What Are Imperfect Markets Definition Types and Consequences

Imperfect Markets: Definition, Types, and Consequences

What Is an Imperfect Market?

An imperfect market refers to an economic market that doesn’t meet the standards of a perfectly competitive market. Perfect competition is an abstract market structure that is only theoretical. Real markets are all imperfect.

In an imperfect market, individual buyers and sellers can affect prices and production. Information about products and prices is not fully disclosed, and there are high barriers to entry or exit in the market.

A perfect market is characterized by perfect competition, market equilibrium, and an unlimited number of buyers and sellers.

Key Takeaways

- Imperfect markets don’t meet the standards of a perfectly competitive market.

- Imperfect markets have competition for market share, high barriers to entry and exit, different products and services, and a small number of buyers and sellers.

- Perfect markets can’t exist in the real world; all real-world markets are imperfect markets.

- Imperfect market structures include monopolies, oligopolies, monopolistic competition, monopsonies, and oligopsonies.

Understanding Imperfect Markets

All real-world markets are imperfect. They involve competition for market share, high barriers to entry and exit, different products and services, prices set by price makers rather than supply and demand, incomplete information about products and prices, and a small number of buyers and sellers.

For example, traders in the financial market don’t have perfect knowledge about financial products. The traders and assets in a financial market aren’t perfectly homogeneous. New information isn’t instantly transmitted, and there is a limited velocity of reactions.

When considering economic activity, economists use perfect competition models. This might make the term "imperfect market" seem misleading. However, market imperfections can have varying degrees of efficiency.

Consequences of Imperfect Markets

Not all market imperfections are harmless or natural. Situations can arise where too few sellers control a single market or where prices fail to adjust to changes in market conditions. These situations spark economic debate.

Some economists argue that deviations from perfect competition models warrant government intervention to promote increased efficiency in production or distribution. Interventions can take the form of monetary policy, fiscal policy, or market regulation. For example, anti-trust law is derived from perfect competition theory.

Governments can also use taxation, quotas, licenses, and tariffs to regulate so-called perfect markets.

On the other hand, other economists argue that government intervention may not always be necessary to correct imperfect markets. Government policy is itself imperfect, and government actors may not possess the right incentives or information to interfere correctly. There are also economists who believe that government intervention is rarely justified in markets. The Austrian and Chicago schools, in particular, blame many market imperfections on erroneous government intervention.

Types of Imperfect Markets

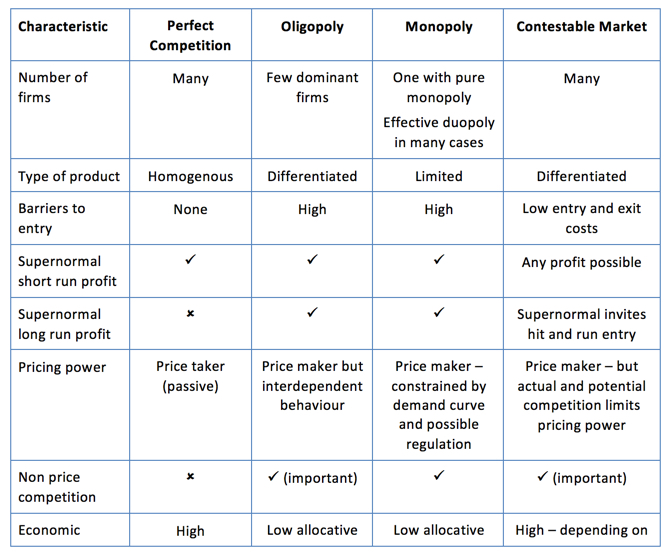

When at least one condition of a perfect market isn’t met, it can result in an imperfect market. Every industry has some form of imperfection. Imperfect competition can be found in the following structures:

Monopoly

There is only one dominant seller. Products offered by this entity have no substitutes. These markets have high barriers to entry, and a single seller sets prices without notice to consumers.

Oligopoly

There are many buyers but few sellers. These few players in the market may prevent others from entering. They may set prices collectively or, in the case of a cartel, one takes the lead in determining the price.

Monopolistic Competition

There are many sellers who offer similar products that can’t be substituted. Businesses compete with one another and are price makers, but their individual decisions don’t affect others.

Monopsony and Oligopsony

There are many sellers, but few buyers. In these cases, the buyer manipulates market prices by playing firms against one another.

Imperfect Markets vs. Perfect Markets

Perfect markets have the following characteristics:

- An unlimited number of buyers and sellers.

- Identical or substitutable products.

- No barriers to entry or exit.

- Buyers have complete information on products and prices.

- Companies are price takers and have no power to set prices.

In reality, no market can ever have an unlimited number of buyers and sellers. Economic goods in every market are heterogeneous, not homogeneous. A diverse range of goods and tastes are preferred in an imperfect market.

Perfect markets, though impossible to achieve, are useful because they help us think through the logic of prices and economic incentives. However, trying to apply the rules of perfect competition to the real world poses logical problems from the start. Perfect competition can only be theoretically assumed; it can never be dynamically reached.