What Is a Capital Improvement and How Does It Work

Contents

- 1 What Is a Capital Improvement and How Does It Work?

What Is a Capital Improvement and How Does It Work?

Andrew Ancheta is a finance editor with extensive experience reporting on cryptocurrency, NFTs, economics, and history. He previously worked as an editor for China Daily.

What Is a Capital Improvement?

A capital improvement is a permanent structural change or restoration that enhances a property’s value, prolongs its useful life, or adapts it to new uses.

Individuals, businesses, and cities can make capital improvements to their properties, some of which receive favorable tax treatment and sales tax exemptions in specific jurisdictions.

In business or corporate finance, this process is similar to capital expenditures (CAPEX) investments.

Key Takeaways

- A capital improvement is a durable upgrade, adaptation, or enhancement that increases a property’s value, often involving a structural change or restoration.

- The IRS grants special tax treatment to qualified capital improvements, distinguishing them from ordinary repairs.

- In addition to enhancing a home, capital improvements can increase the cost basis of a property, which reduces the tax burden when it is sold.

- In some states, capital improvements can allow landlords to increase rent beyond legal limits.

How a Capital Improvement Works

Capital improvements typically increase the market value of a property and may expand its usefulness beyond its current state.

According to the IRS, a capital improvement must endure for more than one year upon completion and be durable or permanent. Both individual homeowners and large-scale property owners make capital improvements, regardless of scale.

IRS Publication 523 provides the official definition of capital improvement. Examples of residential capital improvements include adding or renovating a bedroom, bathroom, or deck. Other IRS-approved projects include adding new built-in appliances, wall-to-wall carpeting, or improving a home’s exterior with roof, siding, or storm window replacement. Installing a fixed swimming pool or driveway can also be qualified capital improvements.

The IRS distinguishes between capital improvements and repairs or replacements due to normal wear and tear. For example, a broken refrigerator or leaky pipes do not qualify as capital improvements.

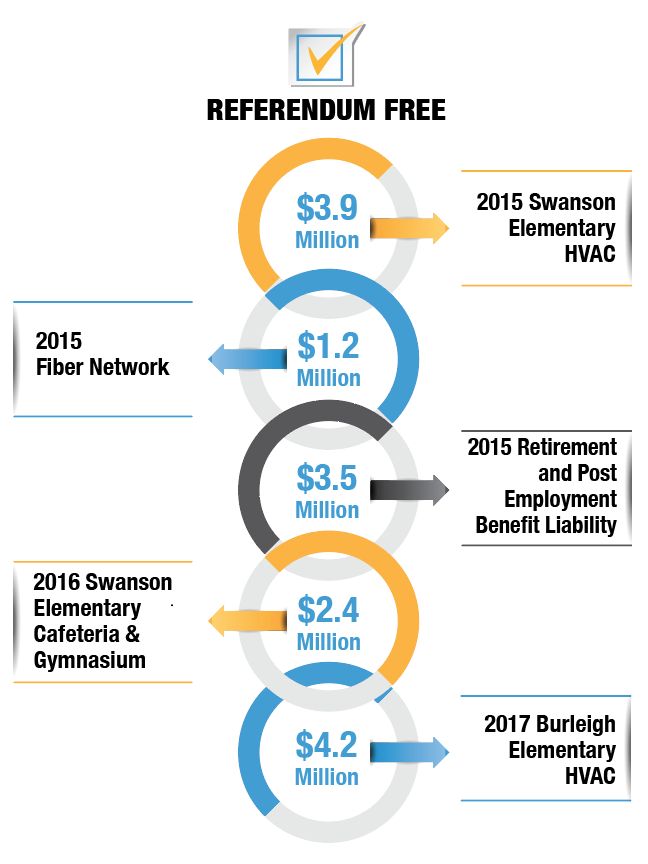

However, adding permanently affixed solar panels and tool sheds to a property would be considered capital improvements. Business-based capital improvements may include installing a new HVAC system or adding Americans with Disability Act (ADA) accessible features to an existing building.

Similarly, creating a new public park in a downtown area would be considered a capital improvement for a city. These additions increase property value, are considered permanent, and their removal would cause material harm to the property.

Most repairs do not count as capital improvements.

Related Expenses

Several expenses should be considered when implementing a capital improvement program, including:

Cost Basis

The cost basis is the original cost of an asset. To qualify as a cost basis increase, an improvement must be in place at the time of property sale. Additionally, a capital improvement must become part of the property or be permanently affixed to it, so its removal would cause significant damage or decrease the property’s value.

Repairs or maintenance cannot be included in a property’s cost basis. However, repairs that are part of a larger project, such as replacing all windows in a home, do qualify as capital improvements. Renovations necessary to maintain a home’s condition are not included if they do not add value to the asset. Non-qualifying repairs, according to the IRS, include painting walls, fixing leaks, or replacing broken hardware.

Capital improvements can help reduce capital gains taxes when selling a home or building.

Capital Gains

In addition to improving a home, a capital improvement increases the cost basis of the structure, which reduces the taxable capital gain upon its sale, according to the IRS.

Capital gains on real estate differ from other types of capital gains. Homeowners are entitled to a capital gains exemption on any profit from the sale of a primary residence up to $250,000 if single and $500,000 if married and filing jointly, as of 2022. To qualify, the homeowner must have resided in the property for at least two of the last five years before the sale.

If the gain exceeds these limits, the tax effects of a capital improvement can be significant. Factors such as property acquisition many decades ago and significant local real estate value increases since purchase may lead to breaching the $250,000/$500,000 capital gains levels.

Local Exemptions

New York State’s rent laws include the Major Capital Improvements (MCI) program. Landlords can raise rent-stabilized or -controlled building rents by up to 6% annually to recoup the cost of major capital improvements to those structures. The MCI program includes HVAC system upgrades, new elevators, updated common spaces, and other improvements.

In February 2019, two State Legislators introduced a bill to eliminate the program, alleging that it is easy for building owners to abuse it. Unscrupulous landlords may submit inflated or fabricated expense claims. Some critics argue that the MCI program is inherently unfair since a capital improvement is a one-time cost for landlords but rent increases are ongoing expenses for tenants.

Examples of Capital Improvements

Consider an individual who purchases a home for $650,000 and invests $50,000 in renovating the kitchen and adding a bathroom. Sales tax may not have to be paid to contractors for this qualified capital improvement.

The cost basis of the home also increases from $650,000 to $700,000. After 10 years of owning and living in the home, the single homeowner sells the property for $975,000.

If no capital improvements had been made, the taxable capital gain would normally be $75,000 ($975,000 sale price – $650,000 purchase price -$250,000 capital gains exclusion). However, due to the $50,000 increase in cost basis from the capital improvement, the taxable capital gain is just $25,000 ($975,000 – ($650,000 + $50,000) -$250,000 = $25,000).

What Is a Capital Improvement Fee?

A capital improvement fee is a one-time fee charged by a Homeowner’s Association (HOA) when a property within the HOA is sold. The fee is typically used for future capital improvements in the community and is usually equivalent to one year of HOA fees.

What Is a Capital Improvement Plan?

A capital improvement plan outlines funding and planning for capital improvements over several years in a community or municipality. The plan includes major, non-recurring expenses related to buildings, land, or other infrastructure, along with completion deadlines and financing plans.

What Is a Certificate of Capital Improvement?

A certificate of capital improvement is a document certifying that a specific project is considered a capital improvement. The owner provides the certificate to the construction manager or contractor to indicate that no sales tax is due.

The Bottom Line

A capital improvement is a permanent alteration or addition to a property that increases its value or usability.

Residential capital improvements receive special tax treatment, allowing homeowners to deduct improvement costs from capital gains when selling a home. It is important to distinguish capital improvements from ordinary repairs to qualify for the deduction. The IRS defines capital improvements as enduring for more than one year upon completion and being durable or permanent in nature.