Wage Assignment What It Means How It Works

Wage Assignment: What It Means, How It Works

What Is a Wage Assignment?

Wage assignment is taking money from an employee’s paycheck to pay back a debt obligation. This plan can be used for various debts, including back taxes, defaulted student loans, and child and spousal support payments.

Key Takeaways:

– A wage assignment takes funds from an employee’s paycheck to pay back a debt.

– Wage assignments are regulated differently in each state, and some states allow for voluntary child support agreements.

– A wage garnishment is an involuntary deduction that requires a court order.

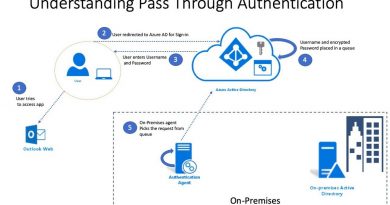

How Wage Assignment Works

Wage assignments are incurred for unpaid debts that have been outstanding for a long time. Employees may choose a voluntary wage assignment to pay for things like union dues or contribute to a retirement fund.

A wage assignment is processed by the employer during payroll. The amount of the assignment is deducted from the employee’s paycheck and noted on their pay stub.

A wage assignment is often the last resort for lenders to receive repayment from borrowers who have previously failed to pay a debt obligation.

While wage assignments are useful for collecting unpaid debts, they may be associated with abusive lending practices. If you’re struggling with debt, consider reaching out to a debt relief company or credit counseling agency for help before incurring a wage assignment.

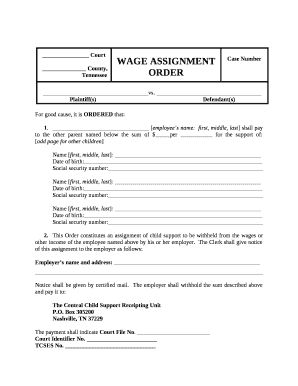

What Makes Wage Assignments Voluntary?

In a voluntary wage assignment, a worker asks their employer to withhold a portion of their paycheck and send it to a creditor to pay off a debt. Loan agreements may include a voluntary wage assignment clause if the borrower defaults on their loan.

Payday lenders often include voluntary wage assignments in their loan agreements to increase the chances of being repaid. Laws regarding wage assignments vary by state.

For example, in West Virginia, wage assignments are capped at 25% of a worker’s take-home earnings, and the agreement must be signed by both the employee and employer, with annual renewals. Under Illinois law, wage assignments can only be used after a debt is 40 days in default. They cannot continue for more than three years, and the worker can stop the assignment at any time.

Wage Garnishment

Involuntary wage deductions, or wage garnishments, require a court order and are commonly used to collect spousal and child support payments ordered by a court. Wage garnishments can also collect unpaid court fines or defaulted student loans.

Some states allow individuals to sign up for voluntary child support agreements, in which case both parents must agree to a plan. Once approved, a voluntary wage assignment may begin.

How Long Can I Have a Wage Assignment?

Since wage assignments are voluntary, the length of time they are used can vary. The duration of a wage assignment may be stated in loan agreements, and each state has its own regulations regarding wage assignments.

How Much of My Income Can Go to Wage Assignments?

Every state has its own regulations, but generally, 15-25% of disposable income can go toward wage assignments.

Is Wage Garnishment the Same as Wage Assignment?

While similar, wage garnishment and assignment are not the same. Wage garnishment is an involuntary paycheck deduction ordered to repay child support, student loans, tax debt, or bankruptcy. A wage assignment is voluntary and used to repay consumer debt.

The Bottom Line

Wage assignments can be a helpful tool for paying down debt. However, they may be hidden in the fine print of some loan products, so carefully read all documents before signing. Check your state’s regulations to determine if your wage assignment can be revoked.