Weather Insurance What It Is How It Works Example

Weather Insurance: What It Is, How It Works, Example

Weather insurance refers to financial protection against losses or damages caused by adverse weather conditions such as wind, snow, rain/thunderstorms, fog, and extreme temperatures.

This type of insurance is commonly used to protect businesses and their activities, including expensive events that could be ruined by bad weather. Insurers provide coverage for lost revenue from events due to weather conditions.

Key Takeaways:

– Weather insurance offers financial protection against losses caused by adverse weather conditions.

– Premiums are based on the likelihood of the insured weather event occurring and the potential loss.

– Conventional weather insurance covers low-probability weather events like hurricanes, earthquakes, and tornados.

– Weather derivatives can be used to hedge against high-probability weather events.

Weather insurance is critical for many companies and can be customized based on the number of days, weather events, and severity of weather to be covered.

While other types of insurance policies like homeowners insurance, property insurance, or special event insurance provide some coverage for losses caused by adverse weather, weather insurance offers more specific protection.

Example:

For instance, an event planner is organizing an outdoor festival and wants to ensure revenue is protected even if bad weather affects turnout. They take out a weather insurance policy to cover lost revenue if the festival is impacted by rain.

Weather Insurance vs. Weather Derivatives:

Traditional insurance primarily covers catastrophic damage and doesn’t protect against reduced demand due to unexpected weather conditions. Weather derivatives, however, are financial instruments used to hedge against weather-related losses. Sellers of derivatives bear the risk of disasters, while buyers receive payouts in the event of adverse weather.

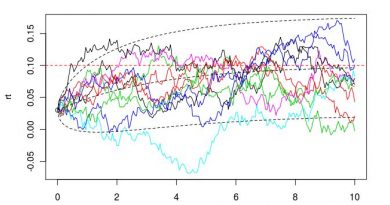

Weather derivatives were introduced in the late 1990s and are comparable to trading stock indices, currencies, interest rates, and agricultural commodities. They usually cover low-risk, high-probability events. On the other hand, weather insurance covers high-risk, low-probability occurrences, allowing companies to mitigate different types of weather-related risks.

In summary, weather insurance provides financial protection against losses caused by adverse weather conditions, while weather derivatives offer a way to hedge against weather-related losses. Companies may have an interest in purchasing both to address different types of weather risk.