What Are Structural Adjustment Programs SAPs

What Are Structural Adjustment Programs (SAPs)?

What Is a Structural Adjustment?

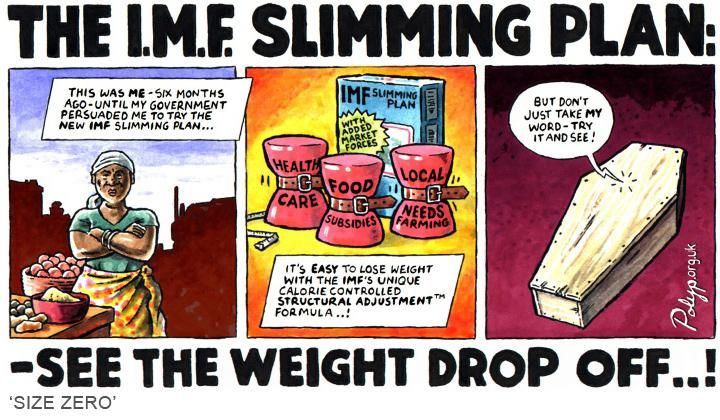

A structural adjustment is a set of economic reforms that a country must adhere to in order to secure a loan from the International Monetary Fund and/or the World Bank. Structural adjustments are economic policies, including reducing government spending and opening to free trade.

Understanding Structural Adjustment

Structural adjustments are thought of as free market reforms, conditional on the assumption that they will make the nation more competitive and encourage economic growth. The IMF and World Bank have long imposed conditions on their loans, but in the 1980s, there was a push for lending to crisis-stricken poor countries to be springboards for reform.

Structural adjustment programs have demanded borrowing countries introduce free-market systems with fiscal restraint. This includes devaluing currencies, cutting public sector employment and spending, privatizing state-owned enterprises, deregulating state-controlled industries, easing regulations to attract foreign investment, and improving tax collection.

Controversies Surrounding Structural Adjustment

Proponents argue that structural adjustment encourages countries to become economically self-sufficient by creating a friendly environment for innovation, investment, and growth. Unconditional loans would only lead to further borrowing without fixing the systemic flaws.

However, structural adjustment programs have been criticized for imposing austerity policies on already-poor nations. Critics argue that the burden falls on vulnerable groups, and view conditional loans as tools of neocolonialism, perpetuating colonial dynamics and exploiting poor countries.

Despite evidence that structural adjustments reduce the standard of living in the short-term, the IMF initially began reducing structural adjustments. However, their use grew again in 2014, raising criticism that countries under these adjustments have less policy freedom to deal with economic shocks compared to rich lending nations.