Management and Employee Buyout MEBO What It is How It Works

Contents

Management and Employee Buyout (MEBO): What It is, How It Works

What Is a Management and Employee Buyout (MEBO)?

A management and employee buyout (MEBO) is a corporate restructuring initiative where both managerial (MBO) and non-managerial employees (EBO) buy out a firm to concentrate ownership.

Key Takeaways

- A management and employee buyout (MEBO) occurs when both management and select employees take over an existing firm.

- MEBOs may be used to take a public company private or as an exit strategy for a newer venture.

- MEBOs may be difficult to arrange and complex to structure due to competing interests or preferences of management and employees.

Understanding Management and Employee Buyouts

MEBOs are commonly used to privatize publicly traded companies or as an exit strategy for venture capitalists and other shareholders in private firms. They are seen as a way to increase efficiency and motivate employees to improve company profitability.

Corporations may use MEBOs to sell divisions unrelated to their core business or to enable retiring owners of private businesses to pass on the company. An internal team of management and employees pool their resources to acquire the business they operate or manage. Funding typically comes from personal savings, capital, seller financing, or private equity financing.

A MEBO allows management and employee teams to directly benefit from company growth and future direction. However, the transition from being employees to owners requires an entrepreneurial mindset. Additionally, differing interests or incentives among management and workers make MEBOs less common than MBOs or EBOs. Consequently, MEBOs may face challenges or fail before completion.

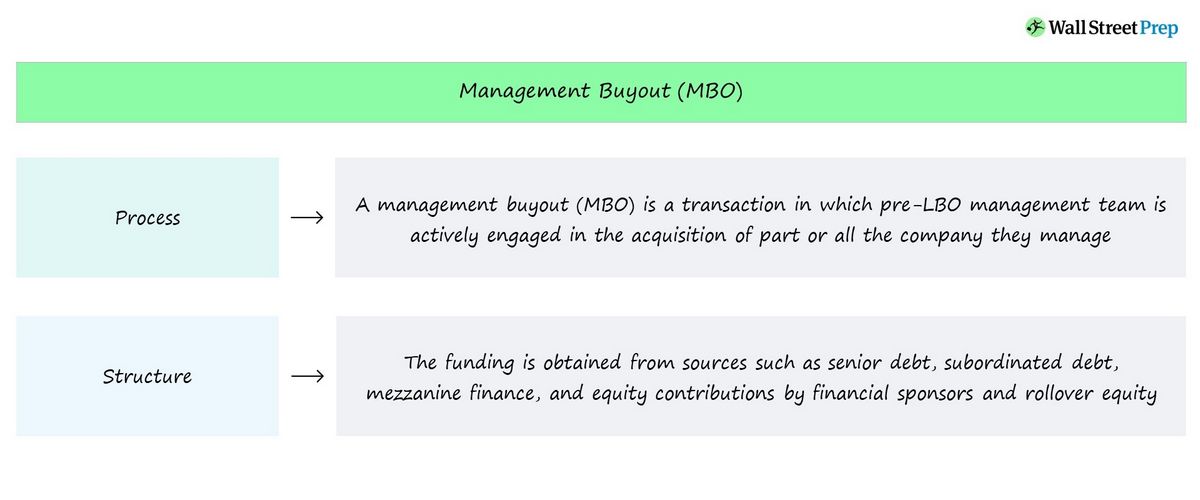

MBO vs. EBO

A MEBO is essentially a combination of a management buyout (MBO) and an employee buyout (EBO). An MBO is a transaction where a company’s management team purchases the assets and operations they manage. Though management gains ownership rewards, they also assume more responsibility and risk.

An EBO is a restructuring strategy where employees purchase a majority stake in their firm. It often involves the sale of company assets for small businesses or a subsidiary/division for larger firms. Buyouts are most common during financial distress.