Tulipmania About the Dutch Tulip Bulb Market Bubble

Contents

- 1 Tulipmania: The Dutch Tulip Bulb Market Bubble

- 1.1 What Was the Dutch Tulip Bulb Market Bubble?

- 1.2 History of the Dutch Tulip Bulb Market Bubble

- 1.3 Tulips Sweep Holland

- 1.4 The Bubble Bursts

- 1.5 Real-World Examples of Extreme Buying

- 1.6 Did the Dutch Tulipmania Really Exist?

- 1.7 What is tulipmania?

- 1.8 What does tulipmania have to do with market bubbles?

- 1.9 How did tulipmania affect the Dutch economy?

- 1.10 How does tulipmania relate to bitcoin?

- 1.11 The Bottom Line

Tulipmania: The Dutch Tulip Bulb Market Bubble

What Was the Dutch Tulip Bulb Market Bubble?

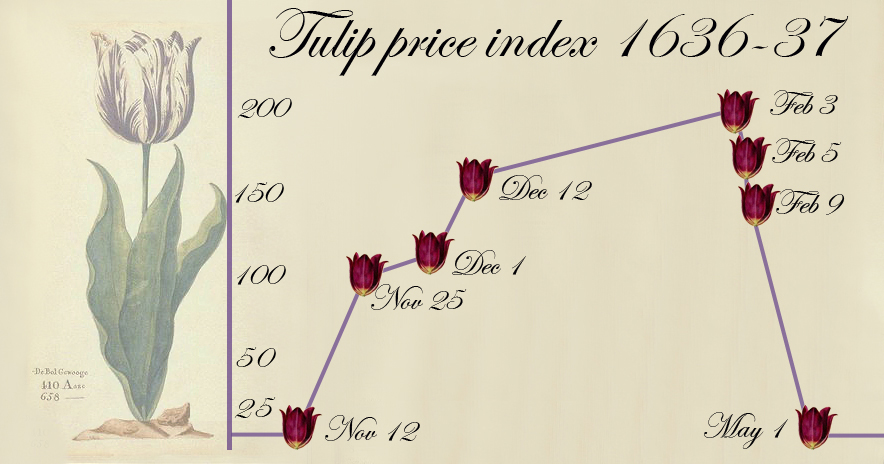

The Dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles of all time. It occurred in Holland during the early to mid-1600s, when speculation drove the value of tulip bulbs to extremes. At the market peak, the rarest tulip bulbs traded for six times the average person’s annual salary.

Today, tulipmania serves as a cautionary tale about the perils of excessive greed and speculation in investing.

Key Takeaways

- The Dutch tulip bulb market bubble was one of the most famous asset bubbles of all time.

- At the peak of the bubble, tulips sold for approximately 10,000 guilders, equal to the value of a mansion on the Amsterdam Grand Canal.

- Tulips were introduced to Holland in 1593, with the bubble occurring primarily from 1634 to 1637.

- Recent scholarship questions the true extent of tulipmania, suggesting it may have been exaggerated as a parable of greed and excess.

History of the Dutch Tulip Bulb Market Bubble

Tulips first appeared in Europe in the 16th century, arriving via the spice trading routes. Their unique appearance made them a luxury item for the gardens of the affluent. Over time, the middle classes sought to emulate the wealthy by acquiring tulips as a status symbol.

Tulips were known to be fragile, but in the early 1600s, techniques were developed in Holland to grow and produce the flowers locally. This created a thriving business sector that continues today.

According to the Smithsonian Magazine, tulips could grow from seeds or buds on the mother bulb. Broken bulbs, with striped, multicolored patterns, became highly sought-after, driving up prices.

Tulips Sweep Holland

In 1634, tulipmania swept through Holland. The Library of Economics and Liberty writes, “The Dutch became obsessed with tulip bulbs. The population, even to its lowest dregs, embarked in the tulip trade.”

A single bulb could be worth as much as 4,000 or even 5,500 florins. By 1636, the demand for tulips was so high that regular marts for their sale were established in multiple towns.

Professional traders joined the trade, and it seemed like everyone was making money. But prices eventually dropped, causing holders to sell their bulbs at any price and declare bankruptcy.

The Bubble Bursts

By the end of 1637, the bubble had burst. Buyers couldn’t pay the high prices they had agreed upon, causing the market to collapse. Though not devastating to the economy, the event undermined social expectations and damaged relationships.

Dutch Calvinists, fearing societal decay from tulip-driven consumerism, painted a scene of economic ruin. These beliefs persist today.

Real-World Examples of Extreme Buying

The tulip craze captivated Dutch society in the 1630s, with people from all walks of life buying and selling bulbs for inflated prices.

Tulipmania serves as a model for the cycle of financial bubbles, involving irrational expectations, biases, and inflated prices followed by a collapse. Similar cycles have been observed in other speculative assets.

Did the Dutch Tulipmania Really Exist?

Recent analysis questions the widely-held belief that tulipmania was a significant financial crisis. Scholars argue that it was exaggerated, but traumatic for the Dutch in other ways. The event has been incorporated into public discourse as a moral lesson.

What is tulipmania?

Tulipmania is a major commodity bubble that occurred in the 17th century when Dutch investors drove up the prices of tulips to unprecedented highs.

What does tulipmania have to do with market bubbles?

Tulipmania exemplifies the cycle of a bubble, from irrational biases and group mentalities inflating prices to their eventual collapse. It serves as a parable for speculative assets.

How did tulipmania affect the Dutch economy?

Though not damaging to the Dutch economy as a whole, tulipmania caused reputations to be lost and relationships to break. Defaults on tulip payments caused cultural shock in an economy built on trade and credit relationships.

How does tulipmania relate to bitcoin?

Bitcoin is often compared to tulipmania due to highly speculative prices for a product with unclear utility. Bitcoin prices exhibit signs of a classic bubble.

The Bottom Line

Tulipmania is often cited as an example of greed and financial mania. However, recent analysis suggests the bubble and crash may have been smaller than believed, and the story serves as a cautionary tale against greed and excess.