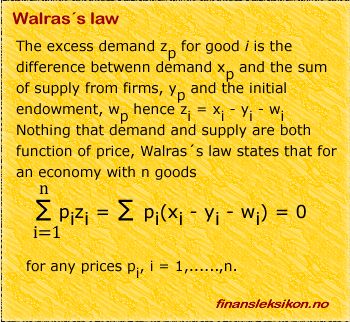

Walras’s law is an economic theory that states excess supply in one market must be matched by excess demand in another market to achieve balance. It asserts that an examined market must be in equilibrium if all other markets are in equilibrium. In contrast, Keynesian economics assumes that one market can be out of balance without a corresponding imbalance elsewhere.

Key Takeaways

- Walras’s law implies that excess demand for a single good is matched by excess supply for at least one other good, resulting in market equilibrium.

- It is based on equilibrium theory, which requires all markets to be cleared of excess supply and demand.

- Keynesian economic theory differs from Walras’s law by allowing for imbalances in one market without affecting others.

- Walras’s law operates on the principle of the invisible hand, where prices rise in response to excess demand and fall with excess supply until equilibrium is achieved.

- Some critics argue that quantifying utility, which influences demand, makes it challenging to formulate Walras’s law as a mathematical equation.

Understanding Walras’s Law

Walras’s law is named after French economist Léon Walras, known for his contributions to general equilibrium theory and the Lausanne School of economics. He explained his insights in the book Elements of Pure Economics published in 1874. Walras, along with William Jevons and Carl Menger, is considered a founding father of neoclassical economics.

According to Walras’s law, the invisible hand works to bring markets into equilibrium. When there is excess demand, prices increase, and when there is excess supply, prices decrease to achieve balance for consumers.

Producers respond to changes in interest rates by adjusting production levels. They reduce production when interest rates rise and increase investment in manufacturing facilities when interest rates fall. Walras’s law builds on the assumptions of self-interest-driven consumers and profit-maximizing firms.

Limitations of Walras’s Law

In practice, Walras’s theory does not always align with observations. Even if all other markets are in equilibrium, an observed market may still have an excess of supply or demand, indicating it is not in balance. Walras’s law considers markets as a whole rather than individually.

Critics of Walras’s law argue that quantifying the subjective concept of utility poses a challenge in formulating the law mathematically as intended by Walras. Measuring utility for each individual and aggregating it across a population to form a utility function is not a practical exercise. They believe that if this cannot be achieved, the law cannot hold because utility significantly influences demand.