Middle Market Firm Definition Criteria and How They Trade

Cierra Murry, an experienced banking consultant with over 15 years of expertise in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, specializes in editorial refinement and language efficiency.

A Middle Market Firm refers to American businesses with annual revenues ranging from $10 million to $1 billion, depending on the industry. The U.S. has approximately 200,000 middle-market firms, most of which are privately owned, with a combined annual revenue exceeding $10 trillion.

Here are the key takeaways:

– Middle market businesses account for about one-third of the U.S. economy.

– Approximately 48 million Americans are employed by middle market companies, and this number is expected to grow.

– These firms are often service-oriented, with limited recognition beyond their industries.

– Middle market companies are often financed through business development corporations (BDCs).

– When publicly traded, middle markets tend to trade as small-cap or micro-cap stocks.

Middle market firms are responsible for about 48 million jobs and generate $10 trillion in annual revenues, contributing significantly to the U.S. economy. However, many of these companies remain relatively unknown to the general public.

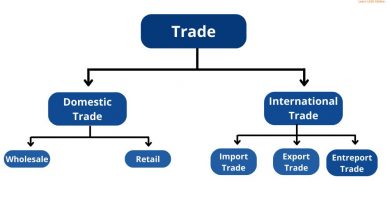

Middle market companies are primarily engaged in service-oriented activities such as business services, health services, and educational services. Additionally, a significant number are involved in retail, wholesale trade, construction, or manufacturing.

The definition of a middle market firm may vary, but it is generally based on annual revenue or the number of employees. The Harvard Business Review defines middle market firms as those earning between $10 million and $1 billion annually. Other sources may set the lower threshold as low as $5 million or as high as $50 million. Alternatively, some analysts consider the value of total assets or the number of employees to define middle market firms.

The lack of a clear delineation results in gray areas when categorizing businesses into small, middle-market, and big businesses. Some categorize all but the largest businesses as small and medium-sized enterprises (SMEs).

In 2021, the U.S. middle market generated approximately $10 trillion in combined revenues, making it comparable to the world’s third-highest GDP.

Middle market firms face challenges in terms of representation in policy and economic debates. Compared to big businesses and small businesses, they are relatively low-profile and less transparent. The COVID-19 pandemic has also negatively impacted middle market firms, with 43% of executives expecting adverse effects on revenues in 2021. Additionally, maintaining customer relationships and managing workforce disruption remain ongoing challenges.

Raising capital for expansion or investment can be challenging for middle market firms, and their costs of debt are typically higher. Business development companies (BDCs) provide funding to many middle market companies. BDCs are similar to closed-end investment funds and are often publicly traded on major stock exchanges. They invest in private or public U.S. firms with market values of less than $250 million, providing managerial assistance to their portfolio companies.

Investing in middle market firms can be done through exchange-traded funds (ETFs) and mutual funds that focus on small-cap indexes. Additionally, investors can directly invest in shares of business development companies, which typically offer above-average dividend yields.

Main Street refers to small businesses with a modest number of employees and revenue. Middle market firms are a step up from Main Street, with larger operations, more employees, and higher annual revenues. Investing in middle market firms can offer higher potential returns, although they may carry higher risks compared to investing in larger, more mature companies.

Middle market banking refers to commercial banking services provided to local governments, nonprofits, and companies with approximately $50 million to $1 billion of total revenue. Middle-market private equity refers to private equity investments in companies worth between $50 million and $500 million. The lower middle market represents a smaller subset of middle-market firms, typically valued between $10 million and $100 million, and is often targeted for mergers and acquisitions.

In conclusion, middle market firms occupy the space between small "Mom & Pop" businesses and major enterprises. These service-oriented companies play a significant role in the U.S. economy, contributing to employment and overall business activity.