What an Algorithm Is and Implications for Trading

What an Algorithm Is and Implications for Trading

What Is an Algorithm?

An algorithm is a set of instructions for solving a problem or accomplishing a task. In finance, algorithms are essential for developing automated and high-frequency trading systems and pricing sophisticated financial instruments.

Key Takeaways:

– Algorithms are sets of instructions for problem-solving or task completion.

– Every computerized device utilizes algorithms to streamline tasks.

– Algorithmic trading, also known as automated or black-box trading, uses computer programs for rapid buying and selling.

– Algorithmic trading accounts for over 60% of global equities market volume.

– Algorithmic traders can analyze information and respond to minute price movements faster than humans.

Understanding Algorithms:

Financial companies employ algorithms in various areas such as loan pricing, stock trading, and asset-liability management. Algorithmic trading, also known as algo trading, utilizes computer programs to make decisions about timing, pricing, and quantity of stock orders. High-frequency trading is a key application of algorithms, resulting in a decrease in average stock holding periods over time.

Algorithms enhance efficiency and save companies money by automating processes. Online availability of financial data makes it easier for algorithms to analyze and generate desired outputs based on user-defined parameters. Algorithms are utilized by institutions like investment banks and hedge funds, as well as retail investors, to reduce emotional biases in investing and execute various strategies.

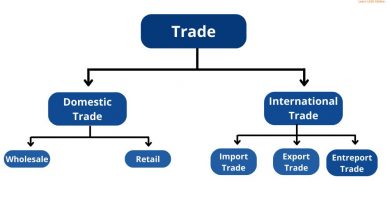

Types of Algorithmic Trading:

Different trading algorithms help investors decide whether to buy or sell. Algos are categorized by the strategies they employ, including mean reversion, arbitrage, market timing, index fund rebalancing, and scalping.

Arbitrage:

Arbitrage exploits price differences for the same asset across different markets. Algorithms quickly analyze data and identify pricing disparities, enabling the rapid buying or selling of assets to capitalize on those differences.

Market Timing:

Market timing strategies use backtesting to predict asset performance over time. Algorithms then trade based on the predicted best time to buy or sell, utilizing extensive datasets and testing.

Mean Reversion:

Mean reversion strategies calculate average stock prices over a specific time period. When stock prices deviate from the average, algo trading can capitalize on potential reversions to the mean.

Algorithm Trading Example:

An example of an algorithm for trading involves creating instructions to buy or sell stocks based on moving averages. Algorithms automate the complex trading process, producing the desired results quickly.

Algorithms in Computer Science:

In computer science, successful algorithms consist of five basic parts: mathematically describing the problem, creating formulas and processes, inputting outcome parameters, executing the program repeatedly, and obtaining the final result. Complex financial algorithms utilize extensive data to generate accurate assessments for trading decisions.

Advantages and Disadvantages of Algorithmic Trading:

Algorithmic trading eliminates emotional biases and enhances consistency while adapting to changing markets faster than humans. However, reliance on computers and potential technical issues can pose challenges. Additionally, algorithms may not always perform as expected due to market dynamics or optimization issues.

What Algos Do Hedge Funds Use?

Hedge funds utilize various algorithms and strategies, including big data analysis and machine learning, to optimize investments and operations.

Is Algorithmic Trading Hard?

Algorithmic trading itself is relatively straightforward. However, building or understanding the algorithms requires substantial effort.

Is Algo Trading Safe?

Assuming the algorithm is designed to be profitable, algo trading is generally safe. However, it still requires sufficient computational power.

Do Banks Use Algorithmic Trading?

Banks, including institutional and retail traders, extensively employ algorithmic trading for large trade orders and fast execution.

How Do Predatory Algos Work?

Predatory algos may reduce stock liquidity or increase transaction costs. They are designed to manipulate markets and exploit liquidity issues.