Tweezer What it Means and How it Works in Technical Analysis

Contents

Tweezer: What it Means and How it Works in Technical Analysis

What Is a Tweezer?

A tweezer is a technical analysis pattern involving two candlesticks that can indicate a market top or bottom.

Key Takeaways

- A tweezer is a technical analysis pattern involving two candlesticks that can indicate a market top or bottom

- Tweezer bottoms are short-term bullish reversal patterns, while tweezer tops are bearish reversals

- Tweezers gained popularity through Steve Nison’s book, "Japanese Candlestick Charting Techniques"

Understanding Tweezers

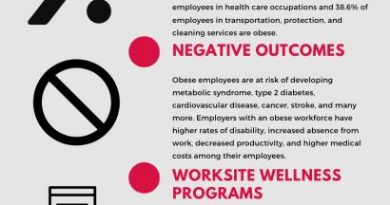

Tweezer patterns are reversals that occur when two or more candlesticks touch the same bottom for a tweezer bottom pattern, or the same top for a tweezer top pattern.

Tweezer bottoms are short-term bullish reversal patterns, while tweezer tops are bearish reversals. In both cases, buyers or sellers were unable to push the top or bottom any further. These patterns require careful observation and research to interpret and use correctly.

- A bearish tweezer top occurs during an uptrend when bulls push prices higher and then, on the following day, traders reverse their market sentiment. The market opens without breaching the prior day’s highs and heads straight down, often erasing most of the prior period’s gains.

- On the flip side, a bullish tweezer bottom is seen during a downtrend when bears continue to drive prices lower, and on Day 2, prices open without breaching the prior day’s lows and head sharply higher. A bullish advance on Day 2 can quickly eliminate losses from the previous trading day.

A tweezer top is identified by two candles with similar highs occurring back to back, while a tweezer bottom has two candles with similar back-to-back lows.

Special Considerations

As an investment strategy, tweezers offer traders precision in taking advantage of market trends. While tweezers can take on various appearances, they all share common traits. They can indicate the possibility of a reversal or provide trend traders with trade signals when used in conjunction with other market analysis tools.

Tweezers gained popularity through Steve Nison’s book, "Japanese Candlestick Charting Techniques." Candlestick methods involve the body of a candle representing the difference between the open and close, while the thin "shadows" on either end mark the high and low of that period. A dark or red candle indicates the close was below the open, while a white or green candle signifies the price closed higher than it opened.

Like any other trading tool or indicator, tweezers should be used alongside other indicators or market signals.