What Is a Barrier Option Knock-in vs Knock-out Options

What Is a Barrier Option? Knock-in vs. Knock-out Options

A barrier option is a type of derivative where the payoff depends on whether or not the underlying asset has reached or exceeded a predetermined price.

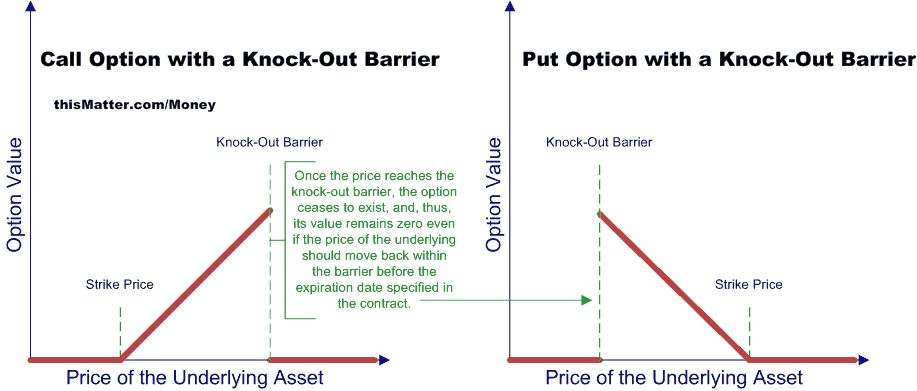

A barrier option can be a knock-out, meaning it expires worthless if the underlying exceeds a certain price, limiting profits for the holder and losses for the writer. It can also be a knock-in, meaning it has no value until the underlying reaches a certain price.

Barrier options are exotic because they are more complex than basic American or European options. They are also path-dependent because their value fluctuates as the underlying value changes during the option’s contract term. In other words, a barrier option’s payoff is based on the underlying asset’s price path. The option becomes worthless or may be activated upon the crossing of a price point barrier.

Key Takeaways

– Barrier options are exotic options. They depend on whether the option has reached or exceeded a pre-determined barrier price.

– Barrier options offer cheaper premiums compared to standard options and are used for hedging positions.

– There are two types of barrier options: knock-out and knock-in.

– Knock-in options come into existence when the price of the underlying security reaches a specified barrier during the option’s life.

– Knock-out options cease to exist if the underlying asset reaches a barrier during the option’s life.

Types of Barrier Options

Barrier options are typically classified as knock-in or knock-out.

Knock-in Barrier Options

A knock-in option only comes into existence when the price of the underlying security reaches a specified barrier during the option’s life. Once a barrier is knocked in, the option remains until it expires.

Knock-in options may be up-and-in or down-and-in. In an up-and-in barrier option, the option comes into existence if the price of the underlying asset rises above the pre-specified barrier, which is set above the underlying’s initial price. A down-and-in barrier option comes into existence when the underlying asset price moves below a pre-determined barrier set below the underlying’s initial price.

Knock-out Barrier Options

In contrast to knock-in barrier options, knock-out barrier options cease to exist if the underlying asset reaches a barrier during the option’s life. Knock-out options may be up-and-out or down-and-out. An up-and-out option ceases to exist when the underlying security moves above a barrier set above the underlying’s initial price. A down-and-out option ceases to exist when the underlying asset moves below a barrier set below the underlying’s initial price. If an underlying asset reaches the barrier at any time during the option’s life, the option is knocked out or terminated.

Other Types of Barrier Options

– Rebate Barrier Options: They provide rebates to holders if the option does not reach the barrier price and becomes worthless. Rebates are a percentage of the premium paid by the holder.

– Turbo Warrant Barrier Options: They are traded in Europe and Hong Kong, highly leveraged, characterized by low volatility, and used for speculation purposes.

– Parisian Options: They require the underlying asset’s price to spend a pre-defined amount of time beyond the trigger barrier price for the contract to kick in. The time spent outside and inside the barrier price range is measured in this option.

Reasons to Trade Barrier Options

Barrier options have additional conditions built-in, making their premiums cheaper than comparable options with no barriers. If a trader believes the barrier is unlikely to be reached, they may opt to buy a knock-out option with a lower premium. Someone who wants to hedge a position only if the price reaches a specific level may use knock-in options, which have lower premiums than non-barrier options.

Examples of Barrier Options

– Knock-in Barrier Option: An investor purchases an up-and-in call option with a strike price of $60 and a barrier of $65 when the underlying stock is trading at $55. The option only becomes applicable if the underlying reaches $65; otherwise, the option is worthless.

– Knock-out Barrier Option: A trader purchases an up-and-out put option with a barrier of $25 and a strike price of $20 when the underlying security is trading at $18. The option becomes worthless when the underlying security rises above $25.

Exotic Options

Exotic options are derivative contracts that differ from traditional American and European options in their payment structure, expiration date, and strike price. They are more complex, provide more investment alternatives, and can be customized to meet investors’ risk tolerance and goals.

Difference Between American and European Options

An American option allows holders to exercise their rights anytime before and including the expiration date, while a European option only allows execution on the day of expiration.

Benefits of Barrier Options

Barrier options have lower premiums for the option buyer than standard options. They carry less risk for the option seller and provide investors with more freedom and flexibility to set the terms of their contracts.

The Bottom Line

Barrier options are derivative contracts that are activated or extinguished when the asset price reaches a specific barrier. They can be knock-in or knock-out and have various variants such as rebate barrier options, turbo warrant barrier options, and Parisian options. Their main advantage is offering lower premiums for the option buyer.