What Is a Co-Applicant Definition Example Vs Co-Signer

A co-applicant is an additional person considered in the approval of a loan or application. Applying with a co-applicant can improve loan approval chances and provide more favorable terms. A co-applicant becomes a co-borrower once approved and funded.

Key Takeaways:

– A co-applicant joins in the application.

– A co-applicant enhances an application by adding income, credit, or assets.

– A co-applicant has more rights and responsibilities than a co-signer or guarantor.

Co-Applicants vs. Co-Signers:

– A co-applicant is involved in the loan process.

– A co-signer helps with loan terms but has no access to funds or collateral.

– A co-applicant shares in the transaction.

Applying With a Co-Applicant:

– Borrowers choose to apply with a co-applicant for various reasons.

– Both borrowers need to submit a credit application.

– Terms are based on the highest quality borrower’s credit information.

– A co-applicant can increase the loan amount obtained.

Co-Applicant Example:

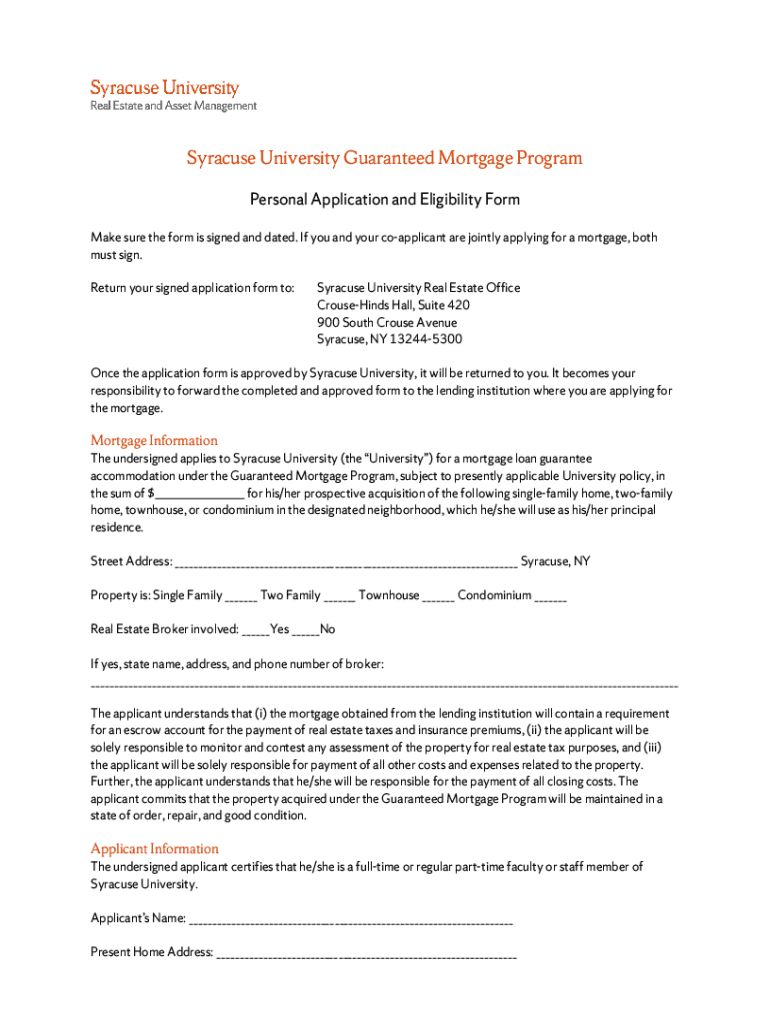

– A married couple co-applies for a mortgage.

– They have excellent credit and receive a larger loan.

– Both are responsible for repayment and named on the title.

Does my Co-Applicant’s Credit Score Impact Approval?

– Yes, a co-applicant is vetted by the same standards.

Does the Co-Signer Own Whatever They Sign for?

– No, a co-signer takes financial responsibility but has no rights to the proceeds.

Is a Spouse Automatically my Co-Applicant if I Apply for a Mortgage?

– No, a spouse is not automatically a co-applicant.

The Bottom Line:

– A co-applicant can increase loan funds.

– A co-signer suffices for a good credit history to gain a lender’s confidence.