What Are Franking Credits Definition and Formula for Calculation

Contents

What Are Franking Credits? Definition and Calculation

What Is a Franking Credit?

A franking credit, also known as an imputation credit, is a tax credit paid by corporations to shareholders with their dividends. Australia and other countries use franking credits to eliminate double taxation.

Corporations pay taxes on dividends before distributing them to shareholders. Franking credits allow corporations to allocate tax credits to shareholders, who may then receive a reduction in income taxes or a tax refund.

How Franking Credits Work

Investors in Australia and other countries with franking credit provisions can expect credits for mutual funds with domestic companies paying dividends. For blue-chip companies in Australia, franking credits promote long-term equity ownership and increase dividend payouts.

In Australia, franking credits are paid proportionally to investors in a 0% to 30% tax bracket. An investor with a 0% tax rate receives the full tax payment as a credit. Payouts decrease as the tax rate increases, and investors with a tax rate above 30% do not receive credits.

Holding periods vary by country. In Australia, investors must hold the stock for 45 days in addition to the purchase and sale date to qualify for a credit.

When filing taxes, investors record both the dividend and the franking credit as income. Grossed up dividend refers to the combined amount.

Key Takeaways

- A franking credit is a tax credit paid by corporations to shareholders with dividends.

- Countries like Australia use franking credits to reduce double taxation.

- Investors may receive a reduction in income taxes or a tax refund based on their tax bracket.

- Franking credits promote long-term equity ownership and increase dividend payouts.

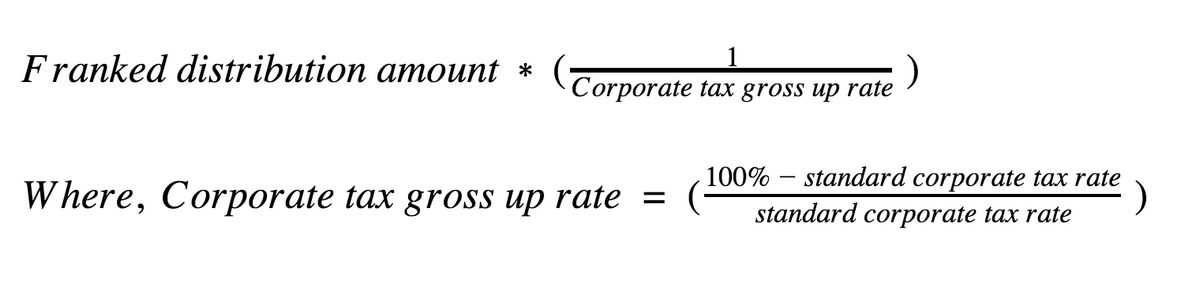

Calculating Franking Credits

This is the standard calculation:

- Franking credit = (dividend amount / (1 – company tax rate)) – dividend amount

For example, if an investor receives a $70 dividend from a company with a 30% tax rate, their franking credit would be $30, resulting in a grossed-up dividend of $100.

To determine an adjusted franking credit, investors must adjust the credit based on their tax rate. In the previous example, if an investor is entitled to a 50% franking credit, their payout would be $15.

The Bottom Line

Franking credits, implemented in 1987, provide incentives for investors in lower tax brackets to invest in dividend-paying companies.

Other countries may consider integrating franking credits to reduce double taxation. Therefore, those interested in a similar system in the United States and elsewhere should closely monitor the effects of franking credits.