What Is a Bad Check Definition What Happens and Example

Contents

- 1 What Is a Bad Check? Definition, What Happens, and Example

- 1.1 Definition of a Bad Check

- 1.2 Understanding Bad Checks

- 1.3 Bad Checks and the Law

- 1.4 How to Avoid Writing a Bad Check

- 1.5 If You Receive a Bad Check

- 1.6 Will My Bank Decline to Pay a Bad Check Without Overdraft Protection?

- 1.7 What Happens If a Debit Card Transaction Overdrafts My Account?

- 1.8 What Are Common Criminal Penalties for Writing Bad Checks?

- 1.9 The Bottom Line

What Is a Bad Check? Definition, What Happens, and Example

Definition of a Bad Check

A bad check is one that cannot be negotiated because it is drawn on a nonexistent or insufficient funds account. Writing a bad check is illegal and is also known as a hot check.

Banks charge a fee for unintentionally writing a bad check. Intentionally passing a bad check can result in misdemeanor or felony charges, depending on the check amount and the state where it was written. Cashier’s checks and certified checks are less susceptible to this issue.

Key Takeaways

- A bad check cannot be negotiated due to a nonexistent or insufficient funds account.

- Bad checks are also known as hot checks.

- People who write bad checks may be charged fees by their banks and may also be responsible for fees incurred by the payee.

- Knowingly writing a bad check can result in misdemeanor or felony charges, depending on the check amount and the state.

Understanding Bad Checks

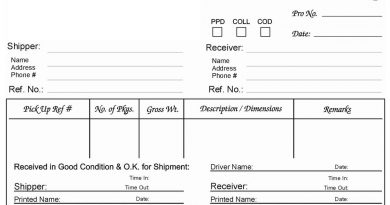

Checks are essentially IOUs for money. When you write a check, you promise the payee that you have enough funds in your account. If there are insufficient funds, the bank will bounce the check and decline payment.

Bad checks can be written unintentionally by individuals who are unaware of insufficient account balances. Banks and vendors charge fees for bounced checks, which can sometimes exceed the check amount. The bank may also add a nonsufficient funds (NSF) charge to the account, potentially reaching $35 for each bad check. Additionally, the payee may incur charges due to the bad check.

However, some individuals knowingly write and try to pass bad checks despite having insufficient funds. This is considered fraud, a crime that incurs penalties beyond NSF charges.

Post-dated checks, which promise future payment, do not constitute a crime if there are insufficient funds at the time of writing.

Bad Checks and the Law

Writing a bad check without realizing it can happen when someone believes they have enough funds in their account or mistakenly assumes the check has cleared before spending the funds.

In such cases, the penalty is typically limited to a bank fee. However, knowingly writing a bad check is considered fraud and is subject to legal consequences.

The criminal penalties for intentionally writing bad checks vary by state, with some states requiring an intent to commit fraud. Misdemeanor charges are common, but writing a bad check can be a felony if the check amount surpasses certain thresholds.

Civil penalties apply in all cases and may include an amount equal to the check face value, a multiple of the check amount, or the check amount plus court costs and attorney fees.

How to Avoid Writing a Bad Check

Online banking makes it easier to stay current with finances, reducing the likelihood of writing bad checks. Regularly checking the account balance and verifying check clearance can prevent these incidents.

If you know you won’t have enough funds to cover a check, consider contacting the payee to discuss delaying its cashing. While potentially embarrassing, it is preferable to proactively avoid charges from the bank and the payee.

Add overdraft protection to your account as another option. This safeguards against insufficient funds by allowing the bank to cover checks up to a certain limit, temporarily allowing a negative account balance. Overdraft protection incurs interest and fees.

If You Receive a Bad Check

Discovering that you’ve received a bad check may not occur until weeks later when the bank notifies you or you check your account. In such cases, the bank reverses the check amount from your account, leading to potential overdrafts if the money has already been spent.

Contact the person who wrote the bad check and inform them of the situation. Avoid assuming it was intentional, as it may have been an innocent mistake. Consider depositing the check again if possible. Legal action may be pursued if the check bounces a second time.

Will My Bank Decline to Pay a Bad Check Without Overdraft Protection?

Not necessarily. A bank’s overdraft policy can be either automated or ad hoc. Automated decisions are based on criteria determined by a computer system, allowing flexibility for payment. Ad hoc decisions are made by staff and can also provide flexibility. Contact your bank promptly to understand their policy and available options.

What Happens If a Debit Card Transaction Overdrafts My Account?

If you have opted in for overdraft protection on your debit card, the bank will likely approve the transaction but charge a fee. If you haven’t opted in, the bank will likely decline the transaction without charging a fee.

What Are Common Criminal Penalties for Writing Bad Checks?

Criminal penalties for writing bad checks vary by state and circumstance. For example, New York imposes a maximum jail time of three months, while California permits up to one year. Writing a bad check in Texas can be considered a felony, with penalties of up to two years in prison. Fines may also be imposed, reaching up to triple the bad check amount.

The Bottom Line

Adding overdraft protection to your bank account can help prevent accidental overspending and bounced checks. If you receive a bad check, contact the issuer and your bank immediately to address any fees resulting from the unintentional check. Take proactive steps to avoid future occurrences and maintain open communication with the recipient and your bank to resolve any outstanding issues.