Lump-Sum Distribution What It is How It Works

Lump-Sum Distribution: What It is, How It Works

What Is a Lump-Sum Distribution?

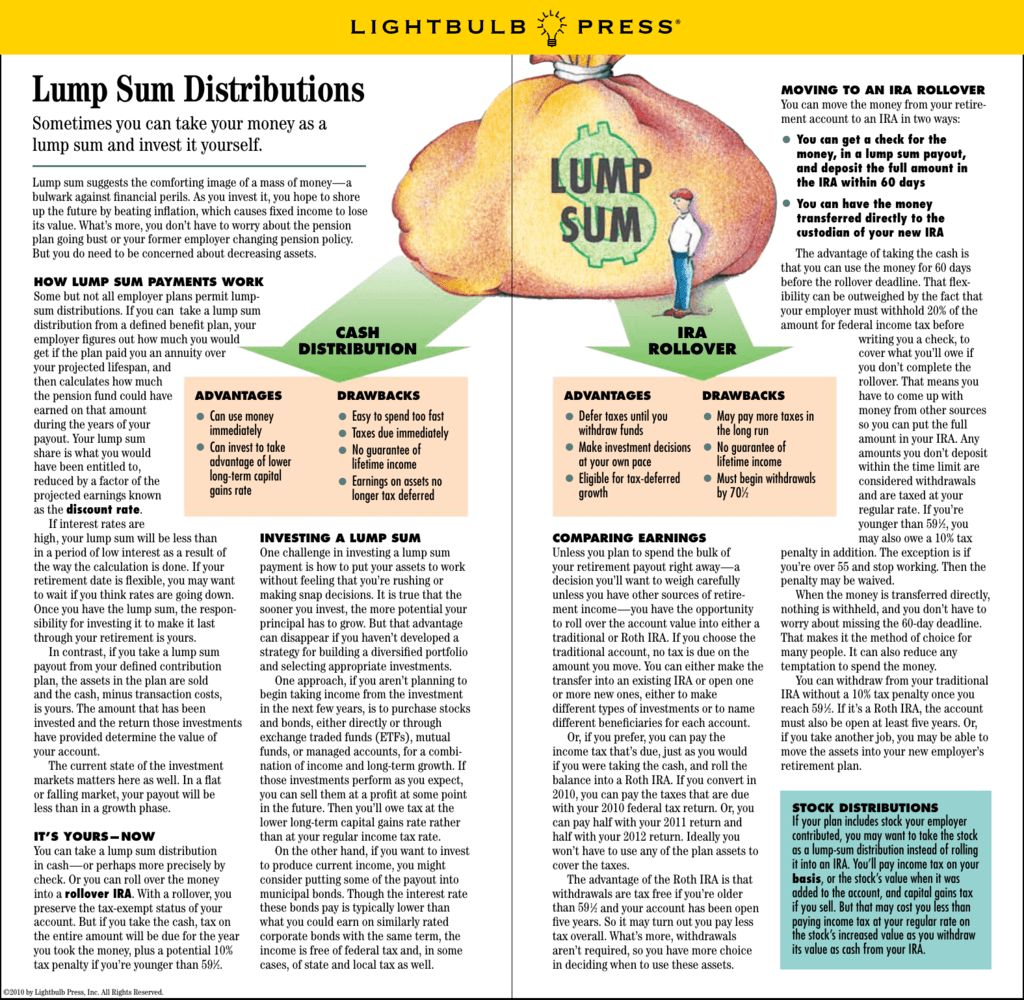

A lump-sum distribution is a one-time payment from money owed to a party, instead of smaller installments. Lump-sum distributions may receive special tax treatment and are often associated with windfall earnings, such as winning the lottery, or retirement or pension plans. They are different from annuitized distributions.

Key Takeaways

– A lump-sum distribution is a one-time payment, as opposed to regular installments.

– Lump-sum distributions can be made from retirement plans, commissions, windfall earnings, or fixed-income investments.

– A lump-sum is typically discounted to its net present value (NPV).

– It is not always the best choice to take a lump-sum distribution; in some cases, annuitized payments may be more suitable.

How a Lump-Sum Distribution Works

Consider taxes, investments, and the net present value (NPV) before deciding whether to take a lump-sum payment or periodic annual payments.

Examples of lump-sum distributions include commission checks and pension plan distributions after a pensioner’s death.

In general, qualified plans treat distributions as lump sums if the total plan balance is distributed in the same tax year and if the distribution is due to the employee:

– Attaining age 59½

– Being deceased (for beneficiaries)

– Separating from service (not applicable to self-employed individuals but applies to their common-law employees)

– Being disabled (only applicable to self-employed individuals)

Pension plans do not allow early withdrawals or loans.

Lump-Sum Distribution and Qualified Retirement Plans

When a pension plan owner dies, a lump-sum distribution may transfer to beneficiaries, including relatives, acquaintances, or institutions. Beneficiaries may have revocable or irrevocable status and discretionary powers.

Qualified plans fall into two categories: defined benefit plans and defined contribution plans. Defined benefit plans guarantee payouts, while defined contribution plans depend on the employee’s savings and investments. Examples of qualified plans that may grant lump-sum distributions include profit-sharing plans, 403(b) plans, 457 plans, and more.

The Internal Revenue Service (IRS) provides a comprehensive guide to qualified plan requirements, including comparisons, risks, and concerns.

Commission Check and Qualified Retirement Plans

Commission checks are a common example of lump-sum payments, often used to incentivize sales and marketing employees. Types of commission checks include base salary and commission, straight commission, draw against commission, and residual commission.

Lump-Sums Versus Annuity Payments

For a $10 million lottery win, taking the entire amount as a lump-sum payment subjects it to income tax in that year. Choosing the annuity option allows payments over several decades, potentially reducing the tax burden. It also provides opportunities to avoid the highest tax brackets and manage finances better over time.

By receiving annual checks, winners have a chance to improve their money management skills, even if the initial year is challenging.