Vested Benefit What it is How it Works

Contents

Vested Benefit: What it is, How it Works

Carla Tardi is a technical editor and digital content producer with over 25 years of experience at top-tier investment banks and money-management firms.

What Is a Vested Benefit?

A vested benefit is a financial package granted to employees who have met the required service term to receive a full benefit. Employers sometimes offer these benefits as an incentive for employees to stay, gradually or suddenly gaining the full amount as they accumulate more time with the company.

This process is called graduated vesting or cliff vesting. When employees earn full rights to the incentive after a set number of years of service, it is called fully vested.

The Employee Retirement Income Security Act (ERISA) sets rules that protect Americans’ retirement assets, including minimum standards for participation, vesting, benefit accrual, and funding. ERISA guarantees that workers can access their vested benefits after completing the prescribed period of work.

The structure of a vested benefits program might be negotiated as part of a labor union’s collective bargaining agreement or during the process of recruiting and hiring new employees.

Understanding Vested Benefits

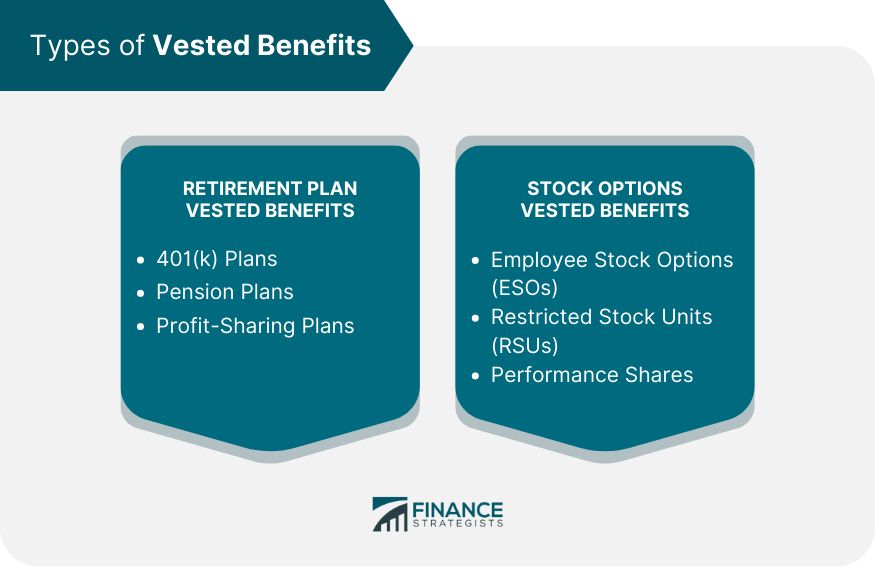

Vested benefits may include various types of financial awards, such as cash, employee stock options (ESO), health insurance, 401(k) plans, retirement plans, and pensions. Gradual vesting might involve the acquisition of ownership of shares of the company’s stock over a certain period of time.

For example, an employee might receive 100 shares of stock as a performance bonus after one year of employment. Under a graduated vesting plan, they could gain full ownership of 20% of the shares after two years, 40% after three years, 60% after four years, 80% after five years, and 100% after six years. The stock bonus would be partially vested from years two to five and fully vested after year six.

How Vested Benefits Are Applied

The time required for full vesting can vary depending on the type of benefit. For instance, a 401(k) plan vests as soon as an employee begins participation, allowing them to access their contributions when they leave the company. In the case of employer-sponsored retirement plans with matching contributions, there may be a minimum required work period for the funding portion to become vested.

The structure of a vested benefits program can be negotiated as part of a labor union’s collective bargaining agreement or during the process of recruiting and hiring new employees. As more employees earn vested benefits, the funding obligations for these benefits can pose potential liabilities for companies. For accounting purposes, companies may need to report the obligation amount carried on their books for these vested benefits.

Key Takeaways

- A vested benefit is a financial package granted to employees who have met the requirements for a full benefit.

- Vested benefits include cash, employee stock options (ESO), health insurance, 401(k) plans, retirement plans, and pensions.

- ERISA sets rules to protect Americans’ retirement assets.