Ultra-Short Bond Funds Meaning Credit Quality Examples

Ultra-Short Bond Funds: Meaning, Credit Quality, Examples

What Is an Ultra-Short Bond Fund?

An ultra-short bond fund invests only in fixed-income instruments with very short-term maturities, typically less than one year. These portfolios offer minimal interest-rate sensitivity and lower risk and total return potential compared to money market instruments. However, they still provide higher yields and fewer price fluctuations than typical short-term funds.

Note that a short-term bond fund should not be confused with a bear bond fund or ETF that goes short bonds on a leveraged basis.

Key Takeaways

– Ultra-short funds hold short-term fixed-income securities, maturing in less than one year.

– These funds pursue higher yields by investing in riskier securities than traditional bond funds.

– The Federal Deposit Insurance Corporation (FDIC) does not cover or guarantee ultra-short bond funds.

– Ultra-short bond funds of certain types may be extra susceptible to losses in high-interest rate environments.

Understanding Ultra-Short Bond Funds

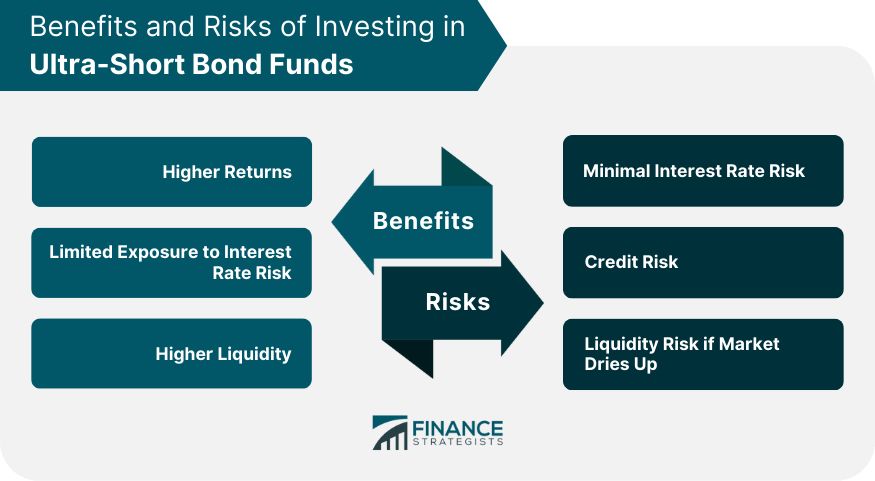

Ultra-short bond funds offer significant protection against interest rate risk compared to longer-term bond investments. These funds have very low durations, making them less affected by increases in interest rates than medium- or long-term bond funds.

While they provide more protection against rising interest rates, ultra-short bond funds carry more risk than most money market instruments. Unlike certificates of deposit (CDs), these funds have no more regulation than a standard fixed-income fund.

Ultra-Short Bond Funds vs. Other Low-Risk Investments

The differences between ultra-short bond funds and other low-risk fixed-income investments, such as money market funds and CDs, are important.

Money market funds invest in high-quality, short-term investments issued by the U.S. government, corporations, and state and local governments. In contrast, ultra-short funds have more freedom and pursue higher yields by investing in riskier securities. Ultra-short bond funds’ net asset values (NAV) fluctuate, while money market funds aim to maintain NAV stable at $1.00 per share. Money market funds also follow strict diversification and maturity standards, which do not apply to ultra-short bond funds.

Furthermore, the FDIC does not cover or guarantee ultra-short bond funds, unlike CDs that offer insurance up to $250,000. CDs usually provide a better interest rate on deposited funds than regular savings accounts.

Ultra-short bond funds with longer average maturity dates tend to be riskier than those with shorter maturity dates, all other factors being equal.

Credit Quality of Ultra-Short Bond Funds

Investors should research the types of securities an ultra-short fund invests in to avoid credit downgrades or defaults that may result in losses. Credit risk is less of a factor for ultra-short funds compared to traditional bond funds due to the relatively quick maturation of short-term bonds. However, funds investing in lower credit-rated company bonds, derivative securities, or private-label mortgage-backed securities have higher investment risk. Investors should be skeptical of any investment promising higher returns with no additional risk and review the fund’s prospectus for more information.

Ultra-Short Bond Funds and High-Interest Rates

Certain types of ultra-short bond funds are extra susceptible to losses in high-interest rate environments. Prospective investors should research a fund’s "duration" to understand its sensitivity to fluctuations in interest rates.

Investments that promise higher returns with no additional risk should be approached with skepticism. Investors should review an ultra-short bond fund’s full prospectus for a comprehensive understanding.

Examples of Ultra-Short Bond Funds

Some of the better performing ultra-short bond funds include:

– SPDR Blmbg Barclays Inv Grd Flt Rt ETF (FLRN)

– iShares Floating Rate Bond ETF (FLOT)

– VanEck Vectors Investment Grd Fl Rt ETF (FLTR)

– iShares Short Treasury Bond ETF (SHV)

– SPDR Blmbg Barclays 1-3 Mth T-Bill ETF (BIL)