What Are Direct Costs Definition Examples and Types

Contents

Direct Costs: Definition, Examples, and Types

Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company. She has nearly two decades of experience in the financial industry and as a financial instructor.

What Is a Direct Cost?

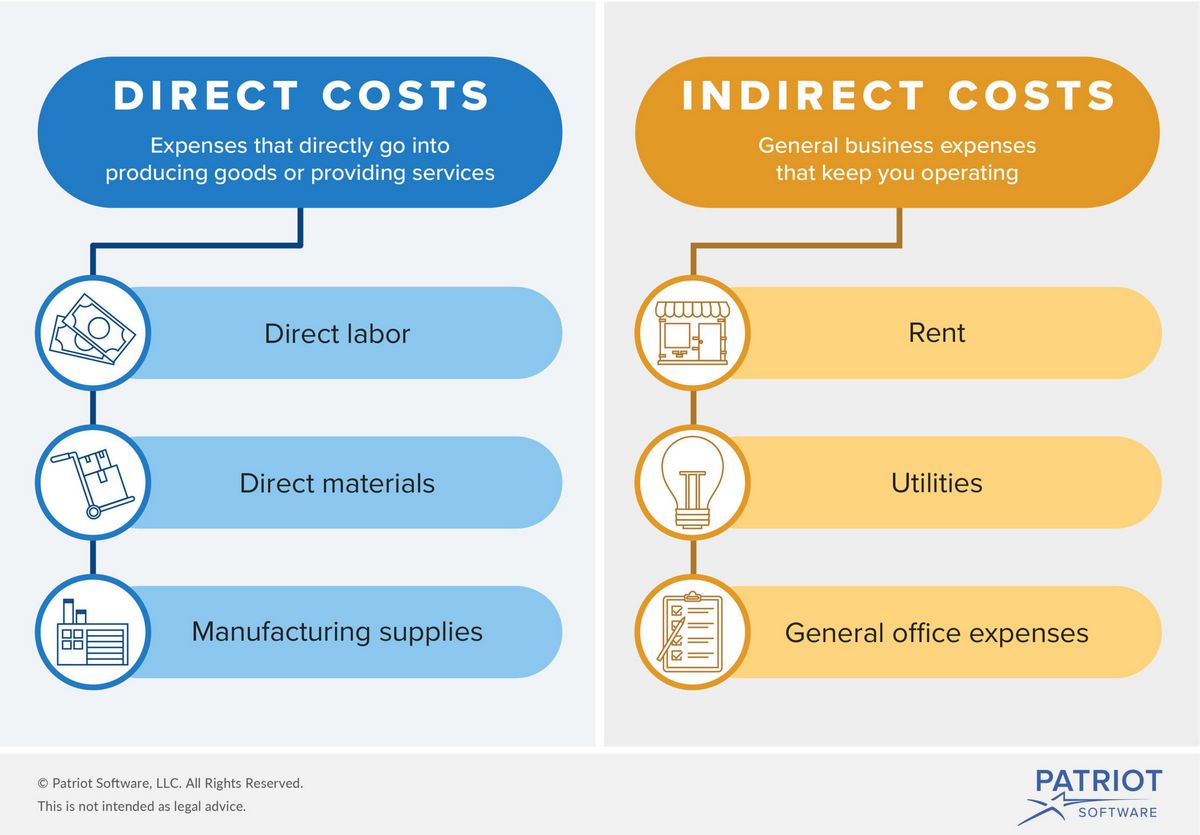

A direct cost is a price directly tied to the production of goods or services. It can be traced to the cost object, such as a service, product, or department. Direct and indirect costs are the two types of expenses or costs that companies can incur. Direct costs are often variable costs, fluctuating with production levels like inventory. Indirect costs, on the other hand, are harder to assign to a specific product, and they include depreciation and administrative expenses.

Understanding Direct Costs

Direct costs can include fixed costs. For example, rent for a factory can be tied directly to the production facility. Although rent is usually considered overhead, fixed costs can sometimes be associated with the units produced in a particular facility.

Direct Costs Examples

Direct costs involved in producing a good, even if they only represent a portion of the cost allocated to the production facility, are included as direct costs. Examples of direct costs include:

- Direct labor

- Direct materials

- Manufacturing supplies

- Wages for production staff

- Fuel or power consumption

Direct costs do not need to be allocated to a specific cost object; they usually benefit only one cost object. Non-direct costs are pooled and allocated based on cost drivers.

Direct and indirect costs are the major costs involved in the production of goods or services. While direct costs can be traced to a product, indirect costs cannot.

Key Takeaways

- A direct cost is a price directly tied to the production of specific goods or services.

- A direct cost can be traced to the cost object, such as a service, product, or department.

- Direct cost examples include direct labor and direct materials.

- Direct costs can also be fixed costs. For example, rent for a factory could be tied directly to a production facility.

Direct vs. Indirect Costs

The cost object for direct costs is fairly straightforward. For example, Ford Motor Company (F) manufactures automobiles and trucks. The steel and bolts needed for the production of a car or truck are classified as direct costs. Indirect costs, however, include expenses like electricity for the manufacturing plant. While the electricity expense can be tied to the facility, it cannot be directly tied to a specific unit and is thus classified as indirect.

Fixed vs. Variable

Direct costs do not need to be fixed. For example, the salary of a supervisor who worked on a single project can be directly attributed to the project and relates to a fixed dollar amount. Materials used in building a product, such as wood or gasoline, can be directly traced but do not have a fixed dollar amount. This is because the supervisor’s salary quantity is known, while unit production levels vary based on sales.

Inventory Valuation Measurement

Using direct costs requires strict management of inventory valuation when inventory is purchased at different dollar amounts. For example, the cost of an essential component of a manufactured item may change over time. As the item is being manufactured, the component’s price must be directly traced to the item.

Companies typically trace these costs using two methods: first-in, first-out (FIFO) or last-in, first-out (LIFO). FIFO assigns costs, like inventory purchase, based on what items arrived first. As inventory is used in the production process, the oldest inventory items are used first to measure the cost of the item. Conversely, LIFO assigns the value of a cost item based on the last item purchased or added to inventory.

Companies typically trace these costs using two methods: first-in, first-out (FIFO) or last-in, first-out (LIFO). FIFO assigns costs based on what items arrived first. As inventory is used up, the oldest inventory items are used first when measuring the cost of the item. LIFO assigns the value of a cost item based on the last item purchased or added to inventory.