What Is a Buyout With Types and Examples

Contents

What Is a Buyout, Types, and Examples

What Is a Buyout?

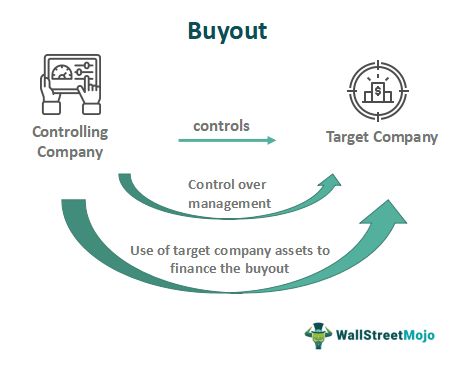

A buyout is the acquisition of a controlling interest in a company, synonymous with acquisition. If bought by the firm’s management, it is a management buyout; if funded with high levels of debt, it is a leveraged buyout. Buyouts often occur when a company is going private.

Key Takeaways

- A buyout is the acquisition of a controlling interest in a company, synonymous with acquisition.

- If bought by the firm’s management, it is a management buyout; if funded with high levels of debt, it is a leveraged buyout.

- Buyouts often occur when a company is going private.

Understanding Buyouts

Buyouts occur when a buyer acquires more than 50% of the company, resulting in a change of control. Firms specializing in funding and facilitating buyouts act alone or together on deals, and are financed by institutional investors, wealthy individuals, or loans.

In private equity, funds and investors pursue underperforming or undervalued companies to take private and eventually go public. Buyout firms are involved in management buyouts (MBOs), where the purchased company’s management takes a stake. They also play key roles in leveraged buyouts, which are funded with borrowed money.

Sometimes, buyout firms believe they can provide more value to a company’s shareholders than the existing management.

Types of Buyouts

Management buyouts (MBOs) provide an exit strategy for large corporations wanting to sell off non-core divisions or for private businesses with retiring owners. MBOs require substantial financing, usually a combination of debt and equity from buyers, financiers, and sometimes the seller.

Leveraged buyouts (LBOs) heavily rely on borrowed money and use the target company’s assets as collateral for loans. The acquiring company may contribute only 10% of the capital, with the remaining financed through debt. This high-risk, high-reward strategy requires the acquisition to generate significant returns to cover interest payments. Buyout firms may sell parts of the target company to reduce debt.

Examples of Buyouts

In 2007, Blackstone Group purchased Hilton Hotels for $26 billion via an LBO. Blackstone contributed $5.5 billion in cash and financed $20.5 billion in debt. Before the 2009 financial crisis, Hilton faced cash flow and revenue issues but later improved operations and refinanced at lower interest rates. Blackstone sold Hilton for a nearly $10 billion profit.

In 2007, Blackstone Group acquired Hilton Hotels for $26 billion through an LBO, investing $5.5 billion in cash and financing $20.5 billion in debt. Despite facing declining cash flows and revenues prior to the 2009 financial crisis, Hilton later refinanced at lower interest rates and improved its operations. Blackstone sold Hilton, making a profit of almost $10 billion.