Transfer of Physical Assets TPA What It is How it Works

Transfer of Physical Assets (TPA): What It is, How it Works

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is a Transfer of Physical Assets (TPA)?

A transfer of physical assets (TPA) is the sale of property that involves a change in ownership of a mortgage loan sponsored by the U.S. Department of Housing and Urban Development (HUD). Qualifying properties insured by the Federal Housing Administration (FHA) and held with HUD must go through HUD for the title transfer to a new owner, even if the loan is not paid off. The transfer process follows HUD guidelines instead of the lenders’ guidelines, as with traditional mortgages. TPAs can also involve the complete transfer of a beneficial interest through a passive trust. The process consists of two steps and can be either full or modified.

Key Takeaways

- A transfer of physical assets is the transfer of real estate property involving the assumption of a HUD-insured mortgage.

- Using a TPA preserves the property’s HUD and/or FHA qualifications.

- A TPA application must be filled, followed by preliminary approval.

- Buyers should be conscious of any use agreements associated with the property beforehand.

- TPAs can be either full, where ownership is transferred in its entirety, or modified, which means only a portion of ownership applies.

Understanding a Transfer of Physical Assets (TPA)

The U.S. federal government has programs in place to help consumers realize their dreams of homeownership and make it affordable. HUD, which oversees the FHA, is particularly valuable for people who don’t have adequate credit histories or enough money for a down payment to satisfy the requirements of traditional lenders. Both HUD and the FHA insure loans advanced by private lenders, stepping in to pay the lender if the borrower defaults.

A transfer of physical assets occurs when a borrower wants to sell the property to another party while the loan is still outstanding. With traditional mortgages, the buyer’s payment covers the seller’s mortgage, home-related debt, closing costs, and directly pays the seller. However, with HUD loans, ownership and the loan can be transferred together, known as a transfer of physical assets.

Property owners must submit an application to HUD for a TPA, followed by the preliminary approval process. All TPA applications must go through HUD and involve various forms, including the purchaser’s financial statements, a description of the transaction, proposed organizational documents, and previous participation certificates. If the terms of preliminary approval are not met within 45 days, both parties are bound to reconvey the property to the seller.

Properties financed through HUD-sponsored loans are often multiunit properties rented at low costs under government regulations. While commercial entities may own multi-unit properties, TPAs only apply to HUD-insured residential loans and not commercial loans.

Special Considerations

Some HUD properties come with specific use agreements that potential buyers should read carefully before purchasing. These agreements may require property owners to set aside units as affordable housing for individuals and families with limited income. If a TPA is approved and ownership changes, the new owner must abide by the rules set out by the agency, which means maintaining the affordability of designated housing units.

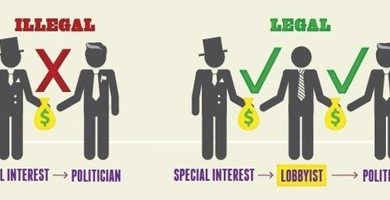

Mortgage lending discrimination is illegal. If you believe you’ve experienced discrimination based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, you can file a report with the Consumer Financial Protection Bureau or the U.S. Department of Housing and Urban Development (HUD).

Types of TPAs

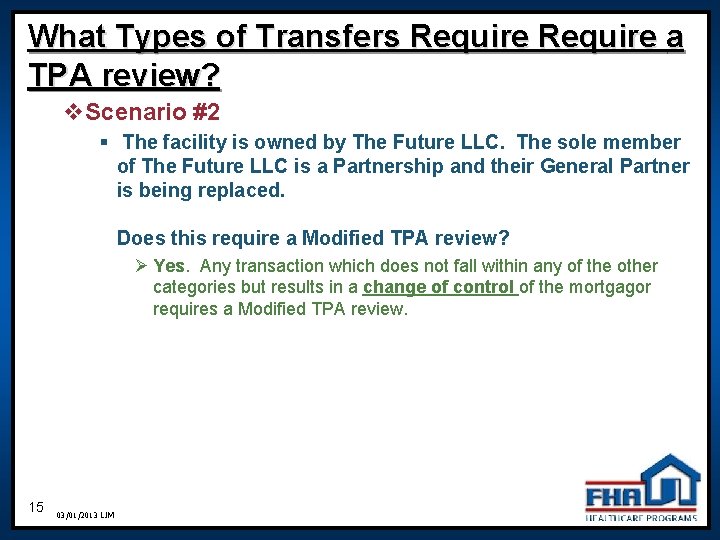

A TPA requires HUD approval and can be either full or modified.

In a full TPA, the property completely changes hands, with the buyer assuming the note, mortgage, and existing regulatory agreement with HUD or entering into a new regulatory agreement.

A modified TPA involves a change in the structure of ownership while the actual owner remains the same.

How Does a Transfer of Personal Assets Work?

A transfer of personal assets occurs when a property owner wishes to transfer ownership to another party while holding an outstanding FHA-backed loan with HUD. The application process includes filling out forms and providing supporting documents. After submitting the application, the agency conducts a preliminary approval. Buyers must adhere to any use agreements in place. TPAs can be either full or modified.

What Is Affordable Housing?

Affordable housing refers to homes and housing units provided to individuals and families at below-market rates. Federal government agencies, including the U.S. Department of Housing and Urban Development, oversee affordable housing programs. Property owners may receive incentives, such as tax incentives and lower purchase prices, to make their housing units affordable.

What Is HUD?

HUD stands for Housing and Urban Development, a department within the U.S. federal government established in 1965 to improve housing affordability. Its actions support the nation’s housing market, homeownership rates, provide affordable and safe options for renters, and combat housing discrimination.