What Are Real Estate Market Tiers Defining Characteristics

Contents

What Are Real Estate Market Tiers? Defining Characteristics

What Are Real Estate Market Tiers?

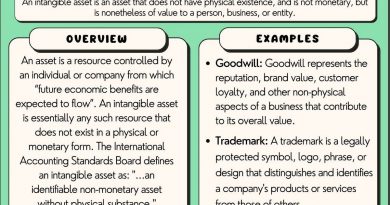

Real estate market tiers categorize cities as Tier I, Tier II, or Tier III based on their real estate market development stage.

Each tier has defining characteristics:

- Tier I cities have an established real estate market. They are highly developed, with desirable schools, facilities, and businesses. Real estate in these cities is the most expensive.

- Tier II cities are in the process of developing their real estate market. Many companies have invested in these up-and-coming areas, but they haven’t reached their peak yet. Real estate in these cities is relatively inexpensive, but prices will rise if growth continues.

- Tier III cities have undeveloped or nonexistent real estate markets. Real estate in these cities is cheap, and there is an opportunity for growth if real estate companies decide to invest in development.

Key Takeaways

- Real estate market tiers represent the development level of underlying cities.

- Tier 1 cities like New York or Los Angeles are highly developed, Tier 2 cities like Seattle or Pittsburgh are still developing, and Tier 3 cities like Akron or Biloxi have underdeveloped markets.

- The higher the tier, the more desirable it is for businesses looking to expand.

- In poor economic times, businesses mostly focus on Tier 1 cities, but in thriving economies, they may consider Tier 2 and Tier 3 cities.

Understanding Real Estate Market Tiers

Many businesses see Tier II and Tier III cities as desirable destinations, particularly in times of economic strength. These areas provide opportunities for growth and development and allow businesses to expand and provide employment. Additionally, operating in prime Tier I real estate is expensive, and underdeveloped areas offer a chance to invest in future growth.

In contrast, businesses tend to focus more on established markets in Tier I cities when the economy is in distress, as these areas don’t require investment and present fewer risks than undeveloped areas. Though expensive, Tier I cities offer the most desirable facilities and social programs.

U.S. cities often classified as Tier I cities include New York, Los Angeles, Chicago, Boston, San Francisco, and Washington D.C. Tier II cities may include Seattle, Baltimore, Pittsburgh, and Austin—although classifications may change over time and based on criteria. Real estate prices often vary drastically from tier to tier. For example, Kiplinger estimates the median home value in Pittsburgh at $152,000 compared to $418,000 in New York City and $650,000 in Los Angeles as of Feb. 2020.

Risks Associated with Different Real Estate Market Tiers

Tier I cities are often at risk of a housing bubble, which occurs when high demand drives prices up to an unsustainable level. When prices become unaffordable, people move away, demand decreases, and prices sharply drop—the bubble bursts.

Tier II and Tier III cities pose greater risks for real estate and business development. These risks stem from the underdeveloped infrastructures and lack of resources to support new ventures. Developing these infrastructures is expensive, and there’s always a chance the development won’t succeed, causing the real estate market to fail.