What Is a Capital Allocation Line CAL Line How to Calculate

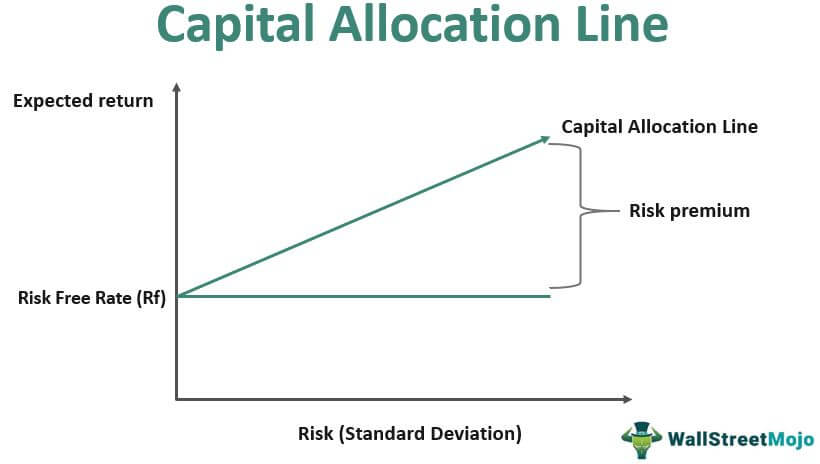

The capital allocation line (CAL), also known as the capital market link, is created on a graph from the possible combinations of risk-free and risky assets. The line displays the returns investors might earn by assuming a certain level of risk with their investment. The slope of the CAL is known as the reward-to-variability ratio.

The CAL helps investors determine their risk tolerance through a mix of risky and risk-free assets based on their financial goals. Asset allocation is how your funds are spread out across different securities and other assets in your portfolio. Capital allocation is the allotment of funds between risk-free assets, such as Treasury bonds, and risky assets, such as equities.

The CAL is represented as a line graph. The y-axis is the expected return, and the x-axis is the amount of risk, usually measured by the standard deviation of returns. The line displays the relationship between the risk and expected return of portfolios that combine a risk-free asset with a market portfolio of riskier assets. The starting point is the risk-free rate (where risk is zero), and the line extends upward to show increasing levels of risk and their corresponding expected returns.

An easy way to adjust the risk level of a portfolio is to change the amount invested in the risk-free asset. The investments plotted include every combination of risk-free and risky assets. These combinations are plotted on a graph where the y-axis is the expected return, and the x-axis is the risk of the asset as measured by the standard deviation.

The simplest example is a portfolio with two assets: a risk-free Treasury bill and a stock. Let’s say the expected return of the T-bill is 3%, and its risk is 0%. The standard deviation of the stock is 20%, measuring the extent of the stock’s return fluctuation around its expected return of 10%. Calculation of the portfolio’s expected return (ER) can be done as follows:

ER of portfolio = (ER of T-bill × Weight of T-bill) + (ER of Stock × Weight of Stock)

The risk calculation for this portfolio is straightforward because the standard deviation of the T-bill is 0%. The risk can be calculated as follows:

Risk of portfolio = Weight of Stock × Standard Deviation of Stock

If you were to invest 100% into the risk-free asset, the expected return would be 3%, and the portfolio’s risk would be 0%. Likewise, investing 100% into the stock would give you an expected return of 10% and a portfolio risk of 20%. If you put 25% in the risk-free asset and 75% in the risky asset, the portfolio’s expected return and risk would be as follows:

ER of portfolio = (3% × 25%) + (10% × 75%) = 0.75% + 7.5% = 8.25%

Risk of portfolio = 75% × 20% = 15%

The slope of the CAL measures the trade-off between risk and return. A steeper slope means you would receive a higher expected return for taking on more risk. The value of this calculation is known as the Sharpe ratio.

The CAL assists in refining portfolios by showing the potential return at each level of risk taken.

If an investment is above the CAL, it offers a higher return for the same level of risk compared with the portfolio in the CAL.

The risk-free asset serves as a benchmark for comparing the risk and return of other investments in the portfolio.

Yes, the CAL can shift upward or downward depending on changes in the risk-free rate or the portfolio’s risk-return characteristics.

The CAL is a vital tool in portfolio management, illustrating the risk-return trade-off of a portfolio mixed with a risk-free asset. It can help improve the allocation of assets, but it depends on the risk-free rate and portfolio characteristics, which fluctuate. Also, it assumes investors are rational and markets are efficient, which is not always the case.