Wall Street Journal Prime Rate Definition Methodology Uses

Contents

Wall Street Journal Prime Rate: Definition, Methodology, Uses

What Is The Wall Street Journal Prime Rate?

The Wall Street Journal Prime Rate is an average of the prime rates charged by 10 of the largest banks in the United States to their highest credit quality customers for short-term loans. This rate is determined through a market survey and published regularly by The Wall Street Journal (WSJ).

Key Takeaways

- The Wall Street Journal Prime Rate is an average of 10 large American banks’ prime rates, published in WSJ regularly.

- The prime rate is the best interest rate charged to a bank’s most financially sound customers.

- The WSJ aggregate prime rate provides a comprehensive view of the best borrowing rate across America.

Understanding the Wall Street Journal Prime Rate

The prime rate is the interest rate that commercial banks charge their most creditworthy customers. It is based on the federal funds overnight rate and serves as the starting point for most other interest rates. The WSJ prime rate is a leading source for comprehensive reporting of average prime rates. It is named after The Wall Street Journal’s practice of surveying the 10 largest U.S. banks to determine their prime lending rates. When seven or more of these banks change their prime rate, The Wall Street Journal publishes a new prime rate. The current rate can be found on the WSJ’s Market Page.

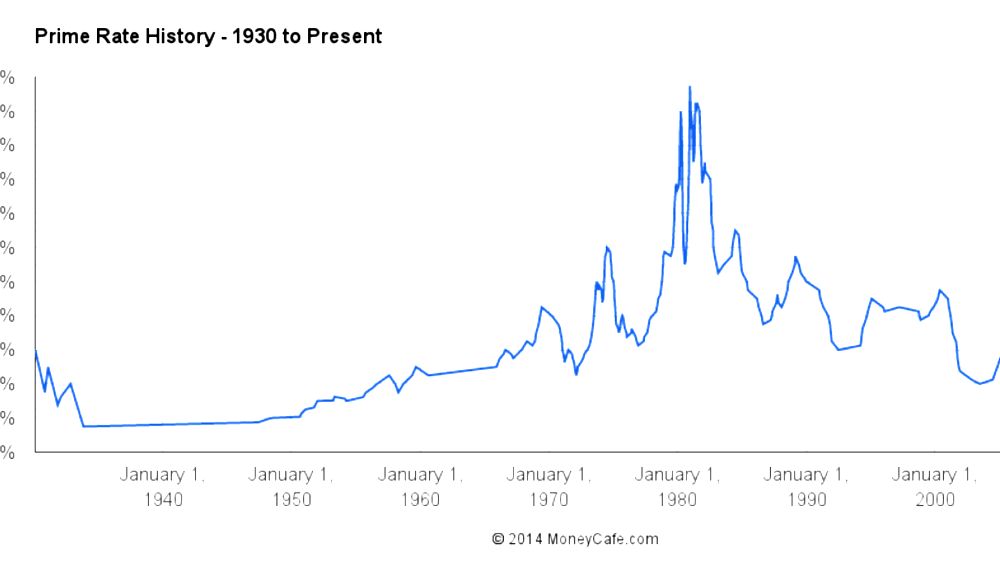

The WSJ prime rate has historically fluctuated significantly. In Dec. 2008, it reached a low of 3.25% after being reported at 9.5% in the early 2000s. In Dec. 1980, it reached a record high of 21.50%. As of Aug. 2021, it stands at 3.25%. The rate is influenced by changes in the Federal Reserve’s Federal Open Market Committee, which meets every six weeks to determine the federal funds rate. The WSJ prime rate typically stays around 3% higher than the federal funds rate and is heavily influenced by the Federal Reserve’s monetary policies.

Lending Products That Utilize the Prime Rate

Banks use their prime rate as the lowest rate for lending to their highest credit quality customers, as well as other banks. It serves as an indexed rate for variable credit products and is used in various lending products, including mortgages, home equity lines of credit and loans, and car loans. The prime rate acts as the base rate of interest for indexed rate products, such as variable rate products.

Indexed rate products often have the prime rate as the base rate of interest, with a margin or spread determined by the borrower’s credit profile. The prime rate is widely recognized and followed across the industry and is used in variable rate products. Comparable indexed rates include LIBOR and U.S. Treasury rates.

Borrowers with variable rate loans or credit cards will see the changes in their variable rate disclosed in their credit agreements. Lenders determine rate spreads based on a borrower’s credit profile, with higher credit scores receiving lower margins and vice versa. In variable rate credit products, the margin remains the same throughout the loan’s life, while the variable rate adjusts with changes in the indexed rate.

Borrowers with variable rate products usually monitor the prime rate, specifically the WSJ prime rate, as it is publicly published. An increase in the prime rate among the majority of surveyed banks indicates rising variable rates.

For example, a Bank of America credit card borrower with a variable annual percentage rate has a margin of 15.99% plus the indexed rate based on the bank’s prime rate. If the prime rate is 3.25%, the borrower’s interest rate will be 19.24%. If the bank’s prime rate increases to 4.25%, the interest rate will rise to 20.24%.