What Are Intangible Assets Examples and How to Value

Contents

- 1 What Are Intangible Assets? Examples and How to Value

- 1.1 What Is an Intangible Asset?

- 1.2 Understanding Intangible Assets

- 1.3 Types of Intangible Assets

- 1.4 How to Value Intangible Assets

- 1.5 Intangible vs. Tangible Assets

- 1.6 Example of Intangible Assets

- 1.7 What Are the Main Types of Intangible Assets?

- 1.8 What’s the Difference Between Intangible and Tangible Assets?

- 1.9 How Are Intangible Assets Disclosed on a Company’s Balance Sheet?

- 1.10 The Bottom Line

What Are Intangible Assets? Examples and How to Value

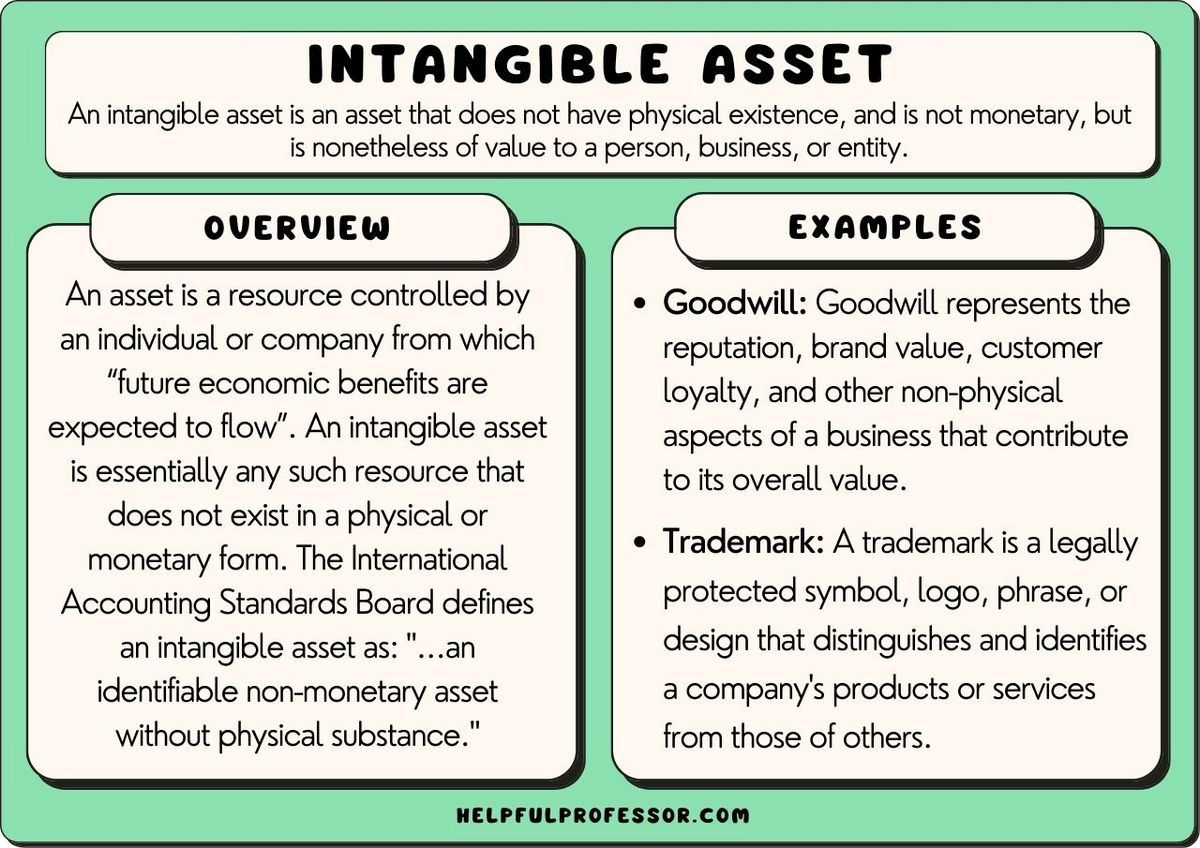

What Is an Intangible Asset?

An intangible asset is one that is not physical in nature. Common types of intangible assets include brands, goodwill, and intellectual property. Businesses have several ways to value these assets. They are in contrast to tangible assets, which have physical forms and can be held.

Key Takeaways

- An intangible asset is an asset that is not physical in nature, such as a patent, brand, trademark, or copyright.

- Businesses can create or acquire intangible assets.

- An intangible asset can be considered indefinite or definite.

- Intangible assets created by a company do not appear on the balance sheet and have no recorded book value.

Understanding Intangible Assets

An intangible asset has no physical form and cannot be handled. These assets are generally considered long-term and can be very valuable for the owner.

Intangible assets are commonly held by businesses and may include brand recognition, goodwill, and intellectual property. These assets can be divided into two categories:

- Indefinite: This type of intangible asset stays with the holder as long as it continues to operate.

- Definite: This type is restricted to a limited time.

Businesses can create or acquire intangible assets. For example, a business may create a mailing list of clients or establish a patent. Intangible assets can lose value if the company that holds them goes bankrupt or fails.

Types of Intangible Assets

Let’s look at some common types of intangible assets—brands, goodwill, and intellectual property.

Brands

A brand sets one business apart from another. This may come in the form of a logo, symbol, or brand name. Brands contribute to a company’s brand equity and help keep customers loyal.

Goodwill

When one company purchases another, the intangible assets associated with that transaction are considered goodwill.

Intellectual Property

Intellectual property is a type of intangible asset that is legally protected. Common forms include copyrights, digital assets, franchises, patents, trademarks, and trade secrets.

How to Value Intangible Assets

There are generally three ways that businesses can value their intangible assets: market approach, income approach, and cost approach. All the expenses of creating intangible assets are expensed. Intangible assets created by a company do not appear on the balance sheet and have no recorded book value.

Intangible vs. Tangible Assets

Tangible assets have a physical form, while intangible assets do not. The value of tangible assets may be easier to determine. Some common forms of tangible assets include equipment, furniture, inventory, land, property, and vehicles.

Example of Intangible Assets

Intangible assets only appear on the balance sheet if they have been acquired. Indefinite life intangible assets, such as goodwill, are not amortized.

What Are the Main Types of Intangible Assets?

Intangible assets fall into two categories: definite and indefinite. The types of intangible assets include brands, goodwill, and intellectual property.

What’s the Difference Between Intangible and Tangible Assets?

Intangible assets have no physical shape or form, while tangible assets can be handled and grasped.

How Are Intangible Assets Disclosed on a Company’s Balance Sheet?

Most intangible assets appear as long-term assets on corporate balance sheets. Some intangible assets, such as goodwill, don’t appear on corporate balance sheets.

The Bottom Line

Businesses can have both tangible and intangible assets. Even though intangible assets can’t be seen and held, they provide a great deal of value for their owners. As such, businesses should take care to guard and protect them the same way they do with their tangible assets.