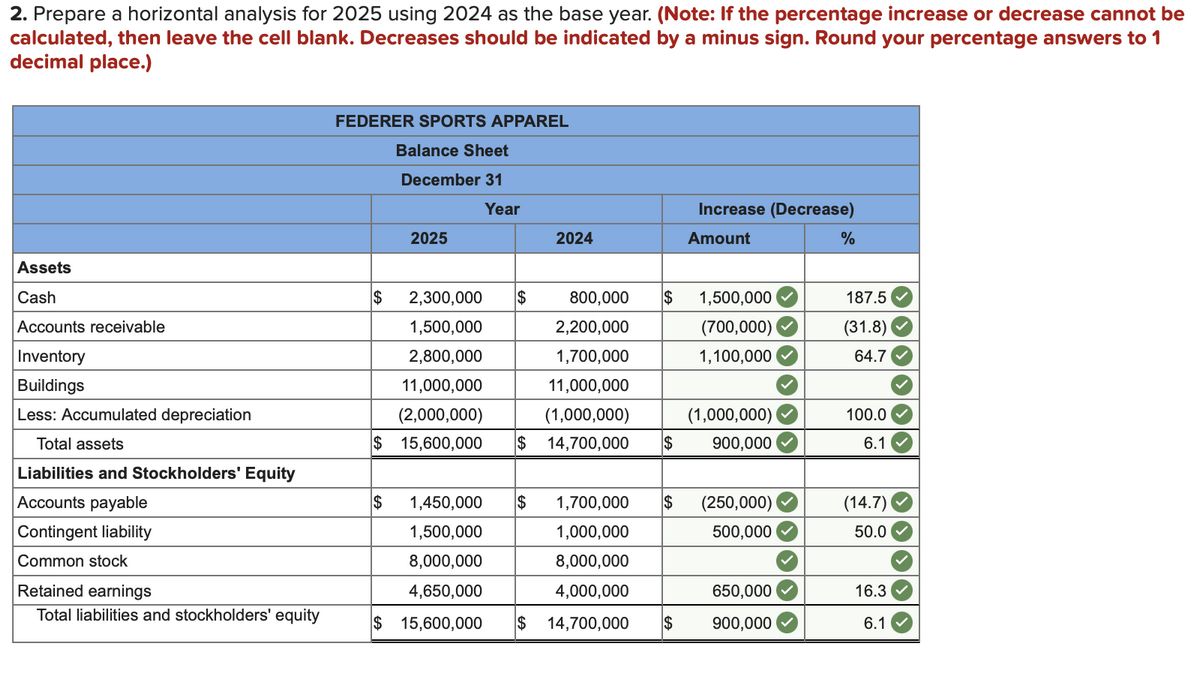

What Is a Base Year How It s Used in Analysis and Example

Ariel Courage, an experienced editor, researcher, and former fact-checker, has performed editing and fact-checking work for leading finance publications, including The Motley Fool and Passport to Wall Street.

A base year is the first year in an economic or financial index, typically set at a level of 100. New base years are periodically introduced to keep data current. Base years are also used to measure company growth, usually choosing recent years.

Key Takeaways:

– A base year is the first year in an economic or financial index.

– Base years are used to measure business activity and growth.

– A base year can be any year chosen for analysis.

A base year is used for comparison in measuring business activity or an economic or financial index. For example, to calculate inflation between 2016 and 2021, 2016 serves as the base year. The base year can also be the starting point for growth or for calculating same-store sales.

Financial ratios often analyze growth, determining how much a number changes from one period to another.

The growth rate equation is (Current Year – Base Year) / Base Year.

In ratio analysis, the past is considered the base period.

Growth analysis is commonly used to describe company performance, especially for sales. For example, if Company A grows sales from $100,000 to $140,000, that implies a 40% increase from the base year value of $100,000.

Investors can analyze a company’s financial statements to assess the consistency of its bottom line growth.

Base years are used in calculating same-store sales growth by considering factors such as new store sales and comp store sales.

In comp store sales calculations, the base year represents the starting point for the number of stores and their sales.

For example, if Company A has 100 stores generating $100,000 in sales in the base year, opening 100 more stores that generate $50,000 while same-store sales decline by 10% indicates a 10% decline in comp store sales.

Base years are also used for comparing or measuring business activity or economic and financial indexes, including gross domestic product (GDP).

The choice of a base year depends on the specific analysis being performed. For instance, a company established in 2021 may use that year as its base year for measuring sales growth.

To calculate growth rate, divide the difference between ending and starting values by the starting value. The growth rate formula is (Current Year – Base Year) / Base Year. The base year represents the starting point for determining growth.

Base years are essential in economic and financial indexes, as well as for measuring company growth. The choice of a base year depends on the analysis. Investors researching stocks can perform a base-year analysis to assess a company’s growth potential and decide on investment opportunities.