Venture Capitalists Definition Who Are They and What Do They Do

Contents

- 1 Venture Capitalists: Who Are They and What Do They Do?

Venture Capitalists: Who Are They and What Do They Do?

Skylar Clarine is an experienced fact-checker and personal finance expert with a background in veterinary technology and film studies.

What Is a Venture Capitalist?

A venture capitalist (VC) is a private equity investor that provides capital to high-growth potential companies in exchange for equity. VC investments can support startup ventures or small companies aiming to expand without access to public markets.

Key Takeaways

Understanding Venture Capitalists

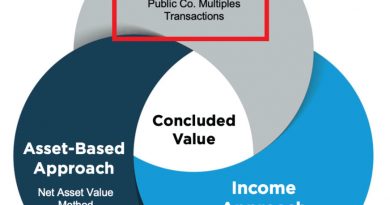

Venture capitalist firms operate as limited partnerships (LPs) where partners invest in the VC fund. A committee makes investment decisions and deploys pooled investor capital to fund emerging growth companies in exchange for equity stakes.

Contrary to common belief, VCs do not typically fund startups at the outset. Instead, VCs target revenue-generating firms seeking additional funding to commercialize their ideas. VCs buy stakes in these firms, nurture their growth, and aim for substantial returns on investment (ROI).

Venture capitalists look for companies with strong management teams, large potential markets, unique products or services, and a competitive advantage. They prefer opportunities in familiar industries and aim to own a significant percentage of the company to influence its direction.

VC firms manage pools of investors’ money, distinguishing them from angel investors who use their own funds.

VCs are willing to take risks due to the potential for massive returns. However, they also experience high failure rates with new and unproven companies.

Venture Capital Structure

Wealthy individuals, insurance companies, pension funds, foundations, and corporate pension funds pool money in a fund controlled by a VC firm. The VC firm serves as the general partner (GP), while other companies/individuals act as limited partners (LP). All partners have partial ownership of the fund.

A VC firm’s structure varies, but it generally consists of three positions:

- Associates: Individuals with business consulting or finance experience who analyze business models, industry trends, and sectors. They may introduce promising companies to upper management.

- Principals: Mid-level professionals serving on portfolio company boards, ensuring smooth operations, identifying investment opportunities, and negotiating terms for acquisitions and exits.

- Partners: Upper-level partners identifying areas to invest in, approving deals, representing VC firms, and occasionally sitting on portfolio company boards.

As the GP, the VC firm controls investment decisions. Investments are usually made in businesses or ventures considered too risky for banks or capital markets.

Venture capitalists must comply with regulations, including those set by the U.S. Securities and Exchange Commission (SEC) for private equity firms and venture capitalists, as well as anti-money laundering regulations for financial institutions.

Venture capital fund managers receive management fees and carried interest. Roughly 20% of profits go to the managing company, while the remainder is distributed to limited partners. General partners may also receive an additional 2% fee.

History of Venture Capital

The first venture capital firms in the U.S. emerged in the mid-twentieth century. Georges Doriot, a Frenchman who became an instructor at Harvard Business School, founded the first publicly funded venture capital firm, American Research and Development Corporation (ARDC), in 1946.

ARDC allowed startups to raise funds from private sources beyond wealthy families. It attracted significant investments from educational institutions and insurers. Former ARDC employees went on to establish firms like Morgan Holland Ventures and Greylock Partners.

The Investment Act of 1958 played a pivotal role in shaping modern-day venture capital. The act enabled the licensing of small business investment companies by the Small Business Administration, leading to increased startup financing.

Venture capital firms gained prominence by investing in businesses with growth potential but higher risk than traditional lenders would accept. The San Francisco Bay Area, with its emerging technologies, became closely associated with venture capital. Independent venture capital firms multiplied, leading to the founding of the National Venture Capital Association in 1973.

$348 billion

U.S. venture capital investments reached a record-setting value of $348 billion in 2021. Impressive figures continued in 2022 and 2023, with venture capital activity valued at $242.2 billion and $170.6 billion, respectively.

How Are Venture Capitalist Firms Structured?

VC firms typically manage funds collected from wealthy individuals, insurance companies, pension funds, and institutional investors. While all partners have partial ownership, the VC firm decides how to allocate the funds. Investments are usually made in businesses with strong growth potential but considered too risky for banks or capital markets. The VC firm serves as the general partner with other financiers as limited partners.

How Are Venture Capitalists Compensated?

Venture capitalists earn money from carried interest on their investments and management fees. VC firms typically collect around 20% of the private equity fund’s profits, while the remaining share goes to the limited partners. General partners may also receive an additional 2% fee.

What Are the Prominent Roles in a VC Firm?

VC funds have various roles, primarily divided into associates, principals, and partners. Associates perform analytical work, introduce prospects, and assist with portfolio company management. Principals have mid-level responsibilities, including portfolio company board positions and identifying investment opportunities. Partners focus on identifying businesses to invest in, approving new investments or exits, and representing the VC firm.

The Bottom Line

Venture capitalists invest in startup companies using limited partnerships. These investments are crucial for startups with unproven business concepts that traditional funding sources deem too risky. VCs typically invest after a startup achieves revenue rather than during its initial stage.